Surety bond as a substitute of automotive insurance coverage is an intriguing risk, opening a brand new avenue for car house owners. It isn’t a easy swap, although, and understanding the specifics is essential. This exploration dives into the elements that make surety bonds a possible various, contrasting them with conventional automotive insurance coverage. From protection variations to price implications and authorized issues, we’ll unravel the intricacies of this monetary choice.

This complete information supplies a transparent overview of the factors to contemplate when exploring surety bonds as a alternative for automotive insurance coverage. We’ll study particular conditions the place surety bonds may be a greater match, evaluating and contrasting the 2 choices to equip you with the required data for knowledgeable decision-making.

Introduction to Surety Bonds and Automotive Insurance coverage Alternate options

Salam, semoga hari ini baik-baik saja. Kita akan membahas alternatif jaminan kendaraan selain asuransi mobil, yaitu jaminan fidusia. Memahami perbedaan dan kondisi yang tepat untuk menggunakan jaminan fidusia akan membantu kita mengambil keputusan yang tepat. Mari kita mulai.Surety bonds, or jaminan fidusia, are a sort of contract the place a 3rd celebration, generally known as a surety, ensures the efficiency of an obligation by one other celebration.

In essence, the surety guarantees to meet the obligations if the principal (the individual needing the surety) fails to take action. That is usually used as a type of assurance, notably in monetary transactions or authorized issues. This idea is typically utilized to car possession.

Function and Operate of Automotive Insurance coverage

Automotive insurance coverage is designed to guard people and companies from monetary losses arising from vehicle-related incidents. This consists of damages to the car, accidents to others, and legal responsibility for property harm. It supplies a security internet for unexpected circumstances, resembling accidents or vandalism. The operate is to supply a monetary cushion in case of accidents, thefts, or damages.

Circumstances for Surety Bonds as Automotive Insurance coverage Alternate options

Surety bonds might be thought of as an alternative choice to automotive insurance coverage in particular circumstances. For instance, when the price of automotive insurance coverage is prohibitive or when the protection supplied by automotive insurance coverage doesn’t absolutely deal with particular wants. This may apply to companies working with a number of autos or these working in high-risk areas.

Widespread Sorts of Surety Bonds for Automobile Operation

A number of sorts of surety bonds are related to car operation. One frequent kind is a efficiency bond, which ensures the completion of a undertaking or contract associated to car upkeep or operation. One other kind is a cost bond, which assures cost to subcontractors or suppliers concerned in vehicle-related work. These are essential for guaranteeing transparency and adherence to contracts in industrial car operations.

Examples of Appropriate Alternate options

Surety bonds may be an acceptable various in conditions the place a enterprise must show monetary duty for vehicle-related actions. For instance, a trucking firm may use a efficiency bond to ensure the well timed supply of products. Equally, a fleet proprietor may use a surety bond to make sure compliance with regulatory necessities.

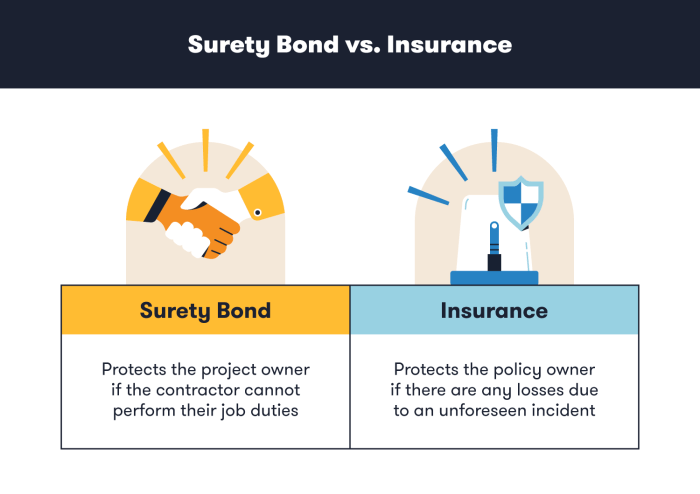

Comparability of Automotive Insurance coverage and Surety Bonds

| Characteristic | Automotive Insurance coverage | Surety Bond |

|---|---|---|

| Protection | Broader protection, together with legal responsibility, collision, complete, and uninsured/underinsured motorist protection. | Focuses on particular obligations, resembling completion of a undertaking, cost of money owed, or compliance with laws. Protection is tailor-made to the precise contract. |

| Price | Premiums primarily based on elements like driver historical past, car kind, and placement. Premiums might be substantial. | Price is dependent upon the quantity of the bond and the surety’s evaluation of danger. Usually, prices might be extra predictable, doubtlessly decrease than automotive insurance coverage for particular conditions. |

| Utility Course of | Utility with an insurance coverage firm, submission of paperwork, and ready for approval. | Utility with a surety firm, submission of economic and operational info, and analysis of danger. |

Protection Variations and Similarities

Baiklah, mari kita bahas lebih lanjut tentang perbedaan dan kesamaan cakupan antara asuransi mobil dan surety bond. Kita akan melihat jenis-jenis perlindungan yang ditawarkan masing-masing, dan bagaimana mereka membedakan diri dalam konteks operasi kendaraan. Semoga penjelasan ini membantu Anda memahami mana yang paling tepat untuk kebutuhan Anda.Surety bonds, berbeda dengan asuransi mobil, umumnya tidak dirancang untuk melindungi individu dalam setiap kejadian kecelakaan.

Mereka lebih fokus pada jaminan atas kewajiban finansial yang mungkin timbul dari suatu kontrak atau perjanjian. Namun, dalam konteks operasi kendaraan, surety bond bisa memberikan perlindungan tertentu, yang terkadang berbeda dengan cakupan asuransi mobil.

Sorts of Automotive Insurance coverage Protection

Asuransi mobil biasanya menawarkan berbagai jenis perlindungan, seperti perlindungan terhadap kerusakan materiil kendaraan Anda sendiri (Complete dan Collision), perlindungan terhadap kerugian yang Anda sebabkan pada pihak lain (Bodily Harm Legal responsibility dan Property Injury Legal responsibility), dan perlindungan terhadap kerusakan yang Anda alami karena kesalahan pihak lain (Uninsured/Underinsured Motorist). Ketiga jenis ini merupakan bagian penting dari proteksi finansial.

Sorts of Surety Bond Protection Related to Automobile Operation

Surety bond, dalam konteks operasional kendaraan, biasanya fokus pada perlindungan terhadap tanggung jawab finansial yang timbul dari kontrak tertentu. Contohnya, jika Anda memiliki kontrak untuk mengangkut barang menggunakan kendaraan Anda, surety bond bisa melindungi pihak yang memesan jasa transportasi Anda dari kerugian finansial jika terjadi pelanggaran kontrak, seperti keterlambatan pengiriman atau kerusakan barang. Penting untuk diingat bahwa cakupan ini lebih spesifik daripada cakupan asuransi mobil yang lebih luas.

Comparability of Protection, Surety bond as a substitute of automotive insurance coverage

Perbedaan utama antara asuransi mobil dan surety bond terletak pada fokus perlindungan. Asuransi mobil lebih luas, mencakup beragam risiko yang terkait dengan operasi kendaraan, seperti kecelakaan, kerusakan materiil, dan tanggung jawab hukum. Surety bond, di sisi lain, lebih terfokus pada kewajiban finansial yang timbul dari kontrak atau perjanjian yang terkait dengan penggunaan kendaraan, seperti kontrak transportasi.

Conditions The place Surety Bonds Provide Broader Protection

Surety bond dapat menawarkan cakupan yang lebih luas dalam situasi tertentu, terutama yang berkaitan dengan kontrak atau perjanjian. Misalnya, jika Anda memiliki kontrak khusus untuk mengangkut barang berharga, surety bond dapat melindungi pihak lain dari kerugian finansial jika terjadi kerusakan atau keterlambatan. Hal ini mungkin tidak dijamin oleh asuransi mobil.

Conditions The place Surety Bonds Provide Narrower Protection

Surety bond tidak mencakup hal-hal yang biasa ditanggung oleh asuransi mobil, seperti kecelakaan yang tidak terkait dengan kontrak. Dalam kasus kecelakaan lalu lintas biasa, surety bond tidak memberikan perlindungan terhadap cedera pribadi atau kerusakan properti yang diakibatkan oleh kecelakaan.

Conditions The place Surety Bonds Might Not Cowl the Identical Liabilities as Automotive Insurance coverage

Surety bond tidak dirancang untuk mencakup tanggung jawab yang muncul dari pelanggaran hukum yang tidak terkait dengan kontrak. Surety bond tidak dapat digunakan sebagai pengganti asuransi mobil untuk mengklaim ganti rugi atas kecelakaan atau kerusakan akibat operasi kendaraan secara umum.

Desk: Protection Comparability

| Facet | Automotive Insurance coverage | Surety Bond |

|---|---|---|

| Protection Focus | Kerusakan materiil, cedera pribadi, dan tanggung jawab hukum dalam operasi kendaraan. | Tanggung jawab finansial yang timbul dari kontrak atau perjanjian yang terkait dengan penggunaan kendaraan. |

| Contoh Situasi Tertanggung | Kecelakaan lalu lintas, kerusakan mobil akibat kecelakaan, cedera pribadi, kerusakan properti. | Keterlambatan pengiriman barang, kerusakan barang yang diangkut, pelanggaran kontrak transportasi. |

| Contoh Situasi Tidak Tertanggung | Tidak ada | Kecelakaan lalu lintas biasa, tanggung jawab hukum akibat pelanggaran lalu lintas. |

Price and Monetary Implications

Baiklah, mari kita bahas lebih lanjut mengenai implikasi finansial dari memilih surety bond sebagai alternatif asuransi kendaraan. Memilih antara asuransi mobil dan surety bond tidak hanya soal perlindungan, tapi juga pertimbangan biaya dan dampak jangka panjang. Kita akan melihat struktur biaya masing-masing, bagaimana biaya dihitung, dan perbandingannya dalam berbagai skenario.Surety bond dan asuransi mobil, meskipun keduanya menawarkan perlindungan, memiliki mekanisme biaya yang berbeda.

Memahami seluk beluk ini akan membantu kita membuat keputusan yang tepat sesuai dengan kebutuhan dan situasi keuangan kita.

Typical Price Construction of Automotive Insurance coverage Premiums

Premi asuransi mobil dipengaruhi oleh banyak faktor, termasuk riwayat pengemudi, jenis kendaraan, lokasi tinggal, dan jenis perlindungan yang dipilih. Beberapa faktor utama yang memengaruhi biaya adalah:

- Riwayat pengemudi: Premi lebih tinggi untuk pengemudi dengan catatan kecelakaan atau pelanggaran lalu lintas yang buruk. Sejarah bebas kecelakaan memberikan diskon yang signifikan.

- Jenis kendaraan: Mobil sport atau kendaraan mewah biasanya memiliki premi yang lebih tinggi dibandingkan mobil keluarga atau sedan standar. Jenis kendaraan juga berpengaruh pada potensi kerugian jika terjadi kecelakaan.

- Lokasi tinggal: Daerah dengan tingkat kejahatan atau kecelakaan yang tinggi cenderung memiliki premi asuransi yang lebih tinggi.

- Jenis perlindungan: Perlindungan yang lebih luas, seperti perlindungan kerusakan whole atau perlindungan kecelakaan pribadi, akan meningkatkan premi.

- Sejarah klaim: Semakin banyak klaim yang diajukan, semakin tinggi premi asuransi akan menjadi.

Surety Bond Premium Willpower

Premi surety bond ditentukan berdasarkan beberapa faktor yang berbeda dari asuransi mobil. Faktor-faktor kunci yang menentukan biaya surety bond meliputi:

- Jenis pekerjaan: Profesional yang memiliki risiko tinggi, seperti kontraktor atau pengemudi truk, mungkin memiliki premi yang lebih tinggi.

- Nilai obligasi: Besarnya obligasi yang diperlukan memengaruhi premi yang dibayarkan. Obligasi yang lebih besar berarti premi yang lebih tinggi.

- Riwayat pembayaran: Riwayat pembayaran yang konsisten dan baik dapat memengaruhi premi.

- Sejarah dan reputasi perusahaan: Reputasi perusahaan yang baik dapat memberikan diskon atau premi yang lebih rendah.

- Nilai risiko yang ditanggung: Faktor risiko yang terkait dengan pekerjaan atau proyek yang dilindungi akan menentukan premi.

Price Comparability in Varied Situations

Untuk membandingkan biaya, mari kita lihat beberapa skenario. Meskipun tidak ada angka pasti, perbandingan ini akan memberikan gambaran umum.

| Situation | Automotive Insurance coverage Premium (estimasi) | Surety Bond Premium (estimasi) |

|---|---|---|

| Pengemudi baru, kendaraan standar, daerah dengan tingkat kecelakaan sedang | Rp 2.000.000 – Rp 3.000.000 per tahun | Rp 500.000 – Rp 1.000.000 per tahun |

| Pengemudi berpengalaman, kendaraan mewah, daerah dengan tingkat kecelakaan rendah | Rp 1.000.000 – Rp 1.500.000 per tahun | Rp 250.000 – Rp 500.000 per tahun |

| Kontraktor dengan proyek besar, obligasi tinggi | Tidak berlaku | Rp 2.000.000 – Rp 5.000.000 per tahun |

Elements Influencing Price

Seperti yang sudah dijelaskan sebelumnya, banyak faktor yang memengaruhi biaya asuransi mobil dan surety bond. Faktor-faktor ini saling terkait dan memengaruhi biaya secara kompleks. Perlu diingat bahwa perkiraan ini dapat bervariasi berdasarkan kondisi spesifik.

Lengthy-Time period Monetary Implications

Memilih surety bond sebagai pengganti asuransi mobil bisa memiliki dampak finansial jangka panjang. Jika Anda memilih surety bond, pastikan Anda memahami risiko dan tanggung jawab yang akan ditimbulkan. Hal ini penting untuk memastikan kestabilan finansial jangka panjang.

Authorized and Regulatory Concerns

Sustaining highway security and guaranteeing monetary duty for accidents are elementary points of driving. Completely different jurisdictions have particular laws relating to car insurance coverage, and understanding these nuances is essential for making knowledgeable selections. Understanding the authorized and regulatory landscapes surrounding surety bonds as an alternative choice to automotive insurance coverage is equally essential.The authorized frameworks governing automotive insurance coverage and surety bonds differ considerably throughout totally different areas.

These variations dictate the necessities, implications, and liabilities related to every possibility. This part will element the authorized necessities for automotive insurance coverage, the implications of utilizing a surety bond, and the regulatory our bodies concerned.

Authorized Necessities for Automotive Insurance coverage

Varied jurisdictions have established necessary automotive insurance coverage necessities to guard people and different highway customers. Failure to adjust to these necessities usually results in penalties, together with fines and suspension of driving privileges. The particular necessities, resembling minimal protection limits and sorts of protection, differ primarily based on the jurisdiction.

- Many states mandate legal responsibility insurance coverage, protecting damages to others in case of an accident. This safety is crucial to make sure that victims of accidents can recuperate monetary compensation for his or her losses. Examples embody property harm and private harm.

- Some states require uninsured/underinsured motorist protection, safeguarding people towards accidents brought on by drivers with out ample insurance coverage.

- Uninsured/underinsured motorist protection provides a security internet, defending victims from monetary hardship when an accident includes a driver missing ample protection.

Authorized Implications of Utilizing a Surety Bond

Using a surety bond as a substitute of automotive insurance coverage carries authorized implications. It is vital to grasp {that a} surety bond acts as a monetary assure, however it would not at all times cowl all points of a car accident. The bond sometimes covers the obligations specified within the bond settlement.

- A surety bond’s scope of protection might not align with the great safety afforded by automotive insurance coverage. This distinction can result in monetary liabilities exceeding the bond’s protection.

- Jurisdictions might have particular legal guidelines relating to the acceptance of surety bonds as an alternative to automotive insurance coverage. Some jurisdictions won’t allow it in any respect, or have strict limitations on its use.

- Understanding the precise phrases and situations of the surety bond is essential. The protection limits and exclusions should align with the authorized necessities of the jurisdiction.

Regulatory Our bodies

Completely different governmental businesses are chargeable for regulating automotive insurance coverage and surety bonds. These our bodies guarantee compliance with laws and defend the pursuits of policyholders and the general public.

- State Departments of Insurance coverage are sometimes chargeable for overseeing automotive insurance coverage insurance policies, guaranteeing they meet the required requirements. In addition they monitor insurers to take care of monetary stability and shopper safety.

- Regulatory our bodies overseeing surety bonds might differ by jurisdiction. Some states have particular departments or businesses devoted to surety bond oversight. They usually monitor bond issuers and implement bond necessities.

Potential Authorized Liabilities and Tasks

Utilizing a surety bond as an alternative choice to automotive insurance coverage carries particular authorized liabilities and duties. A radical understanding of those implications is crucial earlier than making such a call.

- The legal responsibility for damages exceeding the surety bond’s protection falls on the bondholder. This could result in vital monetary implications if the damages exceed the bond quantity.

- A surety bond would not mechanically fulfill all authorized necessities for car operation in a selected jurisdiction. Failure to satisfy these necessities may end up in penalties or different authorized penalties.

Comparability of Authorized and Regulatory Frameworks

Evaluating the authorized and regulatory frameworks for automotive insurance coverage and surety bonds requires analyzing the precise necessities of various jurisdictions. Understanding the variations in protection, legal responsibility, and regulatory oversight is important.

Desk: Authorized Necessities for Automotive Insurance coverage and Surety Bonds in Completely different Jurisdictions

A desk showcasing the comparability could be in depth and require vital analysis to incorporate all jurisdictions. The next instance supplies a primary construction. Additional particulars would necessitate a particular jurisdiction focus.

| Jurisdiction | Automotive Insurance coverage Necessities | Surety Bond Necessities (if permitted) |

|---|---|---|

| Instance State 1 | Legal responsibility, Uninsured/Underinsured Motorist Protection | Restricted acceptance, particular situations |

| Instance State 2 | Legal responsibility, Collision, Complete | No acceptance in its place |

| Instance State 3 | Legal responsibility, Property Injury | Particular protection necessities, restricted use circumstances |

Utility and Declare Processes

Baiklah, mari kita bahas lebih lanjut mengenai proses aplikasi dan klaim untuk asuransi mobil dan surety bond. Memahami perbedaan dalam proses ini sangat penting untuk memilih opsi yang tepat untuk kebutuhan Anda.Masing-masing metode memiliki alur kerja yang unik, mulai dari pengajuan aplikasi hingga penanganan klaim. Pemahaman yang jelas tentang langkah-langkah ini akan membantu Anda dalam membuat keputusan yang bijak.

Acquiring a Automotive Insurance coverage Coverage

Proses mendapatkan polis asuransi mobil biasanya melibatkan beberapa langkah. Pertama, Anda perlu memilih perusahaan asuransi dan produk yang sesuai dengan kebutuhan dan anggaran Anda. Kemudian, Anda perlu mengisi aplikasi dengan informasi pribadi dan element kendaraan. Selanjutnya, perusahaan asuransi akan melakukan penilaian risiko berdasarkan informasi yang Anda berikan. Setelah disetujui, Anda akan menerima polis asuransi dan informasi mengenai premi serta cakupan perlindungan.

- Memilih perusahaan asuransi dan produk yang sesuai.

- Mengisi aplikasi dengan element kendaraan dan pribadi.

- Penilaian risiko oleh perusahaan asuransi.

- Penerimaan polis dan informasi premi serta cakupan.

Acquiring a Surety Bond

Proses mendapatkan surety bond melibatkan langkah-langkah yang berbeda dari asuransi mobil. Anda perlu menemukan penjamin yang kredibel dan memenuhi persyaratan mereka. Ini biasanya mencakup penyediaan dokumen yang mendukung, seperti pernyataan keuangan dan informasi proyek. Setelah penjamin menyetujui aplikasi Anda, surety bond akan diterbitkan dan Anda akan menerima salinannya.

- Mencari penjamin surety yang kredibel.

- Memenuhi persyaratan penjamin, seperti dokumen pendukung.

- Pengesahan aplikasi oleh penjamin.

- Penerbitan dan penerimaan surety bond.

Submitting a Declare underneath a Surety Bond

Ketika terjadi peristiwa yang memicu klaim surety bond, seperti kegagalan memenuhi kewajiban kontrak, Anda perlu mengumpulkan bukti yang mendukung klaim Anda. Dokumen-dokumen ini akan diteliti oleh penjamin untuk memastikan kelayakan klaim. Setelah penjamin menyetujui klaim, proses pembayaran akan dilakukan sesuai dengan ketentuan yang tercantum dalam surety bond.

- Pengumpulan bukti yang mendukung klaim.

- Penilaian klaim oleh penjamin.

- Pengesahan klaim oleh penjamin.

- Proses pembayaran sesuai ketentuan.

Evaluating and Contrasting Declare Processes

Perbedaan utama antara proses klaim asuransi mobil dan surety bond terletak pada jenis peristiwa yang diklaim dan proses penilaiannya. Asuransi mobil menangani peristiwa yang melibatkan kerusakan fisik kendaraan atau cedera pribadi, sedangkan surety bond berfokus pada kegagalan memenuhi kewajiban kontrak. Proses penilaian untuk surety bond lebih kompleks dan berfokus pada bukti-bukti terkait kegagalan tersebut.

Situations for Rejecting a Declare underneath a Surety Bond

Penjamin dapat menolak klaim surety bond jika terdapat pelanggaran ketentuan dalam kontrak atau jika bukti yang diajukan tidak memadai. Contohnya, jika pelanggaran kontrak terjadi karena kesalahan yang disengaja, klaim dapat ditolak. Hal ini berbeda dengan asuransi mobil, di mana penolakan klaim biasanya terkait dengan penyebab kecelakaan atau kerusakan yang tidak tercakup dalam polis.

Desk Illustrating Declare Course of

Berikut ini tabel yang membandingkan langkah-langkah dalam proses klaim untuk asuransi mobil dan surety bond:

| Langkah | Asuransi Mobil | Surety Bond |

|---|---|---|

| Pengajuan Klaim | Melaporkan kecelakaan atau kerusakan ke perusahaan asuransi. | Melaporkan kegagalan memenuhi kewajiban kontrak ke penjamin. |

| Pengumpulan Bukti | Foto kerusakan, laporan polisi, dan dokumen terkait. | Dokumen kontrak, bukti kegagalan, dan bukti kerugian. |

| Penilaian Klaim | Penilaian kerusakan dan kepatuhan terhadap polis. | Penilaian kegagalan dan kepatuhan terhadap kontrak. |

| Keputusan | Disetujui atau ditolak berdasarkan penilaian. | Disetujui atau ditolak berdasarkan penilaian. |

| Proses Pembayaran | Pembayaran sesuai dengan cakupan polis. | Pembayaran sesuai dengan ketentuan surety bond. |

Particular Use Circumstances and Examples

Surety bonds, a sort of economic assure, provide a singular various to conventional automotive insurance coverage, notably in specialised conditions. Understanding the distinct benefits and downsides is essential for making an knowledgeable choice. This part delves into numerous eventualities the place surety bonds may be a extra appropriate alternative, exploring the industries and professions the place they’re generally used.Understanding when a surety bond is a greater match than automotive insurance coverage requires cautious consideration of the precise wants and dangers concerned.

Elements like the character of the work, the potential for monetary loss, and the regulatory surroundings play vital roles in figuring out probably the most acceptable protection.

Conditions The place Surety Bonds Are Extra Appropriate Than Automotive Insurance coverage

Selecting between surety bonds and automotive insurance coverage is dependent upon the context. As an example, in industries with excessive monetary danger or specialised transportation wants, surety bonds usually present extra complete protection.

- Development Contractors: Development firms regularly make the most of surety bonds to ensure their contractual obligations, resembling well timed undertaking completion and adherence to specs. Automotive insurance coverage, whereas essential for private autos, would not deal with the monetary liabilities inherent in large-scale tasks.

- Authorities Contractors: Companies working for presidency businesses usually require surety bonds to show their monetary stability and talent to meet the phrases of contracts. These bonds mitigate the chance of default or non-compliance, a priority indirectly addressed by automotive insurance coverage.

- Transportation Firms (Specialised): Firms transporting hazardous supplies or high-value items sometimes want surety bonds to guard towards potential accidents or harm. Automotive insurance coverage usually would not cowl the great dangers related to such specialised transport.

- Actual Property Brokers/Builders: In sure actual property transactions, surety bonds may be required to make sure that builders or brokers fulfill their contractual commitments. These commitments are past the scope of typical automotive insurance coverage protection.

Industries Generally Utilizing Surety Bonds As an alternative of Automotive Insurance coverage

Surety bonds are a prevalent type of safety in numerous industries. Their utility usually stems from the distinctive nature of the enterprise actions and the potential monetary publicity.

- Development: Development firms usually want surety bonds to ensure undertaking completion, cost to subcontractors, and adherence to contract phrases. The substantial monetary danger related to development tasks makes surety bonds a obligatory component of their operations.

- Authorities contracting: Authorities businesses demand surety bonds to make sure contractors’ capacity to meet their obligations. The stringent regulatory surroundings necessitates this type of monetary assurance.

- Transportation: Companies transporting items, notably these involving hazardous supplies, usually require surety bonds to guard towards potential legal responsibility arising from accidents or damages. The excessive danger inherent in these operations makes surety bonds an important security internet.

Situations The place Utilizing a Surety Bond As an alternative of Automotive Insurance coverage Would possibly Be Riskier

Whereas surety bonds present various safety, they don’t seem to be at all times the best choice. The choice is dependent upon the precise circumstances and potential dangers.

- Private Legal responsibility: Surety bonds primarily deal with enterprise liabilities. If a enterprise proprietor makes use of a surety bond as a substitute of automotive insurance coverage for private autos, their private property could also be in danger in case of accidents involving these autos.

- Restricted Protection: Surety bonds won’t cowl all sorts of private legal responsibility, resembling accidents sustained in a car accident. Automotive insurance coverage, in distinction, supplies a broader scope of safety.

- Lack of Consciousness: Not absolutely understanding the situations and limitations of a surety bond may lead to sudden monetary implications. A complete understanding of the bond’s phrases is essential for minimizing dangers.

Case Research: A Development Firm

A development firm, “Dependable Builders,” was awarded a contract to construct a bridge. The contract required a efficiency bond, guaranteeing the undertaking’s completion. Whereas automotive insurance coverage was in place for firm autos, a surety bond particularly assured the undertaking’s monetary duty, guaranteeing that Dependable Builders would full the undertaking and pay subcontractors, thereby lowering potential monetary losses for the shopper.

Desk: Particular Use Circumstances The place Surety Bonds Might Be Extra Appropriate

| Use Case | Motive for Surety Bond Desire |

|---|---|

| Development Initiatives | Ensures undertaking completion and cost to subcontractors. |

| Authorities Contracts | Ensures compliance with contract phrases and monetary stability. |

| Transportation of Hazardous Supplies | Mitigates potential legal responsibility in case of accidents. |

| Actual Property Transactions | Ensures developer/agent compliance with contractual obligations. |

Concerns for Completely different Automobile Varieties

Selecting between surety bonds and automotive insurance coverage to your car relies upon closely on the kind of car you personal. Understanding the nuances of every kind, from a easy private automotive to a industrial truck, is essential for making the suitable alternative. This part delves into the distinctive issues for numerous car varieties, offering a transparent image of which possibility is extra appropriate.

Impression of Automobile Kind on Surety Bond Applicability

The applicability of surety bonds versus commonplace automotive insurance coverage varies considerably primarily based on the car’s goal and traits. Industrial autos, for instance, usually require totally different protections than private autos. Basic automobiles, with their historic worth and potential for restoration, additionally current distinctive issues.

- Industrial Automobiles: Industrial autos, resembling vehicles, supply vans, and buses, regularly require surety bonds to cowl particular obligations. These bonds sometimes assure the car proprietor’s capacity to meet contractual agreements, resembling these associated to freight transport or development tasks. Automotive insurance coverage usually doesn’t deal with these contractual liabilities. As an example, a trucking firm hauling items throughout state strains may want a bond to make sure compliance with laws and to ensure the security of the cargo and public.

A surety bond, on this case, serves as a type of monetary assurance for the security of the products and compliance with all related laws.

- Basic Automobiles: Basic automobiles usually necessitate a unique strategy in comparison with trendy autos. Whereas automotive insurance coverage can cowl harm, a surety bond won’t be obligatory for normal liabilities. Nonetheless, if the basic automotive is used for industrial functions, resembling in parades or exhibitions, a surety bond may be wanted to cowl any potential liabilities related to these actions.

The price of a surety bond for a basic automotive is usually decrease than for a industrial truck.

- Leisure Automobiles (RVs): RVs, like motorhomes or campers, can fall underneath both surety bonds or automotive insurance coverage, relying on their use. If used solely for private journey, commonplace automotive insurance coverage might suffice. Nonetheless, if the RV is employed for industrial functions, resembling offering excursions or leases, a surety bond could also be essential to cowl potential liabilities.

Particular Automobile Options Affecting Protection and Price

Particular car options play an important function in figuring out the price and protection of each surety bonds and automotive insurance coverage. Options like engine kind, age, and mileage immediately impression the premium. Equally, the kind of cargo transported (if relevant) in a industrial car can have an effect on surety bond prices.

- Engine Kind: The kind of engine in a car can affect insurance coverage premiums. As an example, high-performance engines may include increased insurance coverage prices, whereas surety bonds usually are not affected by the engine kind. That is true for each commonplace automotive insurance coverage and surety bonds.

- Automobile Age and Mileage: Older or high-mileage autos sometimes have increased restore prices, doubtlessly leading to elevated insurance coverage premiums. Surety bonds usually are not immediately impacted by these elements.

- Cargo Kind (Industrial Automobiles): The kind of cargo transported in a industrial car considerably impacts the required surety bond quantity. Transporting hazardous supplies necessitates the next bond quantity to cowl potential environmental harm or harm.

Comparability Desk: Surety Bonds vs. Automotive Insurance coverage for Completely different Automobile Varieties

This desk summarizes the suitability of surety bonds and automotive insurance coverage for numerous car varieties.

| Automobile Kind | Surety Bond Suitability | Automotive Insurance coverage Suitability |

|---|---|---|

| Private Automobiles | Usually not required | Extremely appropriate |

| Industrial Vehicles | Usually required for contractual obligations and regulatory compliance | Appropriate for damages, however not for contractual liabilities |

| Basic Automobiles | Could also be required for industrial use | Appropriate for damages, however not for industrial use liabilities |

| RVs | Could also be required for industrial use | Appropriate for damages, however not for industrial use liabilities |

Closing Notes: Surety Bond As an alternative Of Automotive Insurance coverage

In the end, the selection between surety bond and automotive insurance coverage is dependent upon particular person circumstances. This exploration has highlighted the potential benefits and downsides of every, permitting you to weigh the elements related to your scenario. By understanding the protection, price, authorized implications, and declare processes, you may confidently select the choice finest suited to your wants. Bear in mind, thorough analysis and session with professionals are important for making the suitable choice.

High FAQs

What are the standard causes somebody may think about a surety bond as a substitute of automotive insurance coverage?

Some people or companies may discover surety bonds extra appropriate for particular circumstances, resembling specialised autos, distinctive operational wants, or decrease legal responsibility exposures. They could even be drawn to the doubtless decrease premiums.

Can a surety bond absolutely change all points of automotive insurance coverage protection?

No, surety bonds sometimes don’t cowl all of the liabilities that automotive insurance coverage insurance policies do. Their focus usually lies on particular obligations, and there could also be areas the place automotive insurance coverage supplies broader safety.

How do I decide if a surety bond is the suitable alternative for my car kind?

Take into account the precise use and nature of your car. Industrial autos, for example, may necessitate a surety bond for sure points of operation. Consulting with an insurance coverage skilled is very really useful for customized steering.

What are some examples of conditions the place surety bonds may be a greater various than automotive insurance coverage?

Conditions like specialised transportation contracts, skilled legal responsibility exposures, or car operations with explicit authorized necessities may make surety bonds extra acceptable. Seek the advice of with knowledgeable for particular recommendation tailor-made to your circumstances.