Ny no fault automotive insurance coverage – New York no-fault automotive insurance coverage, a cornerstone of the state’s motorized vehicle legal guidelines, mandates a novel system for dealing with auto accidents. This intricate framework, designed to streamline the claims course of and expedite compensation for injured events, differs considerably from conventional liability-based fashions. Understanding its nuances is essential for each drivers and insurance coverage purchasers, because it impacts the fee and protection of insurance policies.

This information delves into the complexities of New York’s no-fault system, inspecting protection sorts, declare procedures, and the elements influencing premiums. By exploring the assorted sides of this method, we goal to supply a radical understanding of its workings and implications for motorists.

Overview of New York No-Fault Insurance coverage

New York’s no-fault insurance coverage system is a novel method to dealing with automotive accident claims. It differs considerably from different states’ fashions, specializing in instant medical care and property injury compensation no matter fault. This technique goals to streamline the claims course of and cut back litigation.This technique is designed to supply fast and complete protection for injured events in automotive accidents, no matter who triggered the accident.

Because of this policyholders can obtain advantages for his or her accidents and property injury with out having to pursue authorized motion towards the at-fault driver. This considerably impacts the prices and time related to accidents.

Key Elements of the No-Fault System

The New York no-fault system facilities round particular monetary protections for accident victims. These protections are designed to make sure well timed and enough compensation for medical bills and misplaced wages. The system’s core elements are essential to understanding the way it operates.

- First-Get together Advantages: This element ensures that accident victims obtain advantages straight from their very own insurance coverage coverage, no matter who triggered the accident. This covers medical bills, misplaced wages, and different associated prices. For instance, if a policyholder is injured in an accident, they will file a declare with their very own insurer for reimbursement of medical payments, even when one other driver was at fault.

- Private Damage Safety (PIP): It is a vital a part of the system. PIP advantages are supposed to cowl medical bills, misplaced wages, and different associated prices incurred by the injured occasion. That is designed to verify victims have entry to instant help, even when the at-fault occasion lacks insurance coverage or property.

- Property Injury: The system additionally covers injury to the insured automobile. The protection for this facet of the system can also be triggered by the accident and does not depend on fault dedication. This ensures that the automobile proprietor receives compensation no matter who was accountable.

Function and Advantages of the System

The no-fault system in New York has particular targets, aiming to streamline the claims course of and cut back litigation. The intent is to supply instant help to these concerned in accidents, which is a major benefit for victims.

- Lowered Litigation: By eliminating the necessity to set up fault earlier than receiving advantages, the system goals to scale back the variety of lawsuits. This typically saves money and time for all events concerned.

- Sooner Claims Processing: The system’s streamlined method typically results in sooner processing of claims, enabling faster entry to compensation for victims.

- Monetary Safety for Victims: The system is designed to guard accident victims financially, no matter who was at fault. That is essential for many who may need vital medical bills or misplaced wages.

Comparability to Different Insurance coverage Fashions

| Characteristic | No-Fault | Different Fashions (e.g., Fault-Based mostly) |

|---|---|---|

| Fault Willpower | Not required for many advantages | Important for claiming advantages |

| Declare Processing | Typically faster | Doubtlessly slower because of authorized proceedings |

| Compensation for Victims | Assured protection for specified losses | Compensation contingent on proving fault |

| Value of Insurance coverage | Can fluctuate, probably larger than fault-based in some circumstances | Doubtlessly decrease in some areas |

This desk highlights the elemental variations in how no-fault and different insurance coverage fashions function. No-fault prioritizes instant compensation, whereas different fashions prioritize establishing fault.

Protection Varieties and Advantages

New York’s no-fault insurance coverage system is designed to supply swift and honest compensation for automotive accident accidents, no matter fault. Understanding the assorted protection sorts inside your coverage is essential for navigating the system successfully and making certain you are protected. This part particulars the important thing coverages and their particular advantages, together with examples of after they apply.The totally different protection sorts inside a New York no-fault coverage are structured to handle a variety of potential accident outcomes.

Every protection performs a definite position in compensating for medical bills, misplaced wages, and different accident-related prices. A transparent understanding of those coverages is important for claiming advantages when wanted.

Private Damage Safety (PIP)

PIP protection is a cornerstone of New York no-fault insurance coverage. It is designed to pay for medical bills and misplaced wages ensuing from a automotive accident, no matter who was at fault.

- This protection helps guarantee injured people obtain immediate medical care and monetary help for his or her restoration.

- Advantages usually embrace medical remedy, together with physician visits, hospital stays, and rehabilitation. Misplaced wages because of incapacity to work as a direct results of the accident are additionally typically lined.

- Instance: A driver is concerned in a fender bender and suffers whiplash. PIP protection would cowl the related medical bills and misplaced wages.

No-Fault Medical Funds

This protection pays for important medical companies, like physician visits and remedy, associated to the accident.

- It is a separate element from PIP and sometimes has its personal protection limits.

- It is designed to enhance PIP and guarantee entry to essential medical care.

- Instance: A passenger in a automobile struck by one other automotive incurs medical payments for ongoing remedy periods; this protection would pay for the remedy periods.

Uninsured Motorist Protection

This significant protection protects you for those who’re injured in an accident brought on by a driver with no insurance coverage or inadequate protection.

- It steps in to cowl your medical bills, misplaced wages, and different damages in these conditions.

- It is vital for safeguarding your monetary well-being when coping with an uninsured or underinsured driver.

- Instance: A driver is struck by a hit-and-run driver with no insurance coverage. Uninsured motorist protection would assist compensate for the accidents and bills incurred.

Collision Protection, Ny no fault automotive insurance coverage

Collision protection pays for damages to your automobile if it is concerned in a collision, no matter fault.

- This protection is separate from PIP and is essential for repairing or changing your automobile.

- It’s important for the monetary restoration of your automobile within the occasion of an accident.

- Instance: Your automotive is concerned in a collision the place one other driver is at fault. Collision protection would cowl the repairs or substitute of your automobile.

Complete Protection

This protection protects your automobile from damages apart from collisions.

- It covers incidents like theft, vandalism, or injury from pure disasters.

- It gives a security web for varied unexpected circumstances that may injury your automotive.

- Instance: Your automotive is broken by a falling tree throughout a storm. Complete protection would cowl the repairs or substitute.

Desk of Protection Limits and Exclusions

| Protection Kind | Description | Limits | Exclusions |

|---|---|---|---|

| PIP | Pays for medical bills and misplaced wages no matter fault. | Sometimes $50,000 per individual, $25,000 per accident. | Pre-existing circumstances (with sure exceptions), intentional acts, and different particular exclusions. |

| No-Fault Medical Funds | Pays for medical companies straight associated to the accident. | Sometimes $50,000 per individual, $25,000 per accident. | Related exclusions to PIP, together with intentional acts and a few pre-existing circumstances. |

| Uninsured Motorist | Protects towards accidents with uninsured/underinsured drivers. | Much like PIP limits, typically matching or exceeding PIP protection. | Conditions the place the insured driver can also be at fault. |

| Collision | Covers injury to your automobile in a collision. | Depending on coverage; typically vital quantities. | Pre-existing injury to the automobile. |

| Complete | Covers injury to your automobile from non-collision occasions. | Depending on coverage; typically vital quantities. | Injury brought on by put on and tear, or intentional acts. |

Insurance coverage Necessities and Legal guidelines

New York’s no-fault insurance coverage system mandates particular protection for all drivers. Understanding these necessities is essential for avoiding hefty penalties and navigating potential claims successfully. This part particulars the required insurance coverage sorts, penalties for non-compliance, and the procedures concerned in submitting and dealing with no-fault claims.

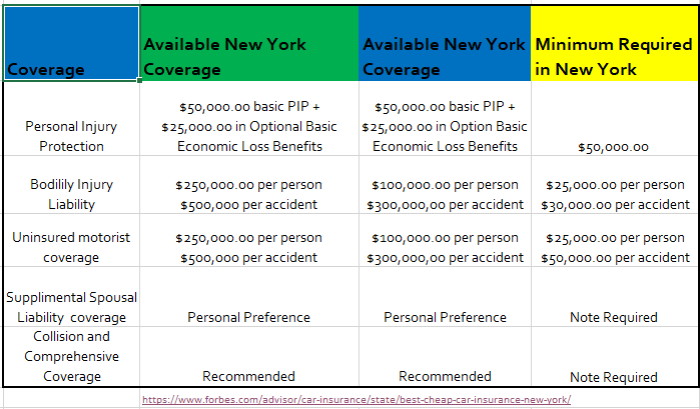

Obligatory Insurance coverage Necessities

New York State requires all drivers to keep up minimal legal responsibility insurance coverage protection. This contains bodily damage legal responsibility protection and property injury legal responsibility protection. Past these, the state mandates no-fault insurance coverage, which covers medical bills and misplaced wages no matter fault in an accident. Failing to keep up the required protection may end up in extreme penalties.

Penalties for Working With out Correct Insurance coverage

Driving with out the mandated insurance coverage protection in New York is a critical offense. Penalties can embrace vital fines, suspension or revocation of your driver’s license, and even potential authorized motion. It is essential to keep up correct insurance coverage to keep away from these penalties. For instance, a first-time offense might end in a considerable wonderful, whereas subsequent offenses would possibly result in extra extreme penalties, together with license suspension.

Authorized Procedures Concerned in No-Fault Claims

No-fault claims in New York comply with particular authorized procedures. The method usually includes submitting a declare together with your insurance coverage firm, offering crucial documentation, and collaborating in any investigations or value determinations carried out by the insurance coverage firm. Understanding the precise steps concerned is essential for making certain a easy declare course of.

Steps to Take After an Accident

Instantly following an accident, it is important to prioritize the security of all concerned. Name emergency companies if crucial, trade data with the opposite driver(s), and doc the accident scene. Gathering particulars resembling the situation, time, climate circumstances, and names and call data of all concerned events is crucial. Taking pictures of the injury and the scene is very beneficial.

After that, contact your insurance coverage firm and report the accident.

Authorized Necessities and Deadlines

| Requirement | Description | Deadline/Timeframe |

|---|---|---|

| Reporting Accident to Insurance coverage Firm | Notify your insurer as quickly as attainable after the accident. | Inside an inexpensive timeframe, usually inside 30 days. |

| Submitting a Declare | Provoke the formal declare course of together with your insurance coverage firm. | Will depend on the specifics of the declare. |

| Offering Documentation | Submit crucial documentation, resembling medical data and police stories. | As requested by the insurance coverage firm. |

| Collaborating in Investigations | Cooperate with any investigations carried out by the insurance coverage firm. | As scheduled. |

Observe: This desk gives a common overview. Particular deadlines and necessities could fluctuate relying on the precise circumstances of the declare. At all times seek the advice of together with your insurance coverage firm and authorized counsel for correct and personalised data.

Claims Course of and Procedures

Navigating a automotive accident declare in New York below no-fault insurance coverage will be complicated. Understanding the method, from reporting the accident to receiving compensation, is essential for a easy and environment friendly decision. This part particulars the steps concerned, emphasizing the significance of correct record-keeping and immediate motion.

Reporting an Accident

Promptly reporting an accident to your insurance coverage firm is paramount. Failure to report can have an effect on your declare. This includes offering correct particulars of the incident, together with time, location, concerned events, and witnesses. Documentation, resembling images of the injury and witness statements, is very beneficial. Insurance coverage firms typically have particular kinds and procedures for reporting accidents, which needs to be adhered to diligently.

Contacting your insurer instantly is crucial to provoke the declare course of and guarantee all crucial steps are taken.

Acquiring Medical Therapy

Searching for medical consideration after an accident is vital. This ensures correct care and documentation of accidents. A immediate go to to a health care provider, even for those who really feel solely minor discomfort, is beneficial. Medical payments are sometimes a key a part of the no-fault declare, so correct documentation out of your healthcare supplier is important. You should definitely maintain data of all medical therapies, together with appointments, diagnoses, and prescriptions.

This documentation is vital to help your declare and guarantee reimbursement for bills.

Function of Insurance coverage Adjusters and Mediators

Insurance coverage adjusters play an important position in evaluating claims. They examine the accident, assess damages, and decide protection. They’re chargeable for gathering data from all events concerned and should contact witnesses. A mediator could also be concerned to facilitate a settlement if there is a dispute between events. Adjusters goal to pretty assess the scenario and attain a decision throughout the framework of the insurance coverage coverage.

Step-by-Step Information to Dealing with a No-Fault Declare

- Instantly report the accident to your insurance coverage firm.

- Search immediate medical consideration and maintain detailed data of all remedy.

- Collect all related documentation, together with police stories, medical data, and restore estimates.

- Talk together with your insurance coverage adjuster and supply requested data in a well timed method.

- If crucial, take part in any mediation periods to resolve disagreements.

- Evaluation and punctiliously perceive any settlement gives.

This step-by-step information Artikels the fundamental procedures concerned in dealing with a no-fault declare. Following these steps effectively and diligently can result in a smoother and sooner decision.

Declare Timelines

| Declare Stage | Estimated Timeline |

|---|---|

| Accident Report & Preliminary Investigation | Inside 24-72 hours |

| Medical Therapy & Documentation | Ongoing, relying on the extent of accidents |

| Declare Analysis & Evaluation | 2-4 weeks |

| Settlement Negotiation | 2-6 weeks |

| Cost Processing | 1-3 weeks (following approval of settlement) |

Observe: These are estimated timelines, and precise occasions could fluctuate based mostly on the complexity of the declare and the precise insurance coverage firm. Contesting a declare can lengthen the method. The desk serves as a common guideline and shouldn’t be thought-about absolute.

Value and Premiums

No-fault insurance coverage in New York, whereas obligatory, is not a free lunch. Understanding the elements that drive up premiums and the methods to maintain them down is essential for accountable budgeting. This part will dissect the elements of New York no-fault insurance coverage prices and current sensible methods to economize.Common premiums fluctuate considerably relying on elements like your driving document, location, and automobile kind.

Evaluating quotes throughout totally different suppliers is crucial to discovering the perfect worth. We’ll Artikel easy methods to successfully examine quotes and spotlight methods for lowering your insurance coverage invoice.

Elements Affecting Insurance coverage Prices

A number of elements affect the price of your New York no-fault insurance coverage coverage. A clear driving document, for example, often interprets to decrease premiums, whereas accidents or site visitors violations can dramatically enhance them. Your location additionally performs a job, as some areas have larger accident charges, resulting in larger insurance coverage prices. The kind of automobile you drive is one other issue.

Greater-value, costlier automobiles usually command larger insurance coverage premiums because of the potential for better monetary loss in an accident. Moreover, insurers contemplate your credit score historical past, although that is much less straight linked to driving potential, it may possibly nonetheless affect premiums.

Evaluating Insurance coverage Quotes

Immediately evaluating quotes is a vital step in securing the absolute best price. A radical comparability includes trying on the particulars of every quote, not simply the marketed value. Options like complete protection, add-ons for roadside help, and deductibles have to be thought-about alongside the bottom premium. Use on-line comparability instruments to collect quotes from a number of suppliers concurrently.

This technique permits you to simply examine options and pricing. Examine protection ranges, not simply the value tag.

Methods to Scale back Insurance coverage Prices

A number of methods might help you cut back your no-fault insurance coverage premiums. Sustaining a clear driving document is paramount, as site visitors violations and accidents can drastically enhance your premiums. Contemplate bundling your insurance policies with different companies like residence insurance coverage, as some suppliers provide reductions for this. Elevating your deductible can decrease your month-to-month premium, however bear in mind that you will have to pay a bigger quantity out of pocket within the occasion of an accident.

Common Premiums Throughout Completely different Suppliers

Whereas exact figures fluctuate, some suppliers have a tendency to supply decrease common premiums than others. Researching provider-specific information and opinions can present invaluable insights into the typical prices related to totally different insurance coverage firms. This analysis might help you identify if an organization’s pricing aligns together with your wants.

Desk of Insurance coverage Choices and Prices

| Insurance coverage Supplier | Protection Degree | Estimated Premium (Annual) |

|---|---|---|

| Firm A | Primary No-Fault | $1,500 |

| Firm B | Primary No-Fault + Complete | $1,800 |

| Firm C | Enhanced No-Fault + Roadside Help | $2,200 |

| Firm D | Primary No-Fault + Collision | $1,700 |

Observe: Estimated premiums are for illustrative functions solely and might fluctuate based mostly on particular person circumstances.

Frequent Points and Disputes

No-fault insurance coverage, whereas designed to streamline the claims course of, can nonetheless result in disagreements between insurers and policyholders. Understanding these widespread points and the avenues for decision is essential for navigating the system successfully.Frequent factors of competition typically revolve across the interpretation of coverage language, the analysis of medical bills, and the dedication of fault in accidents. The complexities of those points, coupled with the inherent monetary stakes, can escalate tensions.

Frequent Sources of Disputes

Policyholders and insurers typically conflict over the interpretation of coverage language, particularly concerning the definition of “cheap and crucial” medical bills. Ambiguity in these areas can result in disputes over reimbursement quantities. One other vital supply of competition includes the calculation of misplaced wage advantages, significantly in circumstances of disputed work-related limitations following an accident. The dedication of whether or not an damage is straight associated to the accident will be extremely contentious.

Mediation and Arbitration

Mediation and arbitration are invaluable instruments for resolving disputes outdoors of court docket. Mediation includes a impartial third occasion facilitating communication and negotiation between the insurer and policyholder. Arbitration, alternatively, includes a impartial third occasion making a binding choice based mostly on introduced proof and arguments.Each strategies will be cost-effective and faster than litigation. Mediation fosters communication and compromise, whereas arbitration gives a proper, but more cost effective, decision.

Profitable outcomes typically rely upon the willingness of each events to interact constructively within the course of.

Profitable Dispute Decision Methods

A proactive method to communication, documentation, and a transparent understanding of the coverage phrases can tremendously improve the possibilities of a constructive decision. Sustaining detailed data of medical payments, misplaced wages, and communication with the insurance coverage firm might help substantiate claims. Thorough evaluation of the coverage phrases and looking for clarification on ambiguous factors can preempt disputes. Participating with the insurance coverage firm early on within the course of and looking for clarification generally is a essential step to keep away from escalation.

Desk of Frequent Disputes and Typical Options

| Frequent Dispute | Typical Answer |

|---|---|

| Disagreement on the reasonableness of medical bills | Presenting detailed medical data, documentation of the need of remedy, and probably looking for a second opinion from a medical skilled. |

| Dispute over misplaced wage calculations | Offering detailed data of misplaced wages, together with pay stubs, documentation of labor limitations, and probably consulting with an employment lawyer or vocational counselor. |

| Variations in interpretation of coverage language | Reviewing the coverage fastidiously, looking for clarification from the insurer, and consulting with an lawyer if crucial. |

| Claims denial with out ample justification | Documenting all correspondence and communications, looking for authorized counsel if the denial seems unjustified, and exploring mediation or arbitration choices. |

Assets and Help for Policyholders

Navigating the complexities of New York’s no-fault insurance coverage system will be difficult. Happily, quite a few sources can be found to assist policyholders perceive their rights and obligations, and resolve points successfully. This part particulars dependable sources, contact data, and sensible tricks to streamline the method.Understanding your rights and obligations throughout the no-fault system is essential to a easy expertise. This part gives important instruments and steering that can assist you navigate the method with confidence.

Dependable Assets for Info

New York State gives varied sources to help policyholders in comprehending no-fault insurance coverage laws and procedures. The Division of Monetary Providers (DFS) and the Workplace of the New York State Insurance coverage Fraud Investigator are invaluable sources for clarifying policyholder rights and obligations. Their web sites present detailed data, continuously requested questions, and call data. These sources assist policyholders keep knowledgeable and make knowledgeable choices.

Authorities Businesses and Client Safety Organizations

A number of authorities companies and shopper safety organizations play an important position in making certain honest and equitable remedy of no-fault insurance coverage policyholders. These entities present steering, resolve disputes, and examine complaints.

| Company/Group | Contact Info | Focus Space |

|---|---|---|

| New York State Division of Monetary Providers (DFS) | (518) 474-8000 or go to dfs.ny.gov | Regulating insurance coverage firms, investigating complaints, and offering shopper schooling. |

| New York State Workplace of the Insurance coverage Fraud Investigator | (518) 474-8000 or go to dfs.ny.gov | Investigating insurance coverage fraud and offering help to victims of fraud. |

| New York State Lawyer Normal’s Workplace | (518) 474-8000 or go to ag.ny.gov | Defending customers and implementing shopper rights, together with these associated to insurance coverage. |

Useful Suggestions for Navigating the No-Fault System

Thorough record-keeping is crucial. Maintain copies of all correspondence, medical payments, and police stories associated to an accident. Talk clearly and promptly together with your insurance coverage firm about any declare. Do not hesitate to hunt authorized counsel for those who encounter difficulties understanding your rights or resolving a declare. This proactive method considerably enhances the chance of a profitable final result.

Steadily Requested Questions (FAQs)

Understanding the intricacies of no-fault insurance coverage typically requires addressing widespread questions. These FAQs present clear and concise solutions to continuously requested questions on no-fault protection, procedures, and disputes.

- What’s the course of for submitting a no-fault declare? Policyholders should submit a declare type to their insurance coverage firm, offering crucial particulars concerning the accident and associated medical bills. Detailed documentation, together with medical data and police stories, is often required. The insurance coverage firm will then consider the declare and decide the suitable protection.

- How lengthy does it take to obtain a payout for a no-fault declare? Declare processing occasions fluctuate based mostly on the complexity of the declare and the effectivity of the insurance coverage firm. Some claims could be processed shortly, whereas others could take longer because of elements resembling intensive medical evaluations or disputes. Typically, the timeframe for a declare to be absolutely processed and settled can vary from a couple of weeks to a number of months.

- What occurs if I disagree with the insurance coverage firm’s settlement provide? Policyholders have choices for disputing a settlement provide, together with requesting mediation or submitting a proper grievance with related authorities. Understanding these choices and pursuing them diligently is essential.

Illustrative Situations: New York No Fault Automobile Insurance coverage

Understanding New York’s no-fault insurance coverage system will be difficult. These situations will stroll you thru widespread accident conditions and the way the claims course of unfolds. Every instance highlights the precise coverages triggered and the final steps concerned.No-fault insurance coverage is designed to supply immediate monetary help for accidents and automobile repairs, no matter who triggered the accident. This technique streamlines the method and reduces delays.

Situation 1: A Minor Fender Bender

A minor fender bender happens on a busy metropolis road. Driver A, insured by Acme Insurance coverage, bumps the rear bumper of Driver B’s automobile, insured by Dependable Insurance coverage. Each drivers are barely shaken however report no vital accidents. The injury to the automobiles is minor.

- Protection Concerned: Property injury protection can be used to restore the automobiles. No-fault advantages will seemingly not be concerned on this scenario, as accidents aren’t vital. Medical funds protection wouldn’t be triggered since there are not any reported accidents.

- Declare Course of: Every driver’s insurance coverage firm will assess the injury. They could organize for repairs at a pre-approved restore store. The claims adjusters will talk and coordinate the restore course of. A declare for property injury can be filed by every insurance coverage firm.

Situation 2: A Multi-Automobile Pile-Up

A multi-vehicle pile-up on a freeway results in a number of drivers needing medical consideration. Driver C, insured by United Insurance coverage, rear-ends a automotive, inflicting a series response. Driver D, insured by Progressive Insurance coverage, suffers a damaged arm, and Driver E, insured by State Farm, experiences a concussion.

- Protection Concerned: On this situation, private damage safety (PIP) protection can be essential for Driver D and Driver E’s medical bills. Property injury protection can be used to restore the automobiles concerned. Driver C’s insurance coverage will deal with their very own automobile’s injury. The specifics of protection will rely upon the coverage limits of every driver’s insurance coverage.

- Declare Course of: Medical payments and remedy can be lined by PIP. The injured events will file claims with their respective insurance coverage firms. The insurance coverage firms will work collectively to settle the declare, together with arranging medical care, coordinating restore work, and figuring out legal responsibility. The insurance coverage firms will negotiate to find out who’s chargeable for the accident and the extent of damages.

Situation 3: An Accident with Severe Accidents

Driver F, insured by Liberty Mutual, is concerned in a hit-and-run accident. Driver F sustains a critical again damage requiring intensive bodily remedy and surgical procedure. The at-fault driver is unknown.

- Protection Concerned: Driver F’s PIP protection will seemingly be the first supply of compensation for medical bills, misplaced wages, and ache and struggling. The supply of protection will rely upon the coverage’s particular limits. A declare for uninsured/underinsured motorist (UM/UIM) protection can be essential to cowl damages above the boundaries of Driver F’s coverage if the at-fault driver is unidentified or uninsured.

- Declare Course of: Driver F will file a declare with their insurance coverage firm for PIP and UM/UIM advantages. The insurance coverage firm will organize for medical care and deal with the declare’s documentation. The insurance coverage firm might also examine the accident to find the at-fault driver and search reimbursement.

Final Level

In conclusion, New York’s no-fault automotive insurance coverage system, whereas presenting a particular method to accident decision, calls for cautious consideration. Navigating the precise protection sorts, declare procedures, and potential disputes requires a nuanced understanding of the authorized framework. This complete information gives a roadmap for understanding the system’s intricacies, empowering policyholders to make knowledgeable choices and guarantee enough safety.

Common Questions

What are the widespread elements influencing insurance coverage premiums in New York?

Elements like driving document, automobile kind, location, and protection choices considerably influence insurance coverage premiums. A clear driving document usually leads to decrease premiums, whereas high-value automobiles or intensive protection choices can enhance the fee.

What are the deadlines for submitting a no-fault declare in New York?

Particular deadlines fluctuate relying on the declare kind and nature of the accident. The information will comprise a desk with the required deadlines and procedures for well timed submitting.

What are the widespread disputes that come up in no-fault claims?

Disputes continuously come up over the extent of accidents, medical remedy prices, and the suitable protection for damages. Insurance coverage adjusters and mediators play an important position in resolving these conflicts.

How can I examine insurance coverage quotes from totally different firms?

Evaluating quotes includes gathering data from a number of insurers, together with particulars on protection, premiums, and reductions. The information will present methods and sources to successfully examine varied choices.