Motorbike insurance coverage vs automobile insurance coverage presents an important choice for riders. Every affords a singular tapestry of safety, but their landscapes differ dramatically. Understanding the nuances of protection, premium components, and claims processes is paramount in navigating this often-complex terrain. This exploration delves into the intricate variations between these two very important types of monetary safety.

This comparability will illuminate the distinctive options of every sort of insurance coverage, offering a transparent understanding of the advantages and downsides related to every. The concerns embrace protection choices, price comparisons, and the intricate processes of submitting claims. This detailed evaluation will empower riders to make knowledgeable choices aligned with their particular person wants and monetary circumstances.

Motorbike Insurance coverage Protection: Motorbike Insurance coverage Vs Automobile Insurance coverage

Motorbike insurance coverage, not like automobile insurance coverage, presents distinctive dangers and concerns because of the nature of the automobile. This necessitates a tailor-made method to protection, typically with completely different premiums and limitations in comparison with insurance policies for cars. Understanding the assorted protection choices is essential for bike house owners to adequately defend their funding and legal responsibility.

Typical Motorbike Insurance coverage Protection

Motorbike insurance coverage insurance policies sometimes embrace related coverages to automobile insurance coverage, however with particular nuances. Legal responsibility protection, for instance, is prime and protects towards monetary accountability within the occasion of an accident the place the insured is at fault. Collision and complete coverages deal with harm to the bike, no matter who’s at fault. Uninsured/underinsured motorist protection is important for defense towards drivers with out enough insurance coverage.

Legal responsibility Protection

Legal responsibility protection is remitted in most jurisdictions and compensates for bodily damage or property harm prompted to others in an accident the place the insured is deemed accountable. The coverage limits outline the utmost quantity the insurer pays for these claims. As an example, a $100,000 restrict would imply the insurer’s most payout for anyone declare can be $100,000.

This protection mirrors related provisions in automobile insurance coverage however typically has decrease limits because of the perceived larger danger related to bikes.

Collision Protection

Collision protection pays for damages to the insured bike if it is concerned in a collision, no matter fault. This safety is important to cowl repairs or substitute prices following an accident. Evaluating this with automobile insurance coverage, collision protection stays comparable in its perform, however premiums and coverage limits would possibly differ.

Complete Protection

Complete protection protects the bike from harm brought on by occasions aside from collisions, akin to theft, vandalism, hearth, or weather-related incidents. The protection typically consists of harm from falling objects or sure forms of animal collisions. This protection is similar to the great protection in automobile insurance coverage, however could have completely different exclusions and limitations based mostly on the precise coverage.

Uninsured/Underinsured Motorist Protection

Uninsured/underinsured motorist protection safeguards the insured and their passengers towards drivers missing enough insurance coverage or being uninsured. This protection turns into very important if one other driver is at fault and lacks enough insurance coverage to cowl the complete extent of damages. This protection is an important safeguard in each bike and automobile insurance coverage.

Deductibles and Coverage Limits

Deductibles are the quantities the insured should pay out-of-pocket earlier than the insurer begins to pay claims. Coverage limits outline the utmost quantity the insurer pays for a declare. Each deductibles and coverage limits range relying on the precise coverage and the extent of protection chosen. Greater limits sometimes correspond with larger premiums.

Exclusions and Limitations, Motorbike insurance coverage vs automobile insurance coverage

Motorbike insurance coverage insurance policies typically include exclusions for particular forms of damages or conditions. As an example, some insurance policies could not cowl harm ensuing from racing or stunt using. Understanding these exclusions is essential to keep away from potential disputes or misunderstandings.

Motorbike vs. Automobile Insurance coverage Protection Comparability

Elements Affecting Motorbike Insurance coverage Premiums

Motorbike insurance coverage premiums, like these for automobile insurance coverage, are influenced by a posh interaction of things. Understanding these components is essential for riders to make knowledgeable choices about their protection and price range. A complete evaluation of those components permits for a clearer understanding of the pricing constructions and the rationale behind various insurance coverage prices.A major distinction between bike and automobile insurance coverage lies within the inherent dangers related to every mode of transportation.

Bikes, attributable to their smaller measurement and lack of the protecting cage of a automobile, are extra weak to accidents and infrequently incur larger restore prices. This inherent danger is a major driver within the premium calculation for bike insurance coverage.

Rider Expertise

Rider expertise is a key determinant in bike insurance coverage premiums. Insurers assess a rider’s driving historical past, together with any prior accidents or violations. Skilled riders with a clear file typically qualify for decrease premiums, reflecting their lowered danger profile. Conversely, newer riders or these with a historical past of site visitors violations face larger premiums. This displays the established relationship between driving expertise and accident probability.

Rider Age

Rider age considerably impacts insurance coverage premiums. Youthful riders are sometimes thought-about higher-risk attributable to their perceived inexperience and doubtlessly larger propensity for dangerous behaviors. Older riders, whereas doubtlessly exhibiting various kinds of danger components, could have established driving histories that present a extra predictable danger evaluation. These components are thought-about in setting the premium for every age bracket.

Location

Geographic location considerably influences bike insurance coverage charges. Areas with larger accident charges, poor street situations, or elevated site visitors density are likely to have larger premiums. It is a direct consequence of the chance related to driving in these particular areas. The native components related to larger danger, akin to climate patterns or site visitors congestion, affect insurance coverage charges accordingly.

Kind of Motorbike

The kind of bike additionally performs an important function in premium calculation. Bigger, extra highly effective bikes are typically related to larger premiums. That is typically because of the elevated potential for harm in an accident and the upper price of repairs. Insurers contemplate the precise options and specs of the bike mannequin to find out the suitable premium.

Motorbike Utilization Patterns

Motorbike utilization patterns, akin to commuting versus leisure using, affect premiums. Commuting riders, sometimes protecting shorter distances and in acquainted places, could face decrease premiums than these engaged in intensive leisure using. The elevated danger related to longer distances and doubtlessly unfamiliar routes contributes to larger premiums. This issue considers the inherent dangers related to every sort of using.

Rider Behaviors

Particular rider behaviors instantly affect premiums. Behaviors like dashing, aggressive driving, and disregarding site visitors legal guidelines are all indicators of upper danger. Insurers typically penalize riders with such behaviors by way of elevated premiums. Conversely, riders who prioritize secure practices and display accountable using habits are sometimes rewarded with decrease premiums. That is based mostly on the precept that secure driving behaviors scale back the likelihood of accidents.

Comparability with Automobile Insurance coverage Elements

Whereas some components, akin to location, have an effect on each bike and automobile insurance coverage, important variations exist. Motorbike insurance coverage charges are sometimes extra delicate to rider expertise and the kind of bike. Automobile insurance coverage, alternatively, could also be extra delicate to components such because the automobile’s make and mannequin and the driving force’s automobile utilization patterns.

Illustrative Instance

A younger rider with a historical past of dashing tickets and a strong sport bike in a high-accident space would doubtless face a considerably larger bike insurance coverage premium than an skilled rider with a clear file, an older, much less highly effective bike, and a historical past of commuting in a lower-risk space.

Evaluating Coverage Prices and Advantages

Motorbike insurance coverage insurance policies, whereas typically perceived as dearer than automobile insurance coverage, can supply substantial price financial savings in particular circumstances. The comparative prices and advantages are closely influenced by regional components, rider expertise, and the chosen protection ranges. This part explores the nuanced price constructions and benefits of motorbike insurance coverage, highlighting conditions the place it may be extra economical than automobile insurance coverage.The common price of motorbike insurance coverage varies considerably throughout completely different areas attributable to components akin to native site visitors legal guidelines, accident charges, and the price of residing.

A complete comparability necessitates contemplating each the bottom premiums and the non-obligatory add-ons, which might dramatically alter the general coverage price.

Common Coverage Prices Throughout Areas

Common bike insurance coverage premiums are typically decrease than automobile insurance coverage premiums in rural areas with fewer site visitors incidents and decrease accident charges. Conversely, city areas with excessive site visitors density and better accident dangers are likely to have larger premiums for each bike and automobile insurance coverage. Knowledge from insurance coverage comparability web sites and trade experiences present a substantial discrepancy in premium prices between city and rural areas.

Comparability of Protection Quantities

Motorbike insurance coverage insurance policies sometimes supply decrease protection quantities in comparison with automobile insurance coverage insurance policies, reflecting the inherent dangers related to bikes. Motorbike insurance policies typically have decrease legal responsibility limits and will not embrace complete protection choices akin to collision or complete damages as normal. Nonetheless, riders can typically add complete protection as an non-obligatory rider, rising the general price.

Rider Expertise and its Impression on Premiums

A rider’s expertise and driving historical past considerably have an effect on bike insurance coverage premiums. New riders with restricted expertise face larger premiums because of the elevated danger of accidents. Insurers sometimes assess components like age, years of expertise, and former accident historical past. Skilled riders with a clear driving file are sometimes eligible for decrease premiums.

Execs and Cons of Motorbike Insurance coverage Protection

Motorbike insurance coverage protection typically focuses on legal responsibility, providing safety towards damages prompted to different autos or people. This typically consists of minimal protection for the bike itself, emphasizing the necessity for riders to contemplate extra riders. Conversely, automobile insurance coverage often offers complete protection for the automobile and its occupants, encompassing collision, complete, and private damage safety. The particular protection choices provided range considerably between insurance policies and areas.

Eventualities The place Motorbike Insurance coverage May Be Extra Price-Efficient

Motorbike insurance coverage might be less expensive than automobile insurance coverage for riders in areas with low accident charges and a deal with legal responsibility protection. As an example, a rider with restricted mileage and residing in a rural space would possibly discover bike insurance coverage considerably cheaper than automobile insurance coverage. Equally, riders primarily utilizing their bikes for commuting or leisure actions could discover bike insurance coverage extra economical than automobile insurance coverage.

Advantages of Extra Add-ons or Riders

Including riders, akin to complete protection, or private damage safety, considerably enhances the safety provided by bike insurance coverage insurance policies. These riders present safety towards harm to the bike in case of accidents, vandalism, or theft. Additionally they lengthen protection to the rider, offering monetary assist in case of accidents or medical bills. Including such add-ons will naturally improve the general price of the insurance coverage coverage.

Desk of Potential Financial savings/Elevated Prices

| Function | Motorbike Insurance coverage | Automobile Insurance coverage |

|---|---|---|

| Premium Price | Doubtlessly decrease in rural areas, larger in city areas | Typically larger in city areas, doubtlessly decrease in rural areas |

| Protection Quantity | Decrease legal responsibility limits, typically minimal complete protection | Greater legal responsibility limits, typically consists of collision, complete, and private damage safety |

| Rider Expertise | Premiums improve with restricted expertise | Premiums improve with restricted expertise |

| Complete Protection | Usually an add-on, rising price | Commonplace protection, decrease price |

Claims Course of and Settlements

The claims course of for bike accidents differs considerably from that of automobile accidents, primarily because of the inherent vulnerabilities of bikes. Understanding these variations is essential for each policyholders and insurance coverage corporations to make sure a good and environment friendly decision. The method includes a collection of steps, from preliminary reporting to closing settlement, every with particular necessities and potential pitfalls.

Motorbike Accident Reporting Procedures

Correct reporting is the primary crucial step within the claims course of. Rapid notification to the insurance coverage firm is important, following particular procedures Artikeld within the coverage. This typically includes contacting the insurer instantly, offering particulars of the accident, and requesting a declare quantity. Documentation of the incident, together with witness statements, can also be very important.

Documentation Necessities for Motorbike Claims

Thorough documentation is paramount for a profitable declare. This consists of the police report, if filed, pictures of the accident scene and harm to the bike, medical information, and witness statements. The readability and completeness of this documentation considerably affect the declare’s consequence. Failure to offer full and correct documentation can result in delays or rejection of the declare.

As an example, a lacking police report would possibly necessitate additional investigation, doubtlessly delaying all the course of.

Position of Adjusters in Motorbike Claims

Insurance coverage adjusters play a key function in evaluating the declare. Their accountability consists of investigating the accident, assessing the damages, and figuring out the suitable settlement quantity. This course of typically includes contacting witnesses, reviewing the documentation, and doubtlessly inspecting the bike. An intensive investigation ensures that the settlement precisely displays the loss. An intensive investigation is essential for a good and equitable settlement, because it prevents over or underneath compensation.

Variations in Motorbike and Automobile Insurance coverage Claims Processes

The claims course of for bikes differs from that of vehicles in a number of key elements. Motorbike accidents typically end in extra extreme accidents and better restore prices for the bike. The shortage of passenger compartment safety in bikes contributes to this distinction. Insurance coverage corporations typically have completely different procedures for evaluating harm to bikes in comparison with vehicles, bearing in mind the distinctive building and vulnerability of bikes.

Frequent Points and Disputes in Motorbike Insurance coverage Claims

A number of points can come up through the claims course of. One widespread dispute includes figuring out fault. Ambiguity within the police report or conflicting witness statements can complicate this side. One other important problem is the analysis of the bike’s restore prices. Variations in restore estimates from numerous mechanics can result in disputes.

Moreover, disagreements over the extent of accidents sustained by the bike rider can complicate the settlement course of. It’s crucial for each events to know and deal with these points transparently and successfully to keep away from disputes.

Step-by-Step Process for Submitting a Motorbike Insurance coverage Declare

- Instantly notify your insurance coverage firm of the accident, offering all obligatory particulars, together with the date, time, location, and concerned events. Contacting the insurance coverage firm instantly is important for well timed processing.

- Acquire all related documentation, together with the police report, medical information, restore estimates, and witness statements. Thorough documentation is essential to a easy and environment friendly claims course of.

- Cooperate totally with the insurance coverage adjuster through the investigation. This consists of offering entry to the bike and cooperating with requests for data.

- Evaluate the settlement supply rigorously. Evaluate the supply with restore estimates and medical payments to make sure it adequately covers the damages incurred. A cautious evaluate ensures a good settlement.

- For those who disagree with the settlement supply, talk your considerations to the insurance coverage firm. A transparent communication of considerations is essential for additional negotiation.

Motorbike Insurance coverage Reductions and Choices

Motorbike insurance coverage premiums can range considerably relying on numerous components, together with the rider’s expertise, the kind of bike, and the geographic location. Reductions can considerably scale back these prices, making insurance coverage extra accessible and reasonably priced for motorcyclists. Understanding obtainable reductions is essential for optimizing insurance coverage protection and monetary planning.

Obtainable Reductions

Reductions for bike insurance coverage typically mirror these in automobile insurance coverage, however distinctive concerns for bike operation are factored in. A wide selection of reductions is accessible, doubtlessly reducing premiums considerably. These reductions can typically result in substantial financial savings for riders who meet the standards.

Secure Driving Applications

Participation in secure driving applications, akin to defensive driving programs, often results in reductions. These applications equip riders with important abilities and data to navigate difficult conditions, minimizing the chance of accidents. Profitable completion of such programs demonstrably lowers accident charges and promotes safer using habits, which insurers acknowledge and reward.

Anti-theft Units

Set up of anti-theft gadgets, akin to alarms or safety methods, can qualify riders for reductions. These gadgets act as deterrents towards theft, safeguarding the funding within the bike. The presence of those gadgets instantly correlates with a lowered danger of theft, an element insurers contemplate when assessing danger profiles and providing premium reductions.

Good Pupil Reductions

Insurers typically supply reductions for college students with a clear driving file. These reductions acknowledge the lowered driving expertise and potential for accidents amongst novice riders, and are a mirrored image of the decrease danger profile related to youthful drivers with fewer years on the street.

Motorbike-Particular Reductions

Some reductions are tailor-made solely to bike insurance coverage. For instance, sure reductions may be provided for bike upkeep information, akin to scheduled servicing and maintenance. These reductions acknowledge the proactive method to bike upkeep, indicating accountable possession and contributing to a lowered accident danger.

Comparability of Reductions in Motorbike and Automobile Insurance coverage

Whereas some reductions overlap between bike and automobile insurance coverage (e.g., secure driving programs), others are distinctive to bikes. Motorbike-specific reductions typically deal with the distinctive challenges and concerns of motorbike operation, such because the forms of anti-theft measures obtainable, and the precise upkeep schedules. Automobile insurance coverage reductions would possibly focus extra on components like automobile sort and security options. Evaluating these reductions permits riders to maximise their financial savings and guarantee they’re receiving the very best protection.

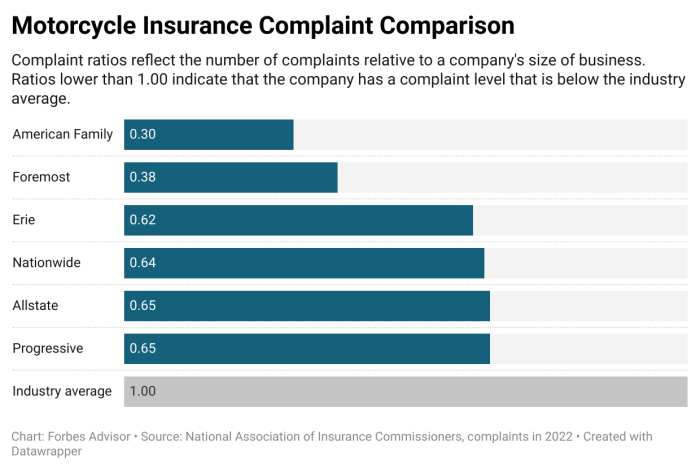

Record of Insurance coverage Corporations Providing Motorbike Insurance coverage

This isn’t an exhaustive listing, and availability could range by area and particular person circumstances. It is advisable to analysis instantly with the businesses to verify present choices and eligibility standards.

- Progressive

- State Farm

- Geico

- Allstate

- Nationwide

- Liberty Mutual

- Farmers Insurance coverage

- Mercury Insurance coverage

- AAA

- USAA

Motorbike Insurance coverage vs. Automobile Insurance coverage – Illustration

Motorbike insurance coverage and automobile insurance coverage, whereas each designed to guard policyholders, differ considerably in protection necessities and premium constructions. Understanding these distinctions is essential for making knowledgeable choices about private monetary safety. This comparability highlights the distinctive dangers and obligations related to every sort of auto, informing selections based mostly on particular person circumstances and wishes.

Protection Comparability

The core distinction lies within the inherent danger profiles. Bikes are extra weak to accidents attributable to components like decrease visibility and fewer structural safety. Consequently, bike insurance coverage typically emphasizes complete protection, together with medical funds for accidents sustained by the rider and others concerned. Conversely, automobile insurance coverage sometimes focuses on legal responsibility protection, which protects towards harm to different autos or accidents to others.

Nonetheless, complete protection for vehicles, together with harm to the insured automobile, can also be obtainable and often included.

Premium Elements Illustration

| Issue | Motorbike Insurance coverage | Automobile Insurance coverage |

|---|---|---|

| Car Kind | Greater premiums attributable to better danger of harm and damage. | Premiums range based mostly on components akin to make, mannequin, and 12 months. |

| Rider Expertise | New riders or these with a poor driving file typically face larger premiums. | Drivers with a historical past of accidents or site visitors violations could have larger premiums. |

| Location | Premiums can fluctuate based mostly on accident charges and native site visitors situations. | Premiums range throughout states and cities attributable to components like site visitors congestion and accident charges. |

| Utilization | Frequency and distance of motorbike use can affect premium prices. | Frequency and distance of automobile use can have an effect on insurance coverage prices. |

| Protection Choices | Complete protection typically consists of medical funds, uninsured/underinsured motorist protection, and collision protection. | Legal responsibility protection is normal, however complete, collision, and uninsured/underinsured motorist protection are additionally obtainable. |

This desk illustrates the important thing components driving premium variations. A hypothetical instance: a younger, inexperienced bike rider in an accident-prone space would possibly pay considerably extra for bike insurance coverage than a seasoned driver of a more moderen, much less accident-prone automobile in a low-accident zone.

Resolution-Making Flowchart

This visible flowchart represents the decision-making course of for selecting between bike and automobile insurance coverage. It Artikels the important thing questions to contemplate, together with automobile sort, using expertise, and placement, to reach on the most fitted coverage. The choice relies on the comparative evaluation of protection and premium components for each forms of insurance coverage.

Ending Remarks

In conclusion, the selection between bike and automobile insurance coverage rests on a cautious analysis of particular person circumstances. Whereas each present important security nets, understanding the precise options of every coverage is essential. The components that affect premiums, the protection particulars, and the claims procedures are key components in making an knowledgeable selection. In the end, this comparability goals to offer a roadmap for riders to confidently choose the insurance coverage that finest protects their funding and way of life.

FAQ Information

What are the standard exclusions in bike insurance coverage insurance policies?

Exclusions typically embrace harm brought on by racing, reckless operation, or use of the bike for unlawful actions. Coverage specifics range by insurer.

How do utilization patterns (e.g., commuting vs. leisure using) have an effect on bike insurance coverage premiums?

Commuting typically ends in decrease premiums in comparison with leisure using, because it suggests a extra predictable and fewer dangerous utilization sample.

What are some widespread points or disputes that come up throughout bike insurance coverage claims?

Disagreements can come up relating to the extent of harm, the validity of the declare, or the accountability for the accident.

Are there particular reductions tailor-made to bike insurance coverage?

Sure, some insurers supply reductions for security programs, anti-theft gadgets, or for riders with clear driving information.