Mexico automotive rental insurance coverage necessities are essential for a easy and worry-free journey. Understanding these laws ensures you are adequately protected towards unexpected circumstances. This complete information will stroll you thru the important elements of automotive rental insurance coverage in Mexico, together with numerous choices, company-specific insurance policies, authorized obligations, and important paperwork.

Navigating the complexities of Mexican automotive rental insurance coverage will be difficult, particularly for vacationers. This information clarifies the often-confusing particulars, enabling you to make knowledgeable selections and keep away from potential issues. From protection limits to different insurance coverage choices, we’ll present a transparent and concise overview that can assist you select the most effective plan in your wants.

Mexico Automobile Rental Insurance coverage Overview

Navigating the panorama of automotive rental insurance coverage in Mexico will be simple with the fitting understanding. This overview particulars the overall necessities and out there choices, serving to you make knowledgeable selections earlier than your journey. Understanding these specifics beforehand ensures a easy and worry-free rental expertise.Rental companies in Mexico typically require a minimal stage of insurance coverage protection to guard each the renter and the automotive.

This sometimes includes a mix of the renter’s private insurance coverage and/or further protection offered by the rental firm. Understanding the precise insurance policies and phrases of your chosen rental is essential for a constructive expertise.

Insurance coverage Necessities

Rental corporations in Mexico sometimes require a mix of insurance coverage choices. This often includes a minimal stage of legal responsibility insurance coverage, and infrequently the necessity for supplemental protection. Understanding the precise necessities of the rental company is vital.

Forms of Insurance coverage Choices

A number of insurance coverage choices can be found to automotive renters in Mexico. These choices range in scope and value, permitting for tailoring to particular person wants and budgets. Choosing the proper protection is essential for a easy rental expertise.

- Legal responsibility Insurance coverage: This sort of insurance coverage covers harm to a different individual’s automobile or accidents sustained by one other individual in an accident. It’s a necessary element of most rental agreements, and infrequently the minimal protection required by Mexican regulation.

- Collision Insurance coverage: This insurance coverage protects the renter from monetary accountability for harm to the rental automotive in case of an accident. This protection is essential for shielding the renter from potential massive bills.

- Complete Insurance coverage: This feature covers harm to the rental automotive brought on by components aside from collisions, equivalent to vandalism, theft, or pure disasters. It is a further layer of safety past legal responsibility and collision insurance coverage, providing a complete safeguard.

- Private Insurance coverage (e.g., bank card protection): Some renters could have already got enough protection by way of their very own private insurance coverage insurance policies or bank card advantages. This must be checked earlier than reserving, as it could scale back the necessity for added rental insurance coverage.

Comparability of Insurance coverage Choices

Understanding the protection provided by completely different insurance coverage choices will be useful. The next desk supplies a comparability, highlighting the important thing variations.

| Insurance coverage Kind | Protection Particulars | Typical Prices |

|---|---|---|

| Legal responsibility | Covers harm to different automobiles and accidents to others in an accident. | Often included within the base rental worth. |

| Collision | Covers harm to the rental automotive in case of an accident. | Typically additional value, varies by rental firm. |

| Complete | Covers harm to the rental automotive from non-collision occasions (e.g., theft, vandalism, pure disasters). | Further value, varies by rental firm. |

| Private Insurance coverage | Might cowl elements of automotive rental insurance coverage, lowering the necessity for added protection. | Depending on private coverage and/or bank card advantages. |

Particular Insurance coverage Necessities by Rental Firm

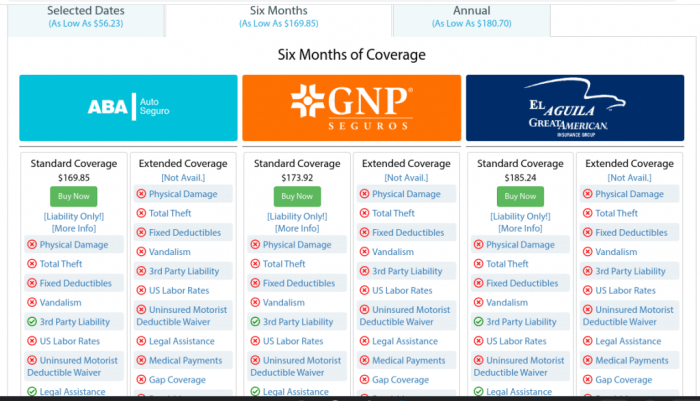

Navigating the world of automotive leases in Mexico will be made simpler with a transparent understanding of the various insurance coverage insurance policies provided by completely different rental companies. This part supplies a comparative overview of the insurance coverage necessities, enabling vacationers to make knowledgeable selections about essentially the most appropriate protection for his or her journey. Understanding these specifics can considerably impression the price and the extent of safety throughout your rental interval.Rental corporations in Mexico typically have differing insurance coverage packages.

Some provide complete protection, whereas others could have insurance policies that require further add-ons for sure ranges of safety. This range highlights the significance of evaluating choices earlier than choosing a rental. This comparability goals to supply readability and empower vacationers to pick out essentially the most appropriate insurance coverage for his or her particular wants and price range.

Variations in Insurance coverage Necessities Throughout Rental Corporations

Completely different rental corporations in Mexico make use of various approaches to insurance coverage insurance policies. Some could have pre-bundled insurance coverage packages, whereas others could provide extra versatile add-ons. Understanding these variations is essential to discovering essentially the most applicable insurance coverage protection in your wants. This range in insurance policies underscores the necessity for cautious comparability earlier than committing to a rental.

Comparability of In style Rental Businesses in Mexico

A desk illustrating the insurance coverage insurance policies of some well-liked rental corporations in Mexico is introduced under. This comparability desk affords a concise overview of the everyday protection offered by every company, facilitating an knowledgeable selection. It is essential to do not forget that these are common descriptions, and particular phrases and situations could range relying on the person reserving and any further extras.

| Rental Firm | Commonplace Insurance coverage Protection | Further Protection Choices | Particular Phrases and Situations |

|---|---|---|---|

| Avis | Fundamental legal responsibility protection. | Collision harm waiver, theft safety. | Insurance policies could range by location. Particular phrases and situations can be found on the corporate web site or on the rental counter. |

| Hertz | Much like Avis, however could embrace roadside help. | Supplemental add-ons for elevated safety towards harm and theft. | Rental agreements typically embrace particular limitations on protection. Particulars are sometimes Artikeld within the rental settlement. |

| Enterprise | Fundamental legal responsibility protection with the choice for an enhanced package deal. | Choices for supplemental insurance coverage packages, together with complete protection. | Particular limitations could exist on protection based mostly on the chosen package deal. Confer with the rental settlement for particulars. |

| Finances | Fundamental legal responsibility insurance coverage. | Collision harm waiver, supplemental insurance coverage. | Detailed phrases can be found on the rental firm’s web site. Verify protection particulars earlier than reserving. |

| Europcar | Complete insurance coverage package deal together with legal responsibility and harm. | Enhanced safety choices, together with extras for particular wants. | Rental contracts Artikel the phrases of insurance coverage. All the time evaluate the settlement for readability. |

Particular Phrases and Situations of Insurance coverage Insurance policies

Reviewing the precise phrases and situations of every insurance coverage coverage is essential for understanding the restrictions and exclusions. This cautious evaluate ensures that you just perceive the scope of protection and keep away from unexpected prices. Thorough examination of the nice print is important to make sure you are adequately protected throughout your rental interval. Search for particulars concerning the deductible, protection limits, and any exclusions.

Authorized Obligations and Implications

Adhering to Mexico’s automotive rental insurance coverage laws is essential for a easy and worry-free journey. Understanding the authorized implications of non-compliance will help vacationers keep away from potential points and guarantee a protected and compliant expertise. This part Artikels the potential penalties and customary violations related to insufficient automotive rental insurance coverage in Mexico.Comprehending the authorized necessities and penalties related to driving with out the correct insurance coverage is important for a protected and accountable journey.

Failure to adjust to these laws can result in vital penalties for each the motive force and the rental firm.

Authorized Implications of Inadequate Insurance coverage

Failure to safe the required automotive rental insurance coverage in Mexico may end up in a spread of authorized repercussions. These repercussions prolong past the quick fines, probably impacting the traveler’s skill to return to their house nation. The results range relying on the severity of the violation and the precise laws of the Mexican state or municipality concerned.

Potential Penalties for Driving With out Insurance coverage

Driving a rental automotive in Mexico with out the required insurance coverage can result in numerous penalties, starting from fines to potential imprisonment. The particular penalties rely upon the severity of the violation and the native laws. A big nice, confiscation of the automobile, or perhaps a prison document are all doable outcomes in instances of great violations.

Examples of Frequent Violations Associated to Automobile Rental Insurance coverage

A number of widespread violations associated to automotive rental insurance coverage in Mexico embrace driving with out the required insurance coverage protection, failing to supply proof of insurance coverage to authorities upon request, and utilizing a rental automobile for functions not lined by the coverage. The failure to adjust to these necessities can result in quick penalties and problems.

Abstract of Authorized Necessities and Penalties

| Violation | Description | Potential Penalties |

|---|---|---|

| Driving with out required insurance coverage | Working a rental automobile with out the required insurance coverage protection. | Fines starting from a number of hundred to a number of thousand Mexican pesos, potential automobile impoundment, and/or prison costs. |

| Failure to supply proof of insurance coverage | Refusal or lack of ability to current legitimate insurance coverage documentation when requested by authorities. | Fines and/or the doable quick return of the rental automobile to the rental firm. |

| Utilizing the automobile for unauthorized actions | Using the rental automobile for functions not lined by the rental settlement or insurance coverage coverage. | Fines, automobile impoundment, and doable further costs associated to the unauthorized exercise. |

Insurance coverage Paperwork and Procedures

Navigating the necessities for automotive rental insurance coverage in Mexico will be made simpler with a transparent understanding of the required paperwork and procedures. This part particulars the important paperwork wanted to reveal legitimate insurance coverage protection, alongside the processes for verification. An intensive understanding of those elements is essential for a easy and stress-free rental expertise.Demonstrating enough insurance coverage protection is a key step in securing a rental automotive in Mexico.

Rental companies make use of rigorous verification procedures to make sure the security and safety of their operations. This course of safeguards towards potential liabilities and helps to make sure that the renter is satisfactorily insured throughout their keep. A complete understanding of the required documentation and procedures simplifies this course of, enabling a extra environment friendly and constructive expertise.

Required Paperwork to Show Insurance coverage Protection

Understanding the documentation required to show insurance coverage protection is paramount for a seamless automotive rental course of. Rental companies sometimes demand proof of complete insurance coverage, encompassing numerous elements of auto safety. This typically contains legal responsibility protection, collision harm waiver, and different vital protections. Offering the suitable documentation confirms that the renter possesses the required insurance coverage to cowl potential damages or incidents throughout the rental interval.

- Proof of Automobile Insurance coverage: A legitimate Mexican insurance coverage coverage or an equal worldwide insurance coverage doc is often required. This may embrace a replica of the insurance coverage card, coverage certificates, or a letter of affirmation from the insurance coverage firm. The specifics will range by rental firm.

- Driver’s License: A legitimate driver’s license from the renter’s house nation is often wanted, together with a translated copy into Spanish if vital. This demonstrates the motive force’s identification and authorized proper to function a automobile in Mexico.

- Passport or Nationwide ID: Identification paperwork equivalent to a passport or nationwide ID card, relying on the renter’s nationality, are important for verification functions.

- Credit score Card: A bank card is often requested for safety deposit and incidentals, together with any potential harm or accident claims. The cardboard particulars present a technique of contact and verification for the rental company.

Procedures for Acquiring and Verifying Insurance coverage Protection

Acquiring and verifying insurance coverage protection includes a collection of steps to make sure compliance with Mexican laws. This contains confirming coverage particulars, acquiring the required documentation, and speaking with the insurance coverage supplier. Verification by the rental company helps mitigate dangers and ensures that every one events concerned are protected.

- Coverage Overview: Overview your insurance coverage coverage to make sure it covers worldwide driving and automobile leases in Mexico. Confirm the extent of legal responsibility and collision protection inside the coverage to verify its adequacy for the rental interval.

- Documentation Gathering: Acquire all vital paperwork, together with insurance coverage playing cards, coverage certificates, and any supplementary paperwork required by the rental company. Verify the validity of the insurance coverage paperwork and the motive force’s license.

- Communication with Insurance coverage Supplier: Contact your insurance coverage supplier for any clarification or additional data required for the rental. This step helps make sure that all the required documentation is in place and that there are not any gaps within the insurance coverage protection.

- Rental Company Verification: The rental company will confirm the offered insurance coverage paperwork to make sure compliance with Mexican laws and their very own insurance policies. The rental company can even evaluate the motive force’s license and different identification paperwork.

Examples of Frequent Paperwork Utilized in Mexico

Examples of widespread paperwork utilized for verifying insurance coverage protection in Mexico embrace Mexican insurance coverage playing cards, worldwide insurance coverage certificates, and even letters of affirmation from insurance coverage corporations. These paperwork reveal the renter’s accountability and insurance coverage protection throughout the rental interval.

- Mexican Insurance coverage Playing cards: These playing cards typically include important particulars in regards to the insurance coverage coverage, together with protection limits and policyholder data.

- Worldwide Insurance coverage Certificates: Worldwide insurance coverage certificates present proof of protection for leases outdoors the renter’s house nation, providing a standardized format for verification.

- Letters of Affirmation: In some instances, letters of affirmation from insurance coverage corporations could be vital to verify the validity and scope of protection, significantly for worldwide insurance policies.

Insurance coverage Verification Course of Steps

The next desk Artikels the widespread steps concerned within the insurance coverage verification course of for a Mexican automotive rental.

| Step | Description |

|---|---|

| 1 | Overview your insurance coverage coverage for worldwide protection. |

| 2 | Collect vital paperwork (insurance coverage card, coverage certificates, driver’s license, and so forth.). |

| 3 | Contact your insurance coverage supplier for any clarification or additional data required. |

| 4 | Current paperwork to the rental company for verification. |

| 5 | Rental company verifies paperwork towards their coverage necessities. |

| 6 | Affirmation of insurance coverage protection. |

Insurance coverage for Vacationers and Locals: Mexico Automobile Rental Insurance coverage Necessities

Navigating the insurance coverage panorama for automotive leases in Mexico will be simplified by understanding the distinct necessities for vacationers and native renters. This part supplies a comparative evaluation of those necessities, highlighting potential variations and concerns for each teams.Understanding the nuances of insurance coverage for various demographics inside Mexico helps guarantee a easy and worry-free rental expertise. This comparative overview clarifies the required steps for each vacationers and locals, enabling knowledgeable selections when choosing applicable protection.

Comparability of Insurance coverage Necessities

Insurance coverage necessities for automotive leases in Mexico range relying on the renter’s standing as a vacationer or an area resident. This differentiation stems from authorized and logistical components distinctive to every class. Overseas vacationers, for instance, could face further verification steps to reveal their skill to satisfy the rental settlement’s obligations.

Particular Provisions for Vacationers

For vacationers renting automobiles in Mexico, rental corporations typically mandate a better stage of insurance coverage protection in comparison with native renters. This displays the inherent dangers related to vacationers unfamiliar with native driving situations and laws. Further necessities may embrace proof of adequate funds to cowl potential damages. Some rental corporations may require a supplemental insurance coverage coverage, significantly for worldwide guests.

Particular Provisions for Locals

Native residents renting automobiles in Mexico sometimes have entry to extra versatile insurance coverage choices. Their familiarity with native laws and driving situations typically results in decrease insurance coverage premiums and fewer stringent verification procedures. The native renter is anticipated to have a extra complete understanding of the authorized necessities.

Further Issues for Foreigners

Foreigners renting vehicles in Mexico ought to rigorously evaluate the precise insurance coverage necessities of every rental firm. It’s prudent to inquire about any particular stipulations associated to overseas drivers, together with documentation wants. Thorough pre-trip analysis will assist guarantee compliance with Mexican laws. A transparent understanding of the native insurance coverage market and laws can considerably scale back the danger of encountering points throughout the rental course of.

Comparability Desk, Mexico automotive rental insurance coverage necessities

| Attribute | Vacationer Renters | Native Renters |

|---|---|---|

| Insurance coverage Necessities | Typically extra complete protection is required, probably together with supplemental insurance coverage insurance policies. Documentation of economic assets could be wanted. | Sometimes, much less stringent necessities in comparison with vacationers. A extra acquainted understanding of the native laws is assumed. |

| Documentation | Might require further documentation to confirm their monetary capability and compliance with Mexican legal guidelines. This may increasingly embrace worldwide driver’s licenses, bank cards, or financial institution statements. | Often requires a sound Mexican driver’s license and native identification. |

| Insurance coverage Prices | Would possibly incur larger insurance coverage premiums attributable to elevated threat evaluation. | Probably decrease premiums, contemplating the assumed familiarity with native laws. |

| Procedures | Rental corporations may need particular procedures for verifying the insurance coverage protection of vacationers. | Rental procedures could also be extra streamlined for native renters. |

Protection Limits and Exclusions

Understanding the restrictions of your Mexican automotive rental insurance coverage is essential for a easy journey. This part particulars typical protection limits and exclusions, serving to you anticipate potential situations and plan accordingly. Figuring out these elements beforehand permits for knowledgeable selections and avoids disagreeable surprises throughout your travels.

Typical Protection Limits

Mexican automotive rental insurance coverage insurance policies, whereas typically complete, sometimes have particular limits on protection. These limits are sometimes expressed in Mexican Pesos and should not totally equate to the protection you may count on in different nations. The quantity of protection out there can range significantly relying on the precise rental firm and the chosen insurance coverage package deal.

Frequent Exclusions

Insurance coverage insurance policies hardly ever cowl each doable eventuality. Frequent exclusions in Mexican automotive rental insurance coverage typically relate to pre-existing harm, intentional acts, and particular sorts of incidents. Understanding these exclusions is important to make sure you are conscious of what your coverage

doesn’t* cowl.

Situations The place Protection Would possibly Not Apply

Sure circumstances can result in a declare being denied. This part highlights typical situations the place insurance coverage protection may not apply, permitting you to organize for these potentialities.

Examples of Declare Denials

The next desk Artikels conditions that might lead to a declare being denied. You will need to notice that these examples usually are not exhaustive and particular person insurance policies could have further or completely different exclusions.

| State of affairs | Cause for Denial |

|---|---|

| Harm brought on by a pre-existing situation within the automobile (e.g., a hidden crack within the body) | Pre-existing harm is commonly excluded from protection. |

| Harm attributable to intentional acts (e.g., vandalism or deliberate collision) | Intentional acts are sometimes excluded from protection. |

| Harm brought on by a driver inebriated or medication | Driving inebriated or medication typically voids protection. |

| Harm ensuing from driving on unsuitable roads (e.g., excessive terrain not applicable for the automobile) | Driving on unsuitable roads will not be lined if it considerably contributes to the harm. |

| Harm attributable to an uninsured third social gathering (e.g., a hit-and-run accident) | The insurance coverage coverage could not cowl harm from an uninsured third social gathering. |

| Harm brought on by an act of struggle or pure catastrophe | Protection could also be restricted or excluded for occasions past typical use of the automobile. |

| Exceeding the rental interval or violating rental phrases | Coverage violations can result in claims being denied. |

Vital Issues

Overview the nice print of your chosen coverage meticulously. Search clarification from the rental company if any elements of the coverage are unclear. Take detailed photographs of the automobile upon pickup and preserve information of any pre-existing harm. Doc any incidents or uncommon situations throughout your rental interval. These precautions will help keep away from disputes and facilitate a smoother declare course of if wanted.

Alternate options to Commonplace Insurance coverage

Exploring choices past the usual automotive rental insurance coverage package deal in Mexico permits vacationers to tailor protection to their particular wants and price range. Understanding the various options out there can considerably impression the price and scope of safety throughout your journey. Cautious consideration of every possibility’s advantages and disadvantages is essential for making an knowledgeable determination.A complete understanding of different insurance coverage choices empowers vacationers to pick out essentially the most appropriate protection for his or her circumstances.

This includes weighing the professionals and cons of every different and evaluating the potential advantages and limitations. It’s essential to check protection limits, exclusions, and the extent of economic safety provided by every choice to make an knowledgeable selection.

Supplementary Insurance coverage Choices

Varied supplementary insurance coverage choices can be found past the usual protection provided by rental corporations. These choices typically present further safety towards unexpected circumstances, equivalent to harm or theft. Understanding the precise options of every possibility is important to decide on the fitting protection.

- Private Accident Insurance coverage: This insurance coverage covers medical bills and misplaced wages in case of an accident involving the renter or passengers. It typically extends past the legal responsibility protection offered by commonplace rental insurance coverage, providing complete safety for medical prices, misplaced revenue, and different potential bills associated to non-public accidents.

- Collision Harm Waiver (CDW) Alternate options: Whereas commonplace CDW is commonly included, vacationers may think about different CDW choices. These could provide decrease premiums or particular situations, probably offering value financial savings. The options could have barely completely different phrases or protection quantities, which must be rigorously reviewed earlier than choosing a coverage.

- Supplemental Loss Harm Waiver (LDW): LDW dietary supplements commonplace insurance coverage protection by providing further safety towards loss or harm to the rental automobile. This may be particularly useful in conditions the place commonplace insurance coverage has restricted protection. The provision and value of supplemental LDW typically range relying on the rental firm and the precise automobile.

- Third-Get together Legal responsibility Insurance coverage Add-ons: In sure instances, vacationers could have to buy supplementary third-party legal responsibility insurance coverage. This ensures that the renter is satisfactorily lined in the event that they trigger harm to a different social gathering’s automobile or property. This protection is essential for authorized safety and minimizing potential monetary obligations.

Evaluating and Deciding on an Applicable Insurance coverage Choice

Cautious comparability of varied insurance coverage choices is important to choosing the right match for a traveler’s wants. Contemplate components equivalent to protection limits, exclusions, and the precise circumstances of the journey.

- Protection Limits: Understanding the utmost quantity of protection provided by every insurance coverage possibility is important. Overview the protection limits for medical bills, automobile harm, and different potential claims.

- Exclusions: Determine any exclusions inside the coverage that will not be lined. Pre-existing situations, particular sorts of harm, or specific driving conditions will not be lined. Rigorously reviewing the exclusions clause within the coverage is essential.

- Particular Wants and Circumstances: Contemplate the traveler’s driving expertise, the size of the journey, the kind of roads they’re going to be driving on, and any further dangers concerned. It will assist to find out the required stage of protection.

- Price Issues: Evaluate the premiums for various insurance coverage choices to seek out essentially the most cost-effective protection. Assess the cost-benefit ratio, contemplating the worth of the protection in relation to the worth.

Examples of Supplementary Insurance coverage Merchandise

A number of corporations provide supplementary insurance coverage merchandise that reach past commonplace automotive rental protection. These merchandise can improve safety towards numerous dangers.

- Journey Insurance coverage Packages: Some journey insurance coverage packages provide complete protection, together with automotive rental insurance coverage, medical bills, and journey cancellations. These packages can present vital safety, however could also be dearer than particular person insurance coverage choices.

- Rental Corporations’ Further Add-ons: Rental corporations typically provide further add-ons to their commonplace packages. These add-ons can present particular protection for particular conditions. Rigorously evaluating the phrases and situations is essential earlier than choosing these add-ons.

Ideas for Selecting the Proper Insurance coverage

Deciding on the suitable automotive rental insurance coverage in Mexico is essential for a easy and worry-free journey. Understanding the assorted choices and potential pitfalls can considerably impression your journey expertise. Rigorously evaluating protection, exclusions, and potential hidden prices are very important steps to keep away from unexpected bills.Thorough analysis and comparability buying are important to securing essentially the most appropriate insurance coverage plan that meets your wants and price range.

This includes contemplating components equivalent to the kind of protection, the boundaries of legal responsibility, and the phrases and situations. Figuring out these components empowers you to make knowledgeable selections and shield your self towards monetary burdens.

Evaluating Insurance coverage Choices

A complete analysis of accessible insurance coverage choices is important to make sure you have enough safety. This includes understanding the several types of insurance coverage provided, the protection limits, and any exclusions.Cautious comparability of various insurance coverage is vital. This contains contemplating components like deductibles, extra protection, and the geographical scope of the protection. By evaluating completely different choices, you may choose the insurance coverage that gives the most effective worth in your wants.

Understanding the nice print of every coverage is essential. This helps to make sure you totally perceive the extent of protection and the situations below which it applies.

Evaluating Insurance policies

When evaluating rental insurance coverage insurance policies, a structured strategy helps make sure you discover the most effective match. An in depth guidelines can information you thru the method of evaluating completely different insurance coverage choices.

- Protection Particulars: Confirm the scope of protection for accidents, theft, harm, and different potential incidents. Evaluate the degrees of legal responsibility protection and extra safety. Contemplate the circumstances below which the insurance coverage could not apply. Reviewing these particulars ensures you perceive the total extent of the safety.

- Exclusions: Rigorously study the coverage’s exclusions. Understanding what will not be lined can stop sudden prices. Examples of widespread exclusions embrace pre-existing harm to the automobile, use of the automobile outdoors the desired space, and sure sorts of incidents.

- Deductibles and Excesses: Be aware the deductibles and excesses for several types of claims. A decrease deductible typically means a better premium, but it surely reduces your out-of-pocket bills in case of an accident. Understanding the monetary implications of various deductibles is important for making an knowledgeable determination.

- Geographical Limitations: Verify the geographical limitations of the insurance coverage coverage. Make sure the protection extends to all areas you propose to journey in Mexico. Insurance policies could have restrictions on driving outdoors a particular area, which wants cautious consideration.

- Supplier Status: Analysis the repute of the rental firm or insurance coverage supplier. Evaluations and testimonials can present useful perception into the standard of service and reliability. Dependable and respected suppliers often provide reliable and reliable service.

Avoiding Scams and Hidden Prices

A proactive strategy is essential in avoiding scams and hidden prices associated to automotive rental insurance coverage in Mexico.

- Confirm Insurance coverage Quotes: Make sure you get hold of quotes from respected sources, such because the rental firm’s web site or unbiased comparability platforms. Don’t depend on unsolicited affords or unfamiliar web sites.

- Scrutinize Wonderful Print: Rigorously evaluate the whole coverage doc, together with the phrases and situations, to keep away from surprises. Pay shut consideration to clauses associated to legal responsibility, protection limits, and exclusions. This diligence helps to forestall potential misunderstandings.

- Inquire About Further Protection: Ask about further protection choices that will not be readily obvious. Choices like complete insurance coverage, collision insurance coverage, and supplemental safety can improve your safety towards sudden bills.

- Watch out for Unrealistic Offers: Be cautious of affords that appear too good to be true. Confirm the legitimacy of the insurance coverage supplier and keep away from any suspicious actions.

Guidelines for Evaluating Insurance policies

This guidelines supplies a framework for evaluating automotive rental insurance coverage insurance policies in Mexico.

| Standards | Motion |

|---|---|

| Protection Particulars | Confirm the scope of protection for numerous incidents. |

| Exclusions | Determine potential exclusions and perceive their implications. |

| Deductibles and Excesses | Evaluate deductibles and excesses throughout completely different insurance policies. |

| Geographical Limitations | Guarantee protection extends to your meant journey areas. |

| Supplier Status | Analysis the supplier’s repute and reliability. |

Understanding Coverage Phrases and Situations

Rigorously reviewing the phrases and situations of your Mexico automotive rental insurance coverage coverage is essential for guaranteeing enough safety and avoiding potential surprises. This doc Artikels the specifics of your protection, clarifies potential limitations, and empowers you to make knowledgeable selections about your insurance coverage wants.An intensive understanding of the coverage’s phrases and situations minimizes unexpected points throughout your journey.

Figuring out the specifics of protection, exclusions, and limitations helps you make knowledgeable selections and keep away from expensive surprises.

Significance of Reviewing Coverage Phrases

Understanding your coverage’s phrases and situations is important for correct safety. These paperwork outline the scope of protection, outlining what’s included and excluded from the coverage’s safety. And not using a complete understanding, it’s possible you’ll inadvertently expose your self to monetary dangers. It’s crucial to pay shut consideration to the nice print and any particular clauses which may have an effect on your protection.

Examples of Clauses Affecting Protection

A number of clauses inside the coverage can considerably impression the extent of your protection. As an example, “deductibles” stipulate the quantity you will have to pay out-of-pocket earlier than the insurance coverage kicks in. “Exclusions” record conditions the place the insurance coverage supplier will not be liable, equivalent to harm brought on by pre-existing situations of the automobile. “Protection limitations” outline the utmost quantity the insurance coverage can pay for particular damages.

“Geographic limitations” could prohibit protection to sure areas inside Mexico or particular timeframes. Lastly, “cancellation insurance policies” element procedures and situations below which you’ll cancel the insurance coverage.

Figuring out Potential Dangers and Limitations

Thorough evaluate of the coverage permits for the identification of potential dangers and limitations. Comprehending the restrictions of the insurance coverage protection is important to make knowledgeable selections. Figuring out clauses that restrict legal responsibility for particular circumstances, like pre-existing automobile situations or particular sorts of accidents, is essential. Understanding geographical restrictions, protection limits, and cancellation insurance policies can mitigate potential dangers.

Abstract of Key Phrases and Situations

| Time period | Description | Influence on Coverage |

|---|---|---|

| Deductible | The quantity you pay out-of-pocket earlier than insurance coverage protection applies. | Larger deductibles scale back the insurance coverage premium however improve your potential monetary accountability. |

| Exclusions | Particular circumstances or occasions not lined by the insurance coverage coverage. | Understanding exclusions helps you anticipate potential dangers and think about different options if protection is restricted. |

| Protection Limitations | Most quantity the insurance coverage can pay for a particular kind of injury. | Figuring out the protection limitations permits you to assess your monetary publicity and decide if further protection is critical. |

| Geographic Limitations | Restrictions on protection based mostly on location or area. | Understanding geographical limitations helps make sure you’re adequately lined all through your rental interval. |

| Cancellation Insurance policies | Situations below which you’ll cancel the insurance coverage coverage and obtain a refund (if relevant). | Understanding cancellation insurance policies is important to make knowledgeable selections about insurance coverage in case your plans change. |

Finish of Dialogue

In conclusion, comprehending Mexico automotive rental insurance coverage necessities is important for a protected and stress-free driving expertise. By rigorously contemplating the completely different insurance coverage choices, understanding the authorized implications, and reviewing the phrases and situations, you may make an knowledgeable determination. This information supplies an intensive overview, equipping you with the data to pick out the fitting insurance coverage protection in your journey to Mexico.

Keep in mind to all the time double-check particular particulars along with your chosen rental company and seek the advice of with native authorities if vital.

Important FAQs

What are the everyday protection limits in Mexican automotive rental insurance coverage insurance policies?

Protection limits range by rental firm and coverage. It is essential to rigorously evaluate the precise limits Artikeld within the coverage paperwork. Some insurance policies may need decrease limits for legal responsibility or harm, so it is really helpful to grasp these particulars completely.

What are the widespread situations the place insurance coverage protection may not apply?

Insurance coverage protection could not apply in instances of pre-existing harm to the automobile, reckless driving, or intentional acts of vandalism. All the time confer with the precise coverage phrases and situations for a complete understanding of exclusions.

What paperwork are wanted to show insurance coverage protection in Mexico?

Rental corporations often require a replica of the insurance coverage coverage or a affirmation of protection from the insurance coverage supplier. Verify with the precise rental firm for his or her necessities.

What are the authorized implications of not having the required insurance coverage in Mexico?

Driving with out the required insurance coverage can result in vital penalties, together with fines, impoundment of the automobile, and even authorized motion. It is essential to make sure you have the suitable protection to keep away from these penalties.