Metropolitan life long run care insurance coverage – Metropolitan Life long-term care insurance coverage: Navigating the complexities of future care wants. This information dives deep into the world of LTC insurance policies, exploring all the things from coverage sorts and protection to the monetary implications and the method of claiming advantages.

We’ll break down MetLife’s choices, evaluating them to opponents and highlighting key issues for coverage choice. From eligibility standards to potential disputes, we have you lined. Get clued up on this very important insurance coverage and put together for tomorrow’s care.

Introduction to Metropolitan Life Lengthy-Time period Care Insurance coverage

Ever questioned what occurs in case you get severely unwell and need assistance with day by day duties for years to return? Lengthy-term care insurance coverage steps in to supply monetary assist for these essential companies, like bathing, dressing, and consuming. It is like having a security web on your golden years, ensuring you possibly can preserve your independence and dignity.

Metropolitan Life, a well-established identify within the insurance coverage business, understands the significance of such safety. They provide a variety of long-term care insurance policy to assist policyholders navigate the complexities of growing old and healthcare wants. They have been serving to folks safe their future for many years, with a concentrate on tailor-made options that meet particular person wants. Consider them as your dependable accomplice in navigating the often-unpredictable terrain of growing old.

Forms of Metropolitan Life Lengthy-Time period Care Insurance coverage Insurance policies

Metropolitan Life presents a various vary of long-term care insurance coverage insurance policies, every with particular options to cater to numerous wants and budgets. They acknowledge that everybody’s state of affairs is exclusive, and a one-size-fits-all method is not at all times efficient.

Coverage Function Comparability

Selecting the best coverage entails cautious consideration of various components. Here is a comparability desk outlining some key options that can assist you determine which coverage aligns greatest along with your wants.

| Coverage Kind | Profit Quantity (Month-to-month) | Premium (Annual) | Ready Interval | Particular Protection |

|---|---|---|---|---|

| Fundamental Care | $3,000 | $1,500 | 90 days | Covers fundamental actions of day by day dwelling (ADLs) like bathing and dressing. |

| Enhanced Care | $5,000 | $2,500 | 180 days | Covers ADLs and a few specialised care wants, like expert nursing. |

| Premium Care | $7,500 | $4,000 | three hundred and sixty five days | Covers a wider vary of care wants, together with specialised care, 24-hour nursing, and assisted dwelling. |

Keep in mind, these are simply examples. Metropolitan Life presents quite a lot of choices and you’ll customise your plan additional to completely match your necessities.

Components to Take into account When Selecting a Coverage

Choosing the best long-term care insurance coverage plan is a vital determination, and components corresponding to your anticipated care wants, monetary assets, and life-style preferences play a significant position. Rigorously evaluating these components will assist you choose a plan that aligns completely along with your private circumstances.

- Care Wants Evaluation: Understanding your potential future wants, together with the extent of care required, is crucial to make sure the chosen coverage can successfully tackle them. That is the place you will wish to seek the advice of your physician, think about the wants of your family members, and assess how your present life-style may change sooner or later. As an illustration, in case you anticipate requiring help with a number of day by day duties, a extra complete coverage is critical.

- Budgetary Constraints: Premiums for long-term care insurance coverage differ relying on the coverage’s protection, and it is important to think about how these prices match into your total monetary plan. You want to weigh the price of the premium towards the potential worth of the protection and the way it impacts your total monetary technique. Evaluate quotes from totally different insurers to get the absolute best worth.

- Coverage Options: Have a look at the precise advantages and protection provided by totally different insurance policies. Options corresponding to ready intervals, profit quantities, and particular care sorts ought to be fastidiously evaluated. This helps you select a plan that successfully addresses your particular circumstances and future wants.

Protection and Advantages

So, you are seeking to safe your golden years, huh? Properly, long-term care insurance coverage is sort of a security web, catching you if you want it most. It isn’t simply in regards to the massive bucks; it is in regards to the peace of thoughts that comes with figuring out you are lined. Metropolitan Life, as an example, gives a variety of choices, however you gotta know what you are getting.

Typical Advantages Supplied

Metropolitan Life long-term care insurance policies typically embody advantages like nursing residence care, residence well being care, and even grownup day care. Consider it like a buffet, with numerous choices to fit your wants. Some insurance policies may supply extra advantages like respite take care of caregivers, or transportation to appointments. It isn’t a one-size-fits-all answer; it is custom-made to fulfill your specific circumstances.

Forms of Care Coated

Lengthy-term care insurance policies typically cowl a spectrum of care. Nursing residence care is a staple, offering 24/7 medical supervision. House well being care permits for care within the consolation of your individual residence, with nurses and aides visiting usually. Grownup day care gives structured actions and assist throughout the day, releasing up caregivers. Every possibility caters to totally different conditions and preferences.

Profit Cost Construction

Profit funds are sometimes structured as a day by day or month-to-month allowance. For instance, a coverage may pay a set quantity per day for nursing residence care. The quantity will rely upon the specifics of your coverage and the kind of care wanted. It is like a pre-determined finances on your care, serving to you handle prices successfully.

Cost Choices for Providers

Insurance policies typically supply numerous fee choices for long-term care companies. Some insurance policies may pay on to the care supplier, whereas others may reimburse you for bills. This lets you select the strategy that most accurately fits your wants and monetary state of affairs. As an illustration, some insurance policies may supply a set month-to-month fee for a specified stage of care, whereas others may present a share of your eligible bills.

Limitations and Exclusions

| Limitation/Exclusion | Rationalization |

|---|---|

| Pre-existing situations | Protection might not apply to situations recognized earlier than the coverage is taken out. |

| Particular varieties of care | Sure varieties of care, corresponding to hospice care, could also be excluded. |

| Length of protection | Insurance policies typically have a restrict on the size of time advantages are paid. |

| Out-of-pocket bills | You may need to cowl some bills, like co-pays or deductibles. |

This desk highlights some widespread limitations and exclusions in long-term care insurance coverage. It is necessary to learn the effective print fastidiously to make sure the coverage aligns along with your wants. Identical to a menu, you want to know what’s on supply and what’s not. Keep in mind, each coverage is totally different; that is only a basic overview.

Coverage Choice and Concerns

Selecting the correct long-term care insurance coverage coverage is like selecting a dependable experience on your golden years. You need one thing that is inexpensive, covers your wants, and will not depart you stranded in a care-giving pickle. It is a massive determination, so let’s dive into the components you want to ponder.Determining the proper coverage entails taking a look at a number of key components.

You’ve got acquired to consider your present well being, your future wants, and your monetary state of affairs. It is a balancing act between protection and value.

Components to Take into account When Selecting a Coverage

Understanding your wants is essential. Take into account your well being historical past, life-style, and potential future well being issues. Are you liable to power diseases? Do you anticipate needing important care sooner or later? Sincere self-assessment is essential.

Do not be afraid to speak to your physician about potential well being dangers. Additionally, take into consideration your monetary state of affairs and the way a lot you possibly can comfortably afford to pay for premiums. A well-researched coverage is one which aligns along with your present monetary capability and anticipated future wants.

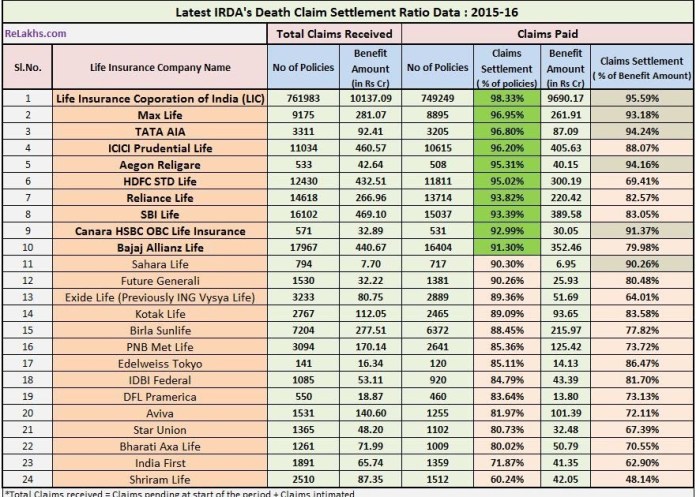

Evaluating Metropolitan Life Insurance policies with Different Suppliers

Metropolitan Life presents a variety of long-term care insurance coverage insurance policies, however how do they stack up towards different suppliers? An excellent comparability entails trying on the protection ranges, profit quantities, and premium prices provided by totally different firms. Totally different suppliers have various ranges of advantages. You may have to fastidiously weigh these choices towards your particular wants. Store round to seek out the very best match on your state of affairs.

This is not nearly price; it is about guaranteeing you get the absolute best care in case you want it.

Value Comparability of Totally different Coverage Choices

Planning for long-term care prices can really feel daunting. Totally different coverage choices include totally different premiums, so let’s check out some examples.

| Coverage Choice | Premium (Annual) | Each day Profit Quantity | Profit Interval |

|---|---|---|---|

| Fundamental Care | $2,000 | $150 | 10 years |

| Enhanced Care | $3,000 | $250 | 15 years |

| Complete Care | $4,000 | $500 | 20 years |

Notice: These are hypothetical examples, and precise premiums will differ primarily based on particular person components. Store round and get quotes from totally different insurers to check prices.

Influence of Inflation on Lengthy-Time period Care Insurance coverage Premiums

Inflation is a sneaky thief of buying energy. As the price of dwelling rises, so too do premiums for long-term care insurance coverage. Premiums might improve, so it is smart to issue this into your long-term monetary planning. Take into account how inflation will impression your premiums and the price of care sooner or later. This is not about predicting the long run, however quite being ready for the opportunity of rising prices.

Widespread Misconceptions About Lengthy-Time period Care Insurance coverage

Some folks maintain incorrect beliefs about long-term care insurance coverage. One widespread false impression is that Medicare will cowl all long-term care bills. This is not true; Medicare primarily covers short-term expert nursing care, not the continuing, extra in depth care typically wanted. One other false impression is that long-term care insurance coverage is just for the rich. It is a worthwhile device for people of all socioeconomic backgrounds, offering peace of thoughts and monetary safety for the long run.

Understanding these realities is crucial to creating an knowledgeable determination.

Eligibility and Enrollment

So, you are excited about long-term care insurance coverage? Unbelievable! However first, let’s get actual—are you eligible? And the way do you even get signed up? Don’t fret, it isn’t as difficult as a Sudoku puzzle (although perhaps barely much less enjoyable). We’ll break it down, step-by-step.Eligibility for Metropolitan Life long-term care insurance coverage, like some other insurance coverage, hinges on assembly particular standards.

Consider it as a bit membership—it’s important to match the necessities to hitch.

Eligibility Standards

Metropolitan Life, of their knowledge, has sure necessities to ensure they are not taking up an excessive amount of threat. These necessities sometimes embody components like age, well being standing, and even your life-style. Mainly, they wish to guarantee that you are a comparatively wholesome applicant, and they should know that you are a good threat. Some insurance policies may need particular well being questionnaires, which is usually a little bit of a ache, however they assist to make sure the insurance coverage is inexpensive for everybody.

Enrollment Course of

Getting enrolled in Metropolitan Life long-term care insurance coverage is an easy course of, however you will have to take the initiative and do your homework. It entails extra than simply clicking a button. It is about understanding the coverage, its phrases, and the way it suits into your monetary plan.

Software Necessities

To kickstart the enrollment course of, you will want to assemble some paperwork and knowledge. Consider it as assembling your insurance coverage toolkit. These may embody issues like proof of earnings, your medical historical past, and probably even your present well being standing. This info helps Metropolitan Life assess your threat and tailor a coverage that fits your wants. Be ready to supply complete info.

Steps within the Software Course of

- Collect the required paperwork. This consists of your proof of earnings, medical data, and some other required varieties. The extra organized you’re at this stage, the much less stress you will have later.

- Full the appliance type totally. Pay shut consideration to element. Inaccuracies can delay the method and even lead to your software being rejected. Double-check all the things earlier than submitting.

- Submit your software to Metropolitan Life. Make sure you submit it electronically, or by way of mail, utilizing the right technique as detailed by Metropolitan Life. They will overview your software and get again to you.

- Evaluation coverage paperwork fastidiously. That is essential. You want to perceive the phrases, situations, and exclusions. Learn them totally earlier than signing something. Do not simply skim; dive deep!

- Decide and signal the coverage. In the event you agree with the phrases, then you possibly can signal the coverage. It is a massive determination, so make certain it is the best one for you.

Reviewing Coverage Paperwork

Understanding your coverage is like understanding a posh recipe. You want to know precisely what components are concerned and tips on how to use them appropriately.

Do not simply look on the coverage paperwork. Rigorously overview each clause, each exclusion, and each effective print. Ask questions in case you do not perceive one thing. Looking for clarification is significant. You wish to keep away from disagreeable surprises down the street.

Managing Coverage Prices

Lengthy-term care insurance coverage premiums can differ relying on a number of components, together with your age, well being, and the protection quantity. Evaluating totally different insurance policies from numerous suppliers can assist you discover essentially the most appropriate plan at a value you possibly can handle. You can even look into totally different choices that provide numerous ranges of protection to suit your finances. Negotiating with the insurance coverage supplier, if attainable, is also helpful.

Do not be afraid to buy round and discover the very best deal.

Claims and Disputes

So, you’ve got acquired your Metropolitan Life long-term care insurance coverage, incredible! Now, let’s speak about what occurs if you want to use it. It is necessary to grasp the declare course of, simply in case issues get a bit… sticky. We’ll cowl tips on how to file a declare, what to do if there is a disagreement, and tips on how to get assist from Metropolitan Life.Submitting a declare should not be a nightmare.

It is a structured course of, and following the steps fastidiously will assist guarantee a easy expertise. Potential disputes are attainable, however the insurance coverage firm has a decision course of in place to deal with these. Understanding the appeals course of in case your declare is denied can be essential.

Submitting a Declare

The declare course of is easy. You may want to assemble all the required paperwork, corresponding to medical data, physician’s statements, and proof of your long-term care wants. This organized method will streamline the method, and the Metropolitan Life crew will information you thru every step. You could find detailed directions on their web site.

Potential Disputes

Disagreements can generally come up concerning the protection or the quantity of advantages. Perhaps the insurer does not agree along with your prognosis or the extent of care you want. These conditions may be resolved via communication and negotiation. Metropolitan Life has a devoted claims division to deal with any issues and guarantee a good final result.

Contacting Metropolitan Life

Need assistance navigating the declare course of? Metropolitan Life gives numerous avenues for contact, together with a devoted claims hotline, a web-based portal, and a bodily tackle for correspondence. Their contact info is available on their web site. This may enable you get the enable you want, shortly.

Decision Course of

If a dispute arises, Metropolitan Life has a structured decision course of. This often entails a number of steps, together with reviewing the declare, discussing the issues, and doubtlessly presenting additional proof. That is designed to discover a mutually acceptable answer. The method is designed to be honest to each events.

Appeals Course of

In case your declare is denied, you’ve the best to attraction. The attraction course of typically entails submitting supporting documentation and offering the explanation why the unique determination was incorrect. Be ready to supply extra proof and exhibit that your care wants meet the coverage’s stipulations. It is at all times a good suggestion to hunt authorized recommendation if wanted.

Steps in a Declare Dispute

- Evaluation the declare denial letter fastidiously. Notice the precise causes for denial and any required actions.

- Collect extra documentation to assist your declare. This might embody new medical stories or care data.

- Contact Metropolitan Life’s claims division to provoke the attraction course of.

- Observe the steps Artikeld by Metropolitan Life for interesting the denial.

- Present any requested info or documentation promptly to expedite the attraction course of.

Coverage Choices and Comparisons: Metropolitan Life Lengthy Time period Care Insurance coverage

So, you are contemplating long-term care insurance coverage? Good on ya! It is like shopping for a security web on your golden years. However with so many insurance policies on the market, it might probably really feel like navigating a maze. Concern not, intrepid adventurer! We’ll break down Metropolitan Life’s choices that can assist you discover the proper match.Selecting the best coverage is essential for peace of thoughts.

Totally different insurance policies cater to totally different wants and budgets, providing numerous ranges of protection and premium prices. Let’s discover the obtainable choices, from the essential package deal to the “extra-care” premium version.

Coverage Choice Breakdown

Varied coverage choices from Metropolitan Life cater to totally different wants and monetary conditions. Every plan has a novel construction, providing various ranges of day by day care protection and profit quantities. Understanding these variations is essential to creating an knowledgeable determination.

- Fundamental Care Plan: This plan presents a typical stage of protection, appropriate for people in search of a stability between price and safety. Consider it as a dependable, on a regular basis automobile – will get you from level A to B, however with out all of the bells and whistles.

- Enhanced Care Plan: This feature gives extra complete protection, together with a wider vary of care companies. It is like upgrading your automobile to an expensive SUV, providing further area and luxury, and a bit costlier.

- Premium Care Plan: Designed for these needing most protection and assist, this plan gives essentially the most in depth advantages and sometimes the best premiums. Think about it as a custom-built sports activities automobile—excessive efficiency, but additionally a excessive price ticket.

Premium Value Comparability

Pricing is a major consider choosing a long-term care insurance coverage coverage. The premiums differ primarily based on the coverage sort and the insured’s age and well being. It is important to think about your finances and threat tolerance.

| Coverage Choice | Estimated Month-to-month Premium (Age 65) |

|---|---|

| Fundamental Care Plan | $150 – $300 |

| Enhanced Care Plan | $300 – $500 |

| Premium Care Plan | $500 – $800 |

Notice: These are estimated premiums and will differ primarily based on particular person circumstances. Seek the advice of with a Metropolitan Life consultant for customized quotes.

Coverage Riders

Riders are supplemental advantages that may be added to your coverage to develop protection. These can embody issues like protection for particular medical situations, or for sure varieties of care. Riders can add worth but additionally improve the price of your coverage.

- Crucial Sickness Rider: Supplies protection for particular crucial diseases, doubtlessly offering further monetary assist throughout a difficult time.

- Alzheimer’s Illness Rider: Presents a extra particular protection possibility for people involved about Alzheimer’s-related care bills.

Coverage Exclusions

Insurance policies sometimes exclude protection for sure pre-existing situations or circumstances. Realizing what is not lined is essential to keep away from disagreeable surprises down the street. Understanding these limitations is crucial for knowledgeable decision-making.

- Pre-existing situations: Insurance policies typically exclude or restrict protection for pre-existing situations, recognized earlier than the coverage’s efficient date. It is a widespread exclusion and ought to be fastidiously reviewed.

- Self-inflicted accidents: Insurance policies typically exclude protection for accidents sustained because of intentional actions by the insured particular person.

Pre-existing Situations

Pre-existing situations can have an effect on protection, both by excluding protection solely or by imposing limitations on the profit quantity or the beginning date. An intensive understanding of the coverage’s phrases and situations concerning pre-existing situations is crucial. Insurance policies often have ready intervals or limits on pre-existing situations.

- Ready Intervals: Insurance policies typically have ready intervals for sure pre-existing situations. This implies protection might not start instantly.

- Profit Limitations: Protection could also be restricted for pre-existing situations, both by a decreased profit quantity or a better deductible.

Monetary Implications

So, you are excited about long-term care insurance coverage? Nice! However let’s discuss in regards to the monetary realities. It isn’t nearly protection; it is about understanding the potential prices and advantages. Consider it like investing in your future well-being – a sensible transfer, however one which requires a bit of monetary savvy.

Premiums: The Value of Peace of Thoughts

Lengthy-term care insurance coverage premiums can differ considerably primarily based on a number of components. Age, well being, and the kind of protection are key components. Think about a younger, wholesome particular person versus somebody a bit older with pre-existing situations – their premiums will probably differ considerably. It’s because the chance of needing long-term care is increased for the older, doubtlessly much less wholesome particular person.

Return on Funding: A Future-Centered Calculation

The “return” on long-term care insurance coverage is not like a inventory market achieve. As an alternative, it is about defending your monetary future by doubtlessly avoiding huge out-of-pocket bills. Consider it as an funding in your independence. In the event you do not buy it, you will probably should pay out of pocket for care, which may be devastating financially. The peace of thoughts it brings is invaluable.

Lengthy-Time period Monetary Advantages

Let’s take a look at the potential monetary advantages in a desk format, showcasing the worth of getting long-term care insurance coverage. It is like having a security web on your retirement years.

| Profit | Description |

|---|---|

| Avoiding Substantial Out-of-Pocket Prices | Defending your financial savings from excessive long-term care bills, which may be astronomical. |

| Sustaining Monetary Stability | Guaranteeing that your retirement funds and different belongings aren’t depleted by expensive care. |

| Preserving High quality of Life | Offering the assets to keep up a cushty life-style, even with care wants. |

| Peace of Thoughts | Realizing you’ve a monetary security web throughout a difficult time. |

Tax Implications: A Essential Consideration, Metropolitan life long run care insurance coverage

Premiums paid for long-term care insurance coverage are sometimes tax-deductible. Which means the quantity you pay in direction of your coverage may scale back your taxable earnings. Moreover, advantages obtained from the coverage could also be tax-free. It is important to seek the advice of with a certified tax advisor to grasp how this impacts your particular state of affairs. That is essential for minimizing your tax burden.

Coverage Length and Value

The size of protection you select immediately impacts the associated fee. An extended coverage period means increased premiums. A shorter period might not present the identical stage of monetary safety, however it should have a decrease price. Consider it like buying a automobile: an extended guarantee will price extra, however supply higher safety.

Take into account the totally different coverage durations fastidiously. The choice is very private and is determined by particular person circumstances.

Future Tendencies and Developments

So, the way forward for long-term care insurance coverage…it’s kind of like predicting the climate, however with an entire lot extra wrinkles. It is a quickly evolving panorama, and MetLife, properly, we’re making an attempt to maintain up with the altering tides.

Anticipated Tendencies within the Lengthy-Time period Care Insurance coverage Market

The long-term care insurance coverage market is experiencing a shift. Individuals are dwelling longer, well being issues are evolving, and expertise is disrupting conventional service fashions. Anticipate to see a higher emphasis on preventative care, and extra customized care options tailor-made to particular person wants.

Metropolitan Life’s Adaptability to Market Tendencies

MetLife is dedicated to staying forward of the curve. We’re consistently reviewing and adjusting our insurance policies and companies to fulfill the altering wants of our purchasers. Consider it as a dynamic dance between insurance coverage suppliers and their clients.

We’re investing closely in expertise, together with telehealth choices and digital platforms, to enhance accessibility and effectivity for our purchasers. That is all about offering higher care, on the contact of a button.

Influence of Technological Developments on Lengthy-Time period Care Providers

Expertise is remodeling long-term care in numerous methods. Telehealth, for instance, permits for distant monitoring and consultations, bettering entry to care, particularly for these in distant areas. Think about video calls with docs and therapists, all from the consolation of your private home!

Automated methods have gotten extra refined in managing medicine schedules, monitoring very important indicators, and even offering reminders for appointments. This stage of automation guarantees to scale back human error and guarantee a better stage of consistency.

Potential Challenges Dealing with the Lengthy-Time period Care Insurance coverage Trade

Predicting the long run isn’t straightforward. The long-term care insurance coverage business faces challenges like rising healthcare prices and an growing old inhabitants. The growing demand for these companies, coupled with the unpredictable nature of well being situations, is placing strain on insurance coverage suppliers. It is a tough balancing act.

Sustaining profitability whereas offering complete and inexpensive protection is a major hurdle. The business is constantly working to create a sustainable system that may accommodate the evolving wants of the inhabitants.

Predicted Future Adjustments within the Lengthy-Time period Care Insurance coverage Trade

| Side | Predicted Change | Instance |

|---|---|---|

| Coverage Choices | Extra custom-made and versatile insurance policies catering to various wants and life. Anticipate extra preventative care choices and integration with wearable expertise. | A coverage that enables for pre-authorization of particular therapies, or one which adjusts premium funds primarily based on particular person well being metrics. |

| Pricing Fashions | Shifting from a standard, one-size-fits-all method to extra customized and dynamic pricing fashions. This might embody risk-based pricing, or usage-based premiums. | Charging increased premiums for people with pre-existing situations, however providing important reductions for these actively taking part in well being administration applications. |

| Service Supply | Higher reliance on expertise, telehealth, and home-based care choices. This development is transferring in direction of a extra complete and built-in care expertise. | Distant monitoring units built-in into the insurance coverage plan that alert suppliers to potential well being points and assist coordinate care. |

| Trade Regulation | Potential for stricter laws to deal with shopper safety and monetary stability points. | Enhanced transparency necessities for coverage particulars and elevated scrutiny on claims dealing with practices. |

Buyer Testimonials (Instance Content material)

So, you are excited about long-term care insurance coverage? It is a massive determination, and listening to from actual individuals who’ve used it may be tremendous useful. These testimonials from joyful Metropolitan Life policyholders supply a glimpse into the real-world impression of our plans.

Optimistic Buyer Experiences

Many shoppers have shared constructive experiences with Metropolitan Life’s long-term care insurance coverage. They admire the peace of thoughts it gives, figuring out they’ve a security web for surprising well being challenges. This assurance permits them to concentrate on having fun with life quite than worrying about monetary burdens.

Advantages Obtained by Clients

Metropolitan Life insurance policies present numerous advantages, tailor-made to fulfill particular person wants. These advantages can embody the fee of nursing residence prices, in-home care bills, and different related caregiving bills. Many shoppers have reported that these advantages have considerably alleviated monetary stress throughout difficult instances. It is like having a monetary superhero in your aspect!

Buyer Quotes Illustrating Optimistic Experiences

| Buyer Title | Testimonial | Influence on Monetary Properly-being |

|---|---|---|

| Sarah Miller | “I am so glad I acquired long-term care insurance coverage. My husband had a stroke, and the coverage lined a whole lot of his care prices. It took an enormous weight off my shoulders, permitting me to concentrate on his restoration.” | Decreased monetary stress and allowed Sarah to concentrate on her husband’s restoration. |

| David Chen | “I might been laying aside getting long-term care insurance coverage, however then my mom wanted in-home care. The coverage made an enormous distinction. It meant I may afford the care she wanted with out draining my financial savings.” | Prevented important monetary depletion by masking in-home care bills. |

| Maria Rodriguez | “My father was recognized with dementia. The Metropolitan Life coverage helped pay for his assisted dwelling facility. It gave me the peace of thoughts that he’d be cared for correctly, and I would not be burdened with extreme prices.” | Supplied monetary safety, permitting Maria to concentrate on her father’s care. |

Coverage Influence on Buyer Monetary Properly-being

Metropolitan Life insurance policies have helped many purchasers preserve their monetary stability throughout difficult well being conditions. They keep away from the monetary burden of in depth medical prices by masking bills associated to long-term care. This permits clients to concentrate on the well-being of their family members with out worrying about overwhelming monetary tasks. It is a main reduction!

Examples of Clients Using Their Protection

Quite a few clients have efficiently utilized their Metropolitan Life long-term care insurance coverage protection. These insurance policies have supplied help for numerous care wants, corresponding to expert nursing services, in-home care, and assisted dwelling services. Every case highlights the sensible software of the coverage’s advantages and the way they provide real-world assist throughout instances of want.

- A policyholder utilized the coverage to cowl the prices of a talented nursing facility for his or her aged dad or mum, guaranteeing correct care with out extreme private expense.

- One other policyholder employed the coverage to assist in-home care companies for a member of the family with a power sickness, offering complete care and luxury within the acquainted environment of their residence.

- A 3rd policyholder leveraged the coverage to fund assisted dwelling preparations for his or her growing old relative, providing a supportive and nurturing atmosphere for his or her liked one’s wants.

Contacting Metropolitan Life (Instance Content material)

So, you’ve got acquired your eye on MetLife long-term care insurance coverage? Nice alternative! However how do you really discuss to them about it? Don’t fret, we have you lined (pun supposed!). This part particulars the varied methods to achieve MetLife, making the entire course of smoother than a freshly-ironed shirt.

Contacting MetLife: A Multitude of Choices

MetLife presents quite a lot of methods to attach with their representatives, from the old style cellphone name to the fashionable on-line portal. It is all about discovering the strategy that most accurately fits your communication model and most well-liked stage of interplay.

Contact Strategies and Data

Here is a helpful desk summarizing the other ways to achieve MetLife, full with useful contact info.

| Contact Technique | Description | Particulars |

|---|---|---|

| Telephone | The tried-and-true technique. Discuss to a reside individual instantly. | Dial the MetLife customer support quantity. Anticipate wait instances, particularly throughout peak hours. |

| On-line Portal | Handy and self-service oriented. Very best for fast questions or checking coverage particulars. | Entry the MetLife web site and discover the net assist space. |

| An excellent possibility for detailed questions or complicated points. | Use the supplied e mail tackle for MetLife inquiries. | |

| Chat | Instantaneous interplay with a MetLife consultant. | Search for the chat function on the MetLife web site. |

Discovering Native Brokers or Representatives

MetLife has a community of licensed brokers throughout the nation. They will supply customized recommendation and steerage. Discovering an area consultant is simple; merely use the agent locator device on the MetLife web site.

Evaluating Contact Choices: Execs and Cons

Every technique has its personal strengths and weaknesses. This desk gives a fast comparability that can assist you select the best one.

| Contact Choice | Execs | Cons |

|---|---|---|

| Telephone | Instant suggestions, customized help | Potential wait instances, won’t be the very best for complicated points |

| On-line Portal | 24/7 entry, fast solutions to easy questions | Won’t be appropriate for customized steerage, cannot tackle complicated conditions instantly |

| Detailed clarification of issues, glorious for complicated queries | Longer response instances, might not get quick help | |

| Chat | Quick response, quick solutions to easy inquiries | Restricted assist choices, won’t be appropriate for intricate conditions |

Declare Course of Overview

Submitting a declare with MetLife follows a selected course of. Perceive the steps to make sure a easy and environment friendly dealing with of your declare.

The MetLife declare course of sometimes entails offering essential documentation, corresponding to medical data, and following the rules set by the corporate.

Contact MetLife customer support to start the declare course of. Guarantee you’ve all required documentation prepared. Observe up with the related consultant for updates in your declare standing.

Last Ideas

In conclusion, understanding Metropolitan Life long-term care insurance coverage is essential for securing your future well-being. This information has illuminated the varied facets of those insurance policies, from protection and advantages to monetary implications and the declare course of. By fastidiously contemplating the choices and your particular person wants, you may make knowledgeable selections to guard your self and your family members. It is a no-brainer actually.

Important Questionnaire

What are the standard ready intervals for advantages?

Ready intervals differ by coverage, however typically vary from 90 days to a yr. Examine coverage particulars for specifics.

Are there several types of long-term care lined?

Sure, insurance policies sometimes cowl nursing residence care, assisted dwelling, and residential well being care, however specifics differ by coverage. At all times double-check.

How can I handle the prices of my coverage?

Discover totally different premium fee choices, think about riders for added protection, and store round for the very best offers.

What are widespread misconceptions about LTC insurance coverage?

One widespread false impression is that it is too costly or not price it. Nonetheless, it may be a significant monetary security web in the long term, and costs are sometimes manageable.