Low-cost automotive insurance coverage in Jackson MS is a must have for drivers navigating the native market. This information dives deep into understanding charges, uncovering the perfect suppliers, and revealing methods for securing reasonably priced protection. We’ll discover the elements influencing premiums, from driving habits to automobile sorts, and equip you with the information to make the neatest decisions on your Jackson, MS wants.

From the native demographics shaping insurance coverage prices to the highest suppliers and their distinctive choices, this complete overview equips you with the instruments to seek out the proper match on your funds. Prepare to save lots of large on automotive insurance coverage in Jackson, MS!

Understanding the Jackson, MS Market

The Jackson, MS automotive insurance coverage market is formed by a singular mix of demographic and financial elements, alongside driving habits and accident statistics. Understanding these parts is essential for residents looking for reasonably priced and acceptable insurance coverage protection. This understanding permits for a extra personalised strategy to insurance coverage wants and higher charges.The Jackson, MS market, like many others, is affected by elements such because the native economic system, earnings ranges, and the prevalence of particular kinds of autos.

These, in flip, affect the kinds of protection which can be most wanted and the pricing fashions utilized by numerous insurance coverage suppliers.

Demographics and Financial Components

Jackson, MS has a various inhabitants, and financial elements play a major position in figuring out automotive insurance coverage charges. The area’s earnings ranges and employment tendencies affect the kinds of autos owned and the danger related to driving. Decrease incomes may correlate with inexpensive autos, probably resulting in greater charges attributable to a better perceived threat. Conversely, a good portion of the inhabitants may personal autos which can be dearer to insure.

Additionally, the presence of particular industries can affect insurance coverage prices, with greater threat industries resulting in greater charges.

Driving Habits and Accident Statistics

Driving habits and accident statistics inside the Jackson, MS space contribute considerably to insurance coverage premiums. Evaluation of site visitors accident knowledge in Jackson, MS can reveal tendencies, corresponding to accident frequency, kinds of accidents, and contributing elements, which affect insurance coverage pricing. This knowledge supplies a transparent understanding of the native threat profile for drivers. For example, if there is a greater incidence of accidents associated to rushing, insurance coverage corporations will doubtless modify their pricing fashions to mirror this greater threat.

This knowledge is significant in tailoring acceptable protection for the wants of the Jackson, MS market.

Insurance coverage Wants and Considerations of Residents

Residents in Jackson, MS, like these elsewhere, have various insurance coverage wants. Some may prioritize complete protection for his or her autos, whereas others may give attention to legal responsibility protection. Frequent issues typically revolve round affordability and the extent of protection required to guard themselves and their property. Understanding these issues is crucial to offering efficient and tailor-made insurance coverage options. Many may prioritize safety in opposition to uninsured drivers or accidents involving property injury.

Common Automobile Insurance coverage Firms in Jackson, MS

A number of well-established and native insurance coverage suppliers serve the Jackson, MS space. These corporations cater to various wants and supply numerous protection choices. Among the most prevalent suppliers are usually these with a powerful presence within the Southern US, attributable to their established infrastructure and familiarity with the native market. These corporations typically have a transparent understanding of the precise challenges and desires of the area.

Common Automobile Insurance coverage Premiums in Jackson, MS

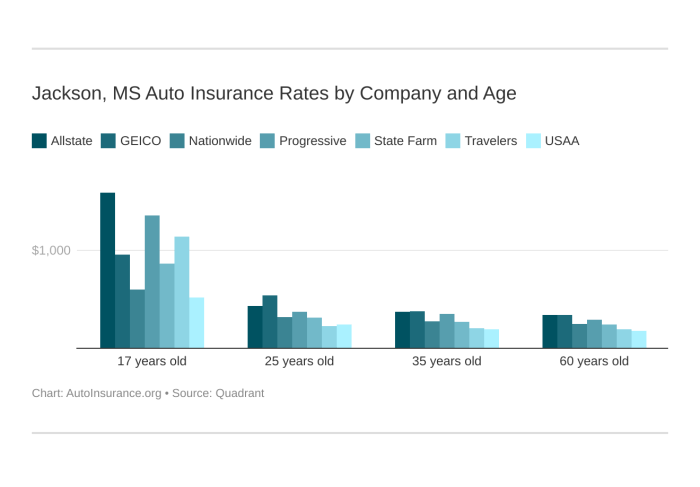

The next desk supplies a comparative overview of common automotive insurance coverage premiums in Jackson, MS, throughout numerous insurance coverage suppliers. This knowledge is an instance and needs to be seen as a common information, as particular person charges depend upon quite a few elements corresponding to driving historical past, automobile kind, and protection picks.

| Insurance coverage Supplier | Common Premium (USD) |

|---|---|

| Firm A | 1,200 |

| Firm B | 1,350 |

| Firm C | 1,150 |

| Firm D | 1,400 |

Components Influencing Low-cost Automobile Insurance coverage

Securing reasonably priced automotive insurance coverage in Jackson, MS, hinges on understanding the important thing parts that form premiums. This entails recognizing the interaction of varied elements, from driving habits to automobile traits and the chosen protection ranges. Navigating these parts permits residents to make knowledgeable selections and probably safe extra favorable charges.Complete evaluation of those elements permits people to optimize their insurance coverage decisions and probably cut back prices.

This understanding equips residents with the information mandatory to buy successfully and choose essentially the most appropriate insurance coverage plan for his or her wants.

Driving Document

A clear driving document is an important issue influencing insurance coverage premiums. Constant secure driving practices demonstrably contribute to decrease premiums. Drivers with a historical past of accidents or violations usually face greater charges, as their threat profile is taken into account higher. Insurance coverage corporations use knowledge on site visitors violations, accidents, and claims to evaluate threat and set up premium quantities.

Car Sort

The kind of automobile performs a major position in figuring out insurance coverage premiums. Larger-value autos or these with a better chance of theft, corresponding to luxurious fashions or sports activities vehicles, usually incur greater premiums. Conversely, extra reasonably priced autos or these thought of much less vulnerable to theft are inclined to have decrease premiums. Insurance coverage corporations contemplate elements such because the automobile’s make, mannequin, yr, and its perceived worth when assessing threat.

Protection Selections

The chosen protection ranges immediately influence premiums. Complete and collision protection, for example, often results in greater premiums than liability-only protection. Legal responsibility-only protection usually protects in opposition to the monetary accountability of harm or harm brought about to others in an accident the place the policyholder is at fault. Nevertheless, this protection doesn’t cowl damages to the policyholder’s automobile.

Reductions Obtainable to Jackson, MS Residents

A number of reductions can be found to residents of Jackson, MS, probably lowering insurance coverage premiums. These reductions are tailor-made to reward particular traits or actions, corresponding to secure driving or automobile upkeep. Understanding these reductions will help residents considerably decrease their insurance coverage prices.

Comparability of Low cost Packages

Numerous low cost applications supplied by totally different insurance coverage corporations range of their effectiveness. Some reductions may present substantial financial savings, whereas others may supply minimal reductions. The influence of a reduction program relies on the precise elements lined by the low cost and the person’s circumstances.

Low cost Packages and Potential Financial savings

| Low cost Sort | Description | Potential Financial savings |

|---|---|---|

| Secure Driver Low cost | For drivers with a clear driving document and no accidents or violations. | 10-20% |

| Defensive Driving Course Low cost | For completion of a defensive driving course. | 5-15% |

| Multi-Coverage Low cost | For having a number of insurance coverage insurance policies with the identical firm. | 5-10% |

| Anti-theft Gadget Low cost | For putting in anti-theft gadgets within the automobile. | 5-10% |

| Good Scholar Low cost | For college kids with good tutorial standing. | 5-10% |

Evaluating Insurance coverage Suppliers

Selecting the best automotive insurance coverage supplier in Jackson, MS, entails cautious consideration of varied elements. Understanding the strengths and weaknesses of various corporations, their claims dealing with processes, and buyer suggestions can considerably influence your determination. This evaluation supplies insights into main gamers within the Jackson market, aiding you in making an knowledgeable alternative.

Main Insurance coverage Suppliers in Jackson, MS

A number of well-established and respected insurance coverage suppliers function in Jackson, MS. Their market presence, repute, and particular choices contribute to the varied panorama of insurance coverage choices obtainable. Components like monetary stability, protection choices, and customer support are crucial concerns.

Claims Dealing with Procedures

Claims dealing with procedures range amongst insurance coverage suppliers. A streamlined course of, immediate communication, and truthful settlement are important points of a constructive claims expertise. Understanding these procedures will help you navigate potential challenges and guarantee a clean decision. Some corporations prioritize digital platforms, whereas others depend on conventional strategies.

Buyer Opinions and Suggestions

Buyer opinions and suggestions supply priceless insights into the real-world experiences of policyholders. On-line platforms and boards typically characteristic opinions detailing buyer interactions with particular insurance coverage suppliers. Optimistic experiences continuously spotlight points corresponding to immediate service and truthful claims settlements. Conversely, adverse suggestions might emphasize points like lengthy processing instances or unsatisfactory communication. These opinions, whereas subjective, present priceless context for evaluating totally different suppliers.

Comparability of Buyer Service Rankings

| Insurance coverage Supplier | Buyer Service Score (Common) | Buyer Service Channels |

|---|---|---|

| State Farm | 4.2 out of 5 stars (based mostly on aggregated on-line opinions) | Cellphone, on-line portal, in-person appointments |

| Progressive | 4.0 out of 5 stars (based mostly on aggregated on-line opinions) | Cellphone, on-line portal, cellular app |

| Geico | 3.8 out of 5 stars (based mostly on aggregated on-line opinions) | Cellphone, on-line portal, chat help |

| Allstate | 3.9 out of 5 stars (based mostly on aggregated on-line opinions) | Cellphone, on-line portal, in-person visits |

Word: Customer support scores are based mostly on publicly obtainable on-line opinions and should not mirror the complete vary of experiences.

Buyer Service Channels

Totally different insurance coverage suppliers supply numerous channels for buyer interplay. Understanding these channels will help you select essentially the most handy technique for communication and help. Examples embody telephone help, on-line portals, cellular purposes, and in-person visits to native workplaces. Accessibility and effectivity are key elements when evaluating these choices. Every firm’s customer support channel choice typically displays its general strategy to policyholder interplay.

Methods for Acquiring Inexpensive Insurance coverage

Securing reasonably priced automotive insurance coverage in Jackson, MS, entails a multifaceted strategy. Understanding the native market dynamics, coupled with proactive methods, can considerably influence the price of your protection. By evaluating quotes, contemplating reductions, and exploring bundling choices, you’ll be able to typically discover a coverage that aligns along with your wants and funds.Efficient methods for securing low-cost automotive insurance coverage contain a mix of sensible decisions and proactive measures.

These methods will help navigate the complexities of the insurance coverage market and obtain a steadiness between protection and affordability.

Evaluating Insurance coverage Quotes

Thorough comparability of quotes from numerous insurance coverage suppliers is essential for locating essentially the most aggressive charges. Totally different corporations use totally different actuarial fashions and pricing constructions, resulting in variations in premiums.

- A complete strategy entails requesting quotes from a number of insurers. This ensures you are not limiting your self to a single supply, which can not characterize the very best worth.

- Evaluate not solely the premium quantity but additionally the protection particulars. Make sure that the coverage supplies sufficient safety in opposition to potential dangers, with out pointless gaps in protection.

- Use on-line comparability instruments or request quotes immediately from insurance coverage suppliers. These instruments can streamline the method, permitting you to shortly collect a spread of choices on your wants.

Bundling Insurance coverage Merchandise

Bundling a number of insurance coverage merchandise, corresponding to auto, owners, and life insurance coverage, can typically lead to substantial financial savings. Insurance coverage suppliers typically supply discounted charges for patrons who mix their insurance policies.

| Insurance coverage Product | Potential Advantages of Bundling |

|---|---|

| Auto Insurance coverage | Diminished premiums, elevated comfort of managing insurance policies by one supplier. |

| Householders Insurance coverage | Potential reductions on premiums, streamlined administrative processes. |

| Life Insurance coverage | Attainable lowered premiums, consolidated billing, enhanced monetary safety. |

“Bundling insurance policies typically affords important value financial savings, which might translate to a substantial discount in general insurance coverage bills.”

Further Concerns: Low-cost Automobile Insurance coverage In Jackson Ms

Securing reasonably priced automotive insurance coverage in Jackson, MS entails extra than simply evaluating charges. Understanding the nuances of your coverage, your rights, and potential pitfalls is essential for making knowledgeable selections. This part supplies important info that will help you navigate the method successfully.Cautious assessment of coverage particulars, consciousness of shopper protections, and information of widespread scams can considerably influence your expertise.

Understanding the various kinds of protection obtainable and the significance of annual coverage opinions are additionally key points of accountable insurance coverage administration.

Coverage Phrases and Situations

Thorough comprehension of your coverage’s phrases and situations is paramount. These paperwork Artikel the specifics of your protection, together with exclusions, limitations, and duties. Familiarizing your self with these particulars ensures you perceive what’s and is not lined, avoiding potential surprises within the occasion of a declare. Pay shut consideration to definitions of “accident,” “injury,” and “legal responsibility,” as these can considerably influence your payout.

Client Rights and Safety

Customers in Jackson, MS have rights relating to their insurance coverage insurance policies. These rights usually contain truthful therapy, transparency, and entry to info. Understanding these rights is crucial to make sure you’re not being handled unfairly or misled by insurance coverage suppliers. Know your state’s particular shopper safety legal guidelines associated to insurance coverage.

Protection Choices

Various kinds of protection choices cater to various wants and dangers. Understanding these choices helps you choose essentially the most acceptable safety on your circumstances. The desk beneath highlights some widespread kinds of protection.

| Protection Sort | Description | Instance |

|---|---|---|

| Legal responsibility Protection | Protects you financially should you trigger an accident and injure another person or injury their property. | Covers damages to a different automobile or accidents to different individuals should you’re at fault. |

| Collision Protection | Covers damages to your automobile in an accident, no matter who’s at fault. | Pays for repairs to your automotive should you hit a tree, even when the opposite driver was negligent. |

| Complete Protection | Covers damages to your automobile from occasions apart from collisions, corresponding to theft, vandalism, or climate occasions. | Covers your automobile if it is stolen or broken by a hailstorm. |

| Uninsured/Underinsured Motorist Protection | Protects you should you’re in an accident with a driver who would not have insurance coverage or would not have sufficient insurance coverage to cowl your damages. | Covers your medical bills and automobile repairs should you’re hit by a driver with out enough protection. |

Frequent Insurance coverage Scams, Low-cost automotive insurance coverage in jackson ms

Sure scams goal shoppers looking for reasonably priced automotive insurance coverage in Jackson, MS. Be cautious of unsolicited calls, emails, or texts promising extraordinarily low charges, particularly in the event that they request delicate private info upfront. Authentic insurance coverage corporations usually don’t strain prospects to make fast selections or reveal private particulars by untrusted channels. At all times confirm the legitimacy of any firm or agent earlier than sharing private info.

Annual Coverage Evaluate

Frequently reviewing your automotive insurance coverage coverage is crucial. Adjustments in your private circumstances (e.g., shifting, modifications in driving habits, or a brand new automobile) may necessitate changes to your protection. This proactive strategy helps guarantee your coverage stays aligned along with your present wants and circumstances, avoiding potential gaps in safety. Failing to assessment your coverage yearly can result in sudden prices or a scarcity of protection.

Illustrative Examples

Securing reasonably priced automotive insurance coverage in Jackson, MS, typically entails cautious consideration of varied elements and choices. Understanding these nuances permits you to make knowledgeable decisions that align along with your funds and desires. This part supplies illustrative examples to make clear the ideas mentioned earlier.

Coverage Premiums and Protection Choices

Totally different insurance coverage insurance policies have various premiums based mostly on the extent of protection chosen. A fundamental coverage with legal responsibility protection solely will usually have a decrease premium than a coverage encompassing complete and collision protection. The premium variations mirror the added threat insurers assume with extra in depth protection.

- A fundamental legal responsibility coverage, together with bodily harm and property injury, for a 25-year-old driver with a clear driving document in Jackson, MS, may cost a little round $800 yearly.

- Including complete and collision protection to the identical coverage might improve the annual premium to roughly $1,200.

- A coverage with greater deductibles, corresponding to $1,000 for collision and complete, may lead to an extra discount within the premium, presumably right down to $950.

Comparability of Insurance coverage Supplier Quotes

Evaluating quotes from totally different insurance coverage suppliers is essential to securing essentially the most aggressive charges. A comparative evaluation reveals potential financial savings and clarifies the pricing constructions of varied corporations.

| Insurance coverage Supplier | Premium (Annual) | Protection Particulars |

|---|---|---|

| Firm A | $950 | Legal responsibility, Complete, Collision, $500 Deductible |

| Firm B | $1,050 | Legal responsibility, Complete, Collision, $1,000 Deductible |

| Firm C | $880 | Legal responsibility, Complete, Collision, $1,000 Deductible |

Word that the premium variations may be affected by elements corresponding to automobile kind, driving historical past, and placement inside Jackson, MS.

Impression of Reductions on Premiums

Insurance coverage corporations typically supply reductions for numerous elements. These reductions can considerably cut back premiums, making insurance coverage extra reasonably priced.

- A driver with a very good driving document may qualify for a reduction, lowering the premium by 10-15%.

- Bundling a number of insurance policies, corresponding to house and auto, with the identical supplier can yield a reduction.

- Utilizing a safety-enhancing system like an anti-theft system might additionally lead to a reduction.

A graphic illustrating this influence would show a comparability of premiums with and with out reductions, showcasing the potential financial savings. For instance, a premium of $1,000 with out reductions could possibly be lowered to $850 with a very good driving document low cost and a multi-policy low cost.

Claims Eventualities and Outcomes

Understanding how claims are dealt with is crucial for efficient threat administration. Totally different declare situations lead to numerous outcomes.

- State of affairs 1: A minor fender bender with minimal injury. The declare course of is comparatively easy, and the settlement quantity will doubtless be in keeping with the restore value.

- State of affairs 2: A extra important accident involving substantial automobile injury. The declare course of is perhaps extra advanced, with an extended decision time. The settlement quantity would mirror the precise restore or alternative prices.

- State of affairs 3: A complete loss declare. The settlement will cowl the automobile’s worth, probably together with further bills for towing or storage.

Understanding the doable outcomes of various claims situations empowers you to organize for potential monetary implications.

Conclusive Ideas

In conclusion, securing low cost automotive insurance coverage in Jackson, MS, entails cautious analysis, an intensive understanding of native elements, and strategic comparability. By contemplating the varied choices, you could find a coverage that balances safety with affordability. Bear in mind to consider reductions, discover totally different suppliers, and assessment your coverage commonly to make sure optimum protection at the very best worth.

Useful Solutions

What are the commonest reductions for automotive insurance coverage in Jackson, MS?

Frequent reductions embody these for secure driving information, multi-policy bundling, and pupil standing. Particular reductions range by insurance coverage supplier.

How can I examine automotive insurance coverage quotes successfully?

Use on-line comparability instruments, request quotes from a number of suppliers, and contemplate elements like protection ranges and deductibles when evaluating quotes.

What are some widespread scams associated to automotive insurance coverage in Jackson, MS?

Be cautious of unsolicited calls promising unusually low charges, and by no means share private info with unknown entities. Confirm the legitimacy of any insurance coverage supply.

What are my shopper rights when coping with automotive insurance coverage corporations in Jackson, MS?

Familiarize your self along with your state’s shopper safety legal guidelines relating to insurance coverage. Understanding your rights will help you navigate disputes successfully.