Canadian automotive insurance coverage in usa – Canadian automotive insurance coverage within the USA presents a posh panorama for drivers crossing the border. Navigating the intricacies of US laws alongside Canadian insurance coverage insurance policies calls for cautious consideration. Drivers want to grasp the nuances of protection, authorized necessities, and potential value variations. This in-depth exploration clarifies the complexities, serving to Canadians make knowledgeable selections when insuring their automobiles to be used in the US.

From evaluating protection ranges and premiums to understanding accident claims procedures, this complete information empowers Canadians to confidently navigate the method. This information examines the various choices, from using Canadian suppliers to deciding on US insurers, to make sure seamless and cost-effective protection whereas on American roads.

Overview of Canadian Automobile Insurance coverage within the USA

Yo, you Canucks lookin’ to cruise stateside? Sorted insurance coverage to your journey is vital, ‘trigger the US ain’t precisely a pleasant zone for international plates. Navigating the insurance coverage panorama can get a bit murky, so let’s break it down.Driving a Canadian-registered automobile within the USA is a little bit of a hoops recreation. Totally different states have totally different guidelines, however typically, you may want proof of monetary accountability, like a US-issued insurance coverage coverage.

Failing to conform can land you with hefty fines and a possible boot to your automotive. You are not simply by yourself, you gotta ensure you’re lined.

Authorized Necessities for Driving within the USA

The authorized hoops for driving a Canadian automotive within the US contain demonstrating proof of monetary accountability, usually a US-based insurance coverage coverage. Because of this when you trigger an accident, you are lined and you are not leaving the state with an unpaid invoice. It is the regulation, and it is best to be on the suitable aspect of it.

Challenges in Buying Insurance coverage

Canadians usually face challenges discovering insurance coverage for his or her automobiles pushed within the US. The insurance policies in Canada usually do not lengthen to US territory, that means you are uncovered. Totally different protection ranges and insurance policies, to not point out various charges, make the choice course of a bit extra of a maze. US insurers may need totally different standards for assessing threat, which might have an effect on your premiums.

Sorts of Insurance coverage Choices

There are numerous insurance coverage choices tailor-made for Canadian-registered automobiles within the US. A normal coverage covers legal responsibility, which is essential for authorized compliance. Complete protection can also be an possibility, defending your automobile towards harm from numerous perils, like accidents or theft. Collision protection is one other selection, paying for harm to your automobile if it is concerned in a crash, no matter fault.

Keep in mind, these choices aren’t simply in regards to the fundamentals, however in regards to the peace of thoughts that comes with figuring out your journey is protected.

Premium Comparability

| Protection Stage | Canadian Insurer Premium (Instance) | US Insurer Premium (Instance) |

|---|---|---|

| Legal responsibility Solely | CAD $500 – $1000 | USD $600 – $1200 |

| Legal responsibility + Complete | CAD $800 – $1500 | USD $1000 – $1800 |

| Legal responsibility + Collision | CAD $1000 – $2000 | USD $1200 – $2500 |

Word: Premiums are estimates and might differ considerably primarily based on elements like automobile sort, driving historical past, and placement. This desk gives a normal thought of the potential value variations.

Insurance coverage Choices for Canadian Drivers

Proper, so you are a Canuck cruising Stateside. Insurance coverage ain’t precisely a breeze once you’re on the opposite aspect of the border. You gotta know the ropes to keep away from getting nicked by hidden costs and awkward conditions. That is your information to navigating the American insurance coverage maze.This part dives deep into the assorted insurance coverage choices accessible for Canadian drivers within the USA.

We’ll cowl the professionals and cons of utilizing Canadian insurers, the method of getting protection from US firms, and the prices and advantages of every method. Plus, we’ll take a look at any potential limitations on protection.

Utilizing Canadian Insurers for US Automobiles, Canadian automotive insurance coverage in usa

Canadian insurers usually supply insurance policies that cowl automobiles within the USA, however it’s kind of of a minefield. They won’t supply complete protection, particularly when you’re out on the open street, and protection ranges is perhaps decrease than what US firms supply. It is usually a less expensive possibility when you stick with the identical metropolis or state you’re acquainted with, however there is a catch.

Some insurance policies have limitations, like decrease payout quantities or exclusions for particular US states or areas.

Acquiring US Insurance coverage for Canadian Automobiles

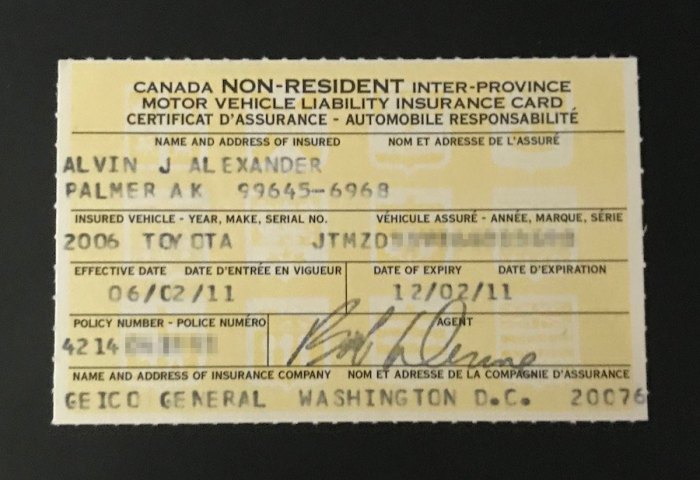

Getting US insurance coverage for a Canadian-registered automobile is mostly simple, although it’d include the next premium than when you used a Canadian firm. You will often want to supply proof of auto registration, proof of possession, and probably, your driving document. Some firms have particular necessities for automobiles imported into the US. A superb tip is to buy round with numerous US insurance coverage suppliers, as charges can fluctuate.

Value Comparability: US vs. Canadian Insurance coverage

US insurers usually cost increased premiums than Canadian insurers for Canadian-registered automobiles, however they may supply extra complete protection, particularly for automobiles used within the US. Think about the full value, together with premiums, deductibles, and potential claims. Canadian insurance coverage might sound cheaper initially, however the next declare may eat into your financial savings when you’re not cautious. It is all about discovering the candy spot.

Protection Limitations of Canadian Insurance coverage within the USA

Canadian insurance policies would possibly exclude sure states or areas, have limits on legal responsibility protection for US accidents, or have decrease protection limits in comparison with US insurance policies. At all times test the advantageous print, and do not assume protection is similar throughout all US states. Ensure you perceive the bounds and exclusions earlier than hitting the street.

Desk of US Insurers Catering to Canadian Drivers

| Insurer | Professionals | Cons |

|---|---|---|

| Geico | Widely known, usually aggressive charges. | Might have increased premiums for non-US residents. |

| State Farm | Sturdy native presence, recognized for customer support. | Charges would possibly differ primarily based on the particular automobile and driver profile. |

| Progressive | Digital platform, user-friendly on-line providers. | Potential for increased premiums in comparison with different insurers, particularly for particular automobiles. |

| Allstate | Intensive community of brokers and declare facilities. | May have much less aggressive charges in comparison with different insurers. |

| Liberty Mutual | Good buyer evaluations, versatile insurance policies. | May require further documentation to substantiate driver standing. |

Components Affecting Insurance coverage Prices

Insurance coverage to your journey throughout the pond is usually a proper ache within the neck. Understanding the elements that inflate these premiums is vital to getting the very best deal. Understanding what’s driving up the associated fee will enable you navigate the murky waters of US automotive insurance coverage, particularly when you’re coming over from Canada.

Automobile Kind and Worth

The kind and worth of your motor are a significant factor within the price ticket. A souped-up sports activities automotive, or a traditional classic journey, often comes with the next insurance coverage premium in comparison with a fundamental household hatchback. That is usually as a result of perceived threat of injury or theft, in addition to the potential restore prices. Insurance coverage firms assess the automobile’s market worth, its make, mannequin, and yr of manufacture to estimate potential restore prices.

Driving Historical past

A clear driving document is a large plus. When you’ve received a historical past of accidents or violations, your premiums will seemingly be increased. This is not nearly US driving infractions; Canadian driving information are additionally factored in. Insurance coverage firms take a look at each your Canadian and any potential US driving historical past when calculating your threat profile. A clear slate is your finest guess for decrease premiums.

Location and Utilization

The place you park your journey and the way usually you utilize it matter. Excessive-crime areas sometimes have increased premiums as a result of elevated threat of theft or harm. Insurance coverage firms usually contemplate the placement of your garaging and the frequency of use. When you primarily drive quick distances, your threat is decrease than somebody who commutes lengthy distances day by day.

Claims Historical past

A historical past of claims can dramatically enhance your premiums. Whether or not it is a fender bender or a complete loss, earlier claims sign the next probability of future claims. A declare historical past can stick with you for years, even after the accident is settled. So, a clear historical past is significant.

Fee Methodology and Reductions

Insurance coverage firms usually supply reductions for paying premiums on time and in full, for instance, via automated funds. These reductions can differ relying on the supplier. Reductions are additionally accessible for secure driving habits, anti-theft units, and even for sure memberships. It is price investigating these reductions to see in the event that they apply to you.

Comparability of Canadian and US Accident Claims Processes

The declare course of within the US and Canada can differ considerably. Canadian accident claims are often extra simple, with clear processes and procedures. Within the US, the method can typically be extra advanced, with a wider vary of things to contemplate, from authorized illustration to third-party involvement. A Canadian driver could need to familiarize themselves with the US claims course of.

| Automobile Kind | Estimated Premium Impression |

|---|---|

| Luxurious Sports activities Automobile | Excessive |

| Compact Sedan | Medium |

| Small SUV | Medium-Low |

| Basic Automobile | Excessive |

| Truck | Medium-Low |

Claims and Dispute Decision

Navigating the maze of cross-border automotive insurance coverage claims is usually a proper ache, particularly when your wheels are spinning in a distinct nation. Understanding the ropes for submitting a declare and resolving disputes when your Canadian journey will get right into a jam on US soil is essential. This part will break down the method for you, so you are not left stranded with a hefty restore invoice and a mountain of paperwork.

Accident Procedures for Canadian-Registered Automobiles within the USA

Understanding the procedures for accidents involving Canadian-registered automobiles within the US is vital to getting issues sorted out shortly and effectively. Firstly, instantly following the accident, you could acquire all obligatory info: police report particulars, witness statements, and photographs of the harm. Then, contacting your Canadian insurer and US insurer (if relevant) is essential. Your insurer may need particular directions for reporting accidents overseas, and the US insurer would possibly require a declare report.

Submitting a Declare with a US Insurer

Submitting a declare with a US insurer when your automobile is registered in Canada requires cautious consideration to element. The insurer wants proof of the accident, together with the police report, medical information, and harm assessments. You need to all the time retain all documentation associated to the declare. Offering correct and complete info to the insurer is crucial to make sure a easy declare course of.

Furthermore, figuring out the particular insurance policies and procedures of the US insurer concerned is necessary for avoiding any delays or issues.

Widespread Disputes in Cross-Border Insurance coverage Claims

Disputes usually come up resulting from differing interpretations of insurance coverage insurance policies throughout borders. Language boundaries, cultural misunderstandings, and ranging authorized programs also can contribute to those conflicts. Misunderstandings about protection limits, obligations, and accident reporting procedures are frequent causes of dispute. For instance, a Canadian driver won’t pay attention to the particular necessities for reporting an accident within the US, resulting in issues afterward.

Likewise, US insurers won’t absolutely perceive Canadian insurance coverage practices. These complexities can usually result in delays and issues in resolving the declare.

Comparability of Declare Dealing with Procedures

| Facet | Canadian Insurer | US Insurer |

|---|---|---|

| Accident Reporting | Normally requires reporting the accident to the Canadian insurer inside a particular timeframe. | Reporting the accident to the US authorities and your insurer is essential. Typically requires a police report. |

| Declare Evaluation | Evaluation usually includes Canadian requirements for repairs and valuations. | Evaluation adheres to US requirements for repairs and valuations. |

| Legal responsibility Willpower | The method for figuring out legal responsibility sometimes follows Canadian legal guidelines. | The method adheres to US legal guidelines and laws. |

| Fee Course of | Repairs and settlements usually observe Canadian fee constructions. | Funds usually observe US fee constructions. |

| Dispute Decision | Canadian dispute decision procedures could apply, together with mediation or arbitration. | US dispute decision mechanisms could embody mediation or litigation. |

This desk gives a simplified overview of the declare dealing with procedures. The particular procedures and necessities can differ primarily based on the circumstances of the accident and the particular insurance policies of every insurer.

Authorized Issues

Navigating the authorized panorama of US automotive insurance coverage once you’re a Canadian driver is usually a proper ache. It isn’t simply in regards to the premiums; figuring out the foundations is essential to keep away from hefty fines or worse. Understanding the legalities ensures you are not simply lined, however you are additionally taking part in by the US gamebook.The US has particular laws for insuring automobiles, even these registered in different nations.

This part dives into the authorized necessities, potential penalties of non-compliance, and the way totally different states method cross-border insurance coverage. It is all about avoiding these nasty surprises that would depart you stranded or worse.

Insurance coverage Necessities for Canadian-Registered Automobiles

US states require proof of monetary accountability for all automobiles working inside their borders. This often means having legal responsibility insurance coverage, a particular minimal quantity of protection. This is not only a matter of politeness; it is the regulation. For Canadian drivers, this usually includes acquiring a US insurance coverage coverage or demonstrating equal protection via a acknowledged reciprocal settlement. Failure to conform may end in hefty penalties.

Implications of Violating US Insurance coverage Laws

Driving with out sufficient insurance coverage within the US can result in extreme penalties, starting from fines to potential license suspension and even automobile impoundment. The particular penalties differ relying on the state and the severity of the violation. This may be extremely disruptive, particularly when you’re reliant in your automobile for work or day by day life.

Particular Authorized Frameworks Governing Cross-Border Insurance coverage

A number of US states have reciprocal agreements with Canada and different nations to simplify the method for drivers with international registrations. These agreements usually Artikel the particular necessities for proof of insurance coverage and tips on how to navigate cross-border insurance coverage wants. Nevertheless, these agreements can differ considerably, and an intensive investigation is essential. When you’re not sure, consulting a authorized professional is a brilliant transfer.

Penalties of Not Having Acceptable Insurance coverage Protection

Driving with out sufficient insurance coverage can lead to a variety of great penalties, impacting not solely your private funds but in addition your potential to journey or work. This is not only a monetary headache; it is a authorized one that would influence your future. Examples embody fines, suspension of your driving privileges, and the potential for going through lawsuits from concerned events.

Moreover, when you trigger an accident, you may be held answerable for any damages, even when you’re only a customer.

US State-Particular Laws Relating to Canadian Automobile Insurance coverage

The US does not have a single, unified system for dealing with cross-border insurance coverage. Laws differ considerably from state to state, creating a posh panorama for Canadian drivers.

| State | Particular Necessities |

|---|---|

| Instance State 1 | Proof of minimal legal responsibility protection; reciprocal settlement with Canada; particular varieties required for verification. |

| Instance State 2 | No reciprocal settlement with Canada; requires a US coverage or equal proof of protection; potential for increased premiums for international drivers. |

| Instance State 3 | Simplified course of for drivers with legitimate Canadian insurance coverage; restricted documentation required. |

This desk is a simplified illustration; all the time seek the advice of the particular insurance coverage division of the state you’re visiting. Laws are advanced and topic to vary.

Comparability of Protection

Navigating US insurance coverage as a Canadian driver can really feel like a maze. Understanding the totally different protection ranges between Canadian and US insurance policies is essential for avoiding nasty surprises down the road. This part breaks down the important thing variations, serving to you make the suitable selections to your wheels.US insurance coverage insurance policies, in contrast to their Canadian counterparts, usually have totally different protection ranges tailor-made for driving within the US.

This implies a coverage legitimate in Canada won’t absolutely shield you within the States.

Typical Protection Ranges

Canadian insurance policies usually deal with the necessities, whereas US insurance policies have a tendency to supply extra complete choices. This distinction in method is instantly tied to the various authorized frameworks and accident charges between the 2 nations. Canadian protection tends to be extra targeted on legal responsibility and fundamental protections. US insurance policies, alternatively, would possibly supply a broader vary of protection to accommodate the upper probability of accidents, collisions, and property harm.

Legal responsibility Protection

Legal responsibility protection within the US is often extra substantial than in Canada. It is because US legal guidelines usually maintain drivers extra accountable for damages triggered in accidents. Canadian legal responsibility insurance policies sometimes cowl damages to different events’ automobiles and accidents sustained by others. Nevertheless, US insurance policies continuously lengthen legal responsibility protection to cowl further damages or medical bills. Understanding the specifics of every coverage is essential for guaranteeing you are adequately protected.

Collision and Complete Protection

Collision protection within the US is mostly extra strong, because it usually covers damages to your personal automobile no matter fault in an accident. Canadian insurance policies could have various ranges of collision protection, usually specializing in the monetary influence of injury to your automobile. Complete protection within the US is often extra inclusive, encompassing harm from occasions past accidents, reminiscent of theft, vandalism, or pure disasters.

Canadian insurance policies won’t embody the identical breadth of complete protection.

Sorts of Insurance coverage Protection

Insurance coverage insurance policies supply a variety of coverages, every taking part in a particular position in defending your pursuits. Legal responsibility protection is crucial for safeguarding your self from claims associated to accidents or harm to different events. Collision protection is designed to deal with the monetary accountability for harm to your personal automobile in a collision. Complete protection gives safety towards numerous dangers past collisions, reminiscent of theft, fireplace, or vandalism.

- Legal responsibility Protection: Protects you from monetary accountability for harm to others’ property or accidents triggered in an accident.

- Collision Protection: Covers harm to your automobile in a collision, no matter who’s at fault.

- Complete Protection: Protects towards damages to your automobile from occasions like theft, vandalism, fireplace, or hail.

- Uninsured/Underinsured Motorist Protection: Gives safety when you’re concerned in an accident with an uninsured or underinsured driver.

- Medical Funds Protection: Covers medical bills for you and your passengers, no matter fault.

- Private Damage Safety (PIP): Just like medical funds, however usually covers misplaced wages and different bills.

Evaluating Protection Choices

Evaluating numerous insurance coverage choices requires cautious scrutiny of coverage particulars. The particular protection ranges, deductibles, and premiums differ significantly amongst totally different insurers. Totally reviewing coverage paperwork is crucial. You need to search for protection that adequately protects you within the US whereas remaining inexpensive.

| Insurance coverage Supplier | Legal responsibility Protection | Collision Protection | Complete Protection |

|---|---|---|---|

| Insurer A | $100,000/$300,000 | $10,000 Deductible | Full Protection |

| Insurer B | $250,000/$500,000 | $5,000 Deductible | Partial Protection |

| Insurer C | $500,000/$1,000,000 | $2,500 Deductible | Full Protection with extras |

Ideas and Suggestions for Canadians

Navigating the US automotive insurance coverage panorama as a Canadian driver is usually a little bit of a maze. Understanding the nuances of protection, laws, and potential pitfalls is essential to keep away from pricey surprises. This part gives sensible recommendation for Canadians seeking to safe the suitable insurance coverage for his or her wheels whereas stateside.

Actionable Ideas for Canadians

Insurance coverage is not only a field to tick; it is a important a part of your journey and possession plan within the States. Do your homework and do not simply accept the primary coverage you see. Examine totally different suppliers, coverages, and premiums to seek out the very best deal tailor-made to your wants.

Dependable Assets for Info

Discovering reliable data on Canadian automotive insurance coverage within the US is vital. Begin with respected insurance coverage comparability web sites and search for assets particularly catering to Canadian drivers. Do not depend on generic on-line searches; search for websites devoted to cross-border insurance coverage. Checking along with your Canadian insurer or their US associates also can present useful insights.

Minimizing Insurance coverage Prices

Conserving your premiums down with out compromising protection is a should. Think about elements like your driving document, automobile sort, and placement when selecting a coverage. A clear driving document is commonly a big think about reducing premiums. Researching reductions provided by insurers also can result in substantial financial savings.

Understanding Particular Laws

Laws differ by state. Ensure you completely perceive the particular laws governing your chosen state for automobile insurance coverage. Totally different states have differing necessities for minimal protection. For instance, some states would possibly require legal responsibility protection, whereas others would possibly demand complete protection.

Suggestions for Canadians

- Totally analysis insurance coverage suppliers providing protection particularly for Canadian drivers within the USA. This usually yields higher premiums and tailor-made help.

- Get hold of a number of quotes from totally different insurers to check costs and protection packages. Do not simply accept the primary quote you discover.

- Be ready to reveal your clear driving document, as this usually results in decreased premiums.

- Perceive and adjust to all state-specific laws for automotive insurance coverage. Totally different states have various necessities for protection.

- Think about including extras like roadside help or emergency medical cowl, particularly when you’re travelling.

Wrap-Up

In conclusion, securing the suitable automotive insurance coverage when driving a Canadian-registered automobile within the USA is essential. Understanding the distinctive challenges, choices, and elements impacting premiums empowers Canadians to make knowledgeable selections. By completely reviewing protection, evaluating insurers, and contemplating authorized implications, drivers can guarantee their automobile is satisfactorily protected and navigate the method with confidence. The information has supplied a transparent overview of the complexities, making the complete course of much less daunting.

Important Questionnaire: Canadian Automobile Insurance coverage In Usa

What are the authorized necessities for driving a Canadian-registered automobile within the USA?

Proof of insurance coverage, usually within the type of a US-compliant coverage, is usually required. Particular laws differ by state. At all times confirm necessities with the state’s Division of Motor Automobiles.

How do I examine premiums for comparable protection ranges between Canadian and US insurers?

Evaluating quotes instantly from insurers, whereas contemplating protection particulars and exclusions, is essential. Think about using on-line comparability instruments. Word that automobile sort, driver profile, and placement inside the USA influence premiums.

What are the frequent disputes arising from cross-border insurance coverage claims?

Disputes usually focus on legal responsibility, protection limits, and declare processing procedures. Understanding the variations in declare processes between Canadian and US insurers is significant.

What are the implications of not having acceptable insurance coverage protection whereas driving a Canadian-registered automobile within the USA?

Penalties can vary from fines to automobile impoundment. Furthermore, with out sufficient protection, drivers could face vital monetary liabilities in case of accidents. At all times make sure the automobile is roofed.