Can unlawful immigrants get automobile insurance coverage? This advanced query delves into the authorized, sensible, and sometimes emotional panorama of acquiring automobile insurance coverage for these with out authorized immigration standing. Navigating the maze of rules, supplier insurance policies, and private circumstances will be daunting, highlighting the disparities and challenges confronted by undocumented immigrants in securing this very important type of safety. The journey is not simple; components like proof of residency, particular insurance coverage necessities, and potential biases inside the insurance coverage business all play a job.

This exploration will unpack the intricate components surrounding automobile insurance coverage for undocumented immigrants, exploring the authorized frameworks, insurance coverage supplier views, sensible procedures, and potential different options. We’ll study the complexities and the hurdles confronted by these people, shedding mild on their battle to entry this basic security web.

Authorized Frameworks and Laws

Insurance coverage rules for motor autos range considerably throughout jurisdictions, usually reflecting nationwide insurance policies on immigration and transportation. These rules often intertwine with broader immigration legal guidelines, creating complexities in figuring out eligibility for automobile insurance coverage for non-citizens. The precise necessities for proof of residency or immigration standing, in addition to the remedy of various immigration statuses, are essential components in understanding entry to automobile insurance coverage for varied teams of non-citizens.Understanding these intricacies is crucial for each people in search of insurance coverage and insurers working inside the advanced panorama of immigration legal guidelines.

Variations in authorized frameworks between jurisdictions result in variations in how insurance coverage firms assess threat and eligibility for non-citizen drivers. A complete understanding of those rules is critical to make sure compliance and facilitate truthful and equitable entry to insurance coverage merchandise for all drivers, no matter their immigration standing.

Insurance coverage Necessities for Non-Residents

The authorized frameworks governing motorcar insurance coverage for non-citizens are sometimes intertwined with broader immigration insurance policies. These rules usually require proof of authorized standing and compliance with immigration legal guidelines for eligibility. Totally different immigration statuses necessitate totally different approaches to assessing insurance coverage eligibility, and particular rules range throughout jurisdictions.

Proof of Residency or Immigration Standing

Proof of residency or immigration standing is a key ingredient in figuring out eligibility for automobile insurance coverage for non-citizens. This proof usually includes presenting documentation that validates the person’s authorized standing inside the goal jurisdiction. The character and extent of required documentation could differ relying on the precise immigration standing and the jurisdiction’s rules. As an illustration, a authorized everlasting resident may want to offer their inexperienced card, whereas a brief visa holder would wish their visa and accompanying documentation.

Insurers depend on these paperwork to confirm the person’s authorized standing and compliance with immigration legal guidelines.

Comparability of Insurance coverage Laws for Totally different Immigration Statuses

The desk beneath Artikels the overall variations in insurance coverage necessities for varied immigration statuses. It is essential to notice that these are common pointers and particular necessities can range primarily based on particular person circumstances and jurisdiction-specific rules.

| Immigration Standing | Insurance coverage Necessities | Proof Wanted | Particular Laws |

|---|---|---|---|

| Authorized Everlasting Resident | Typically just like residents; could require proof of authorized standing | Inexperienced card, legitimate driver’s license, proof of tackle | Particular rules range by jurisdiction; could have to show steady authorized residency |

| Non permanent Visa Holder | Might have particular necessities primarily based on visa kind; usually restricted to particular actions and period of keep. | Visa, proof of employment authorization (if relevant), legitimate driver’s license | Jurisdictions could impose restrictions on insurance coverage protection, relying on the kind of visa. |

| Undocumented Immigrant | Typically not eligible for traditional automobile insurance coverage insurance policies in most jurisdictions. | None, apart from presumably acquiring protection via particular, usually restricted, insurance coverage choices. | That is usually a posh authorized space with various interpretations and insurance policies by particular person insurance coverage firms. It is extremely really helpful to seek the advice of with immigration and authorized professionals for detailed steerage. |

Insurance coverage Supplier Views

Insurance coverage suppliers play a important position in figuring out entry to car insurance coverage for immigrants. Their practices are formed by authorized frameworks, threat assessments, and operational issues. The method of evaluating and underwriting insurance coverage insurance policies for non-citizens usually includes distinctive challenges, as components past commonplace driving data and monetary historical past could have to be thought of.Insurance coverage firms make use of varied methods to handle the dangers related to insuring non-citizens.

These approaches usually mirror a balancing act between offering protection to a broader inhabitants and mitigating monetary publicity.

Widespread Practices Concerning Protection for Immigrants

Insurance coverage suppliers typically adhere to the authorized frameworks and rules Artikeld within the jurisdictions the place they function. Nonetheless, the applying of those guidelines can range primarily based on particular person circumstances and the precise insurance policies of the insurer. The method often includes verifying the immigration standing of the applicant, making certain compliance with related legal guidelines, and assessing their monetary stability and driving historical past.

Components Thought of in Assessing Danger for Non-Residents

Insurance coverage firms meticulously assess the chance profile of non-citizen candidates. Past commonplace standards resembling driving historical past and credit score rating, components resembling immigration standing, size of residency, and employment historical past are sometimes thought of. These components can have an effect on the notion of future claims or cost reliability. Moreover, the insurer’s understanding of native legal guidelines and rules performs an important position within the evaluation course of.

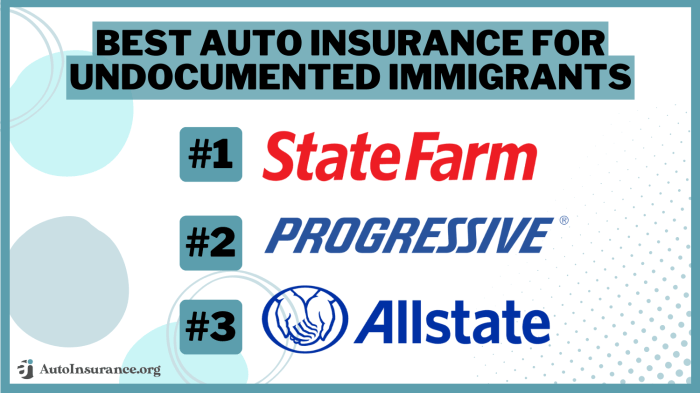

Examples of Totally different Approaches, Can unlawful immigrants get automobile insurance coverage

Totally different insurance coverage firms undertake various approaches in insuring non-citizens. Some insurers could supply specialised packages tailor-made to particular immigrant communities, contemplating components like size of keep and employment documentation. Others could make use of a extra restrictive strategy, limiting protection to solely these with a selected immigration standing or particular documentation. Examples embrace an organization offering complete protection for authorized everlasting residents, however limiting protection for these with short-term visas.

A special firm could require vital down funds for candidates with no everlasting residence or substantial monetary historical past.

Varieties of Insurance coverage Protection Often Excluded or Restricted

Insurance coverage suppliers often exclude or restrict sure kinds of protection for non-citizens. This can be a consequence of each the chance assessments and authorized constraints. Complete protection, together with uninsured/underinsured motorist safety, or protection for accidents exterior the nation could also be restricted or excluded. Hole insurance coverage could also be more durable to acquire or could require particular proof of monetary stability.

Challenges in Assessing Danger of Non-Citizen Drivers

Insurance coverage suppliers face vital challenges in assessing the chance of non-citizen drivers. Lack of constant data or verifiable driving historical past, challenges in acquiring complete credit score reviews, and the complexities of immigration standing and authorized frameworks usually make this evaluation harder. Making certain the accuracy and reliability of knowledge supplied by non-citizen candidates is an important side of this evaluation.

This course of will be additional difficult by language obstacles or an absence of familiarity with the insurance coverage course of.

Sensible Concerns and Procedures

Navigating the complexities of acquiring automobile insurance coverage as an immigrant requires a transparent understanding of the applying course of, obligatory documentation, and potential obstacles. This part particulars the steps concerned, the required documentation for varied immigration statuses, and procedures for verifying immigration standing, finally aiming to offer a complete overview of the sensible realities for immigrants in search of auto insurance coverage.Efficiently acquiring automobile insurance coverage as an immigrant usually hinges on demonstrating compliance with native rules and presenting verifiable proof of authorized residency or short-term standing.

The documentation required and the verification procedures employed by insurance coverage suppliers immediately influence the power of immigrants to entry this important protection.

Software Course of for Immigrants

The applying course of for automobile insurance coverage by immigrants mirrors that of different candidates, however with extra issues. Candidates should present all required documentation, which frequently contains proof of identification, residency, and authorized standing. Insurance coverage suppliers are legally obligated to adjust to all relevant legal guidelines and rules in regards to the issuance of insurance policies to people of all backgrounds.

Documentation Necessities

The documentation required for automobile insurance coverage varies primarily based on the applicant’s immigration standing. Verification of identification and authorized residency is paramount. Offering false or deceptive info can result in coverage cancellation and potential authorized ramifications.

Examples of Required Paperwork for Numerous Immigration Statuses

| Immigration Standing | Instance Paperwork |

|---|---|

| Everlasting Resident | Inexperienced Card, legitimate passport, proof of tackle (utility invoice, lease settlement), social safety card. |

| Non permanent Resident (e.g., pupil visa, work visa) | Legitimate visa, passport, proof of tackle (e.g., housing contract), proof of employment (if relevant). |

| Asylum Seeker | Asylum utility paperwork, proof of identification, proof of tackle, any related courtroom paperwork. |

| Refugee | Refugee standing paperwork, proof of identification, proof of tackle, any related courtroom paperwork. |

Process for Verifying Immigration Standing

Insurance coverage suppliers make use of standardized procedures to confirm the immigration standing of candidates. These procedures usually contain reviewing documentation for authenticity and accuracy. Verification processes are essential for making certain compliance with rules and sustaining the integrity of the insurance coverage market. A key side is the verification of the paperwork offered towards official databases.

Potential Boundaries Confronted by Immigrants in Accessing Automotive Insurance coverage

A number of obstacles could hinder immigrants’ potential to acquire automobile insurance coverage. Language obstacles, cultural variations, and an absence of familiarity with the insurance coverage course of can current vital challenges. Moreover, some immigrants could face difficulties offering the required documentation, particularly if they’ve lately arrived within the nation. Additional, immigration standing is usually a main hurdle. The dearth of a constant, nationwide system for verification of immigration standing throughout all insurance coverage firms presents a considerable problem.

Case Research and Situations

Navigating the complexities of automobile insurance coverage for immigrants requires understanding the varied challenges and potential pitfalls. This part presents hypothetical eventualities for example the challenges and successes encountered within the utility and upkeep of insurance coverage insurance policies. It additionally highlights the numerous responses of insurance coverage suppliers and the essential steps for interesting denied claims.

Hypothetical State of affairs of an Immigrant Making use of for Automotive Insurance coverage

A latest immigrant, missing documentation of prior driving historical past within the new nation, faces vital hurdles in acquiring automobile insurance coverage. The applicant, whereas possessing a legitimate driver’s license from their residence nation, could battle to offer proof of driving expertise or accident-free data acknowledged by insurance coverage suppliers of their new location. Language obstacles and cultural variations can additional complicate the method.

The applicant may additionally lack data of the native insurance coverage rules and procedures. This instance illustrates the potential for bureaucratic and linguistic obstacles that may hinder the method.

Profitable Acquisition of Automotive Insurance coverage by an Immigrant

Conversely, profitable insurance coverage acquisition will be achieved via proactive measures. An immigrant with a clear driving document, regardless of missing formal documentation of their historical past of their new nation, could discover a supplier prepared to simply accept an alternate type of proof, resembling driving data from a good driving college or proof of secure driving practices. This state of affairs demonstrates that insurers is perhaps receptive to verifiable proof of accountable driving habits.

Moreover, a transparent understanding of insurance coverage rules and the power to speak successfully with the insurance coverage supplier will be essential on this course of.

Examples of Insurance coverage Suppliers Denying Protection to Immigrants

Insurance coverage suppliers could deny protection to immigrants resulting from an absence of adequate documentation, resembling a legitimate driver’s license acknowledged of their new nation. Moreover, undocumented immigrants usually face obstacles in accessing insurance coverage. An immigrant’s immigration standing or the perceived increased threat profile related to their demographic group is perhaps contributing components to the denial of protection.

An absence of constant entry to driving data or the issue in verifying earlier driving historical past within the new nation may also result in denial.

Widespread Misconceptions about Insurance coverage Protection for Immigrants

A prevalent false impression is that every one immigrants are ineligible for automobile insurance coverage. That is inaccurate, as many insurance coverage suppliers supply protection to immigrants with legitimate driver’s licenses and a clear driving document. One other false impression is that undocumented immigrants can not acquire insurance coverage. Whereas there are particular challenges for undocumented people, there are suppliers who could supply choices, although the supply and phrases of such insurance policies could range.

Procedures for Interesting a Denied Insurance coverage Declare

Interesting a denied insurance coverage declare requires a radical understanding of the insurer’s coverage and the precise causes for the denial. Immigrants ought to rigorously evaluation the denial letter and doc any supporting proof to justify their attraction. The method usually includes contacting the insurer’s claims division to request a evaluation and supply additional supporting documentation. This will contain contacting authorities businesses or different related authorities to offer extra verification.

Lastly, immigrants could take into account in search of authorized counsel to help in navigating the appeals course of.

Impression of Immigration Insurance policies: Can Unlawful Immigrants Get Automotive Insurance coverage

Immigration insurance policies exert a major affect on entry to automobile insurance coverage for people. The authorized standing of an immigrant, coupled with various authorities rules, usually creates complexities in acquiring inexpensive and appropriate protection. These insurance policies can immediately influence insurance coverage charges, availability of protection, and the general insurance coverage panorama for each immigrants and insurers.The connection between immigration insurance policies and automobile insurance coverage is multifaceted.

Totally different nations have distinct immigration frameworks, which, in flip, affect the insurance coverage business’s potential to evaluate threat and decide acceptable premiums. This intricate relationship necessitates a nuanced understanding of the interaction between coverage and follow.

Impression of Authorized Standing on Insurance coverage Availability

The authorized standing of an immigrant immediately correlates with the supply of automobile insurance coverage. People missing authorized documentation usually face substantial obstacles to acquiring protection. Insurance coverage suppliers usually assess threat primarily based on components like driving historical past, location, and authorized residency. With out authorized residency standing, these assessments change into tougher, resulting in decreased availability or elevated premiums.

Potential Biases and Discriminatory Practices

Insurance coverage suppliers could inadvertently or intentionally discriminate towards immigrants primarily based on their immigration standing. Implicit biases inside the business can manifest in increased premiums, restricted protection choices, or outright refusal to offer insurance coverage. These biases, whereas doubtlessly unintentional, can have vital penalties for immigrants’ monetary stability and mobility. Specific discrimination, although unlawful in lots of jurisdictions, is a priority that have to be addressed via efficient regulatory oversight and ongoing business scrutiny.

Examples of Immigration Coverage Impression on Charges and Availability

In sure jurisdictions, particular immigration insurance policies have led to demonstrably increased insurance coverage premiums for immigrants. These insurance policies could impose extra necessities or limit entry to sure insurance coverage merchandise, usually primarily based on perceived threat components. For instance, some nations may impose increased premiums on drivers who’ve lately arrived within the nation, reflecting a perceived increased threat profile till they set up a historical past inside the group.

Lack of Authorized Standing and Insurance coverage Entry

The dearth of authorized standing poses vital obstacles to acquiring automobile insurance coverage. Insurance coverage suppliers usually require proof of authorized residency, and people with out such documentation could discover it difficult or inconceivable to fulfill these necessities. This limitation can have substantial implications for day by day life, as the lack to safe automobile insurance coverage can hinder transportation, employment, and different important actions.

Authorities Laws and Insurance coverage Practices

Authorities rules play a pivotal position in shaping insurance coverage practices concerning immigrants. Laws concerning the remedy of non-citizens in insurance coverage markets range throughout jurisdictions. In some jurisdictions, insurers could also be legally obligated to offer protection to all drivers, no matter immigration standing, whereas others enable for particular exclusions or restrictions. These rules considerably have an effect on the insurance coverage firms’ methods and threat evaluation processes.

These rules are often up to date and amended, necessitating a continuing evaluation of their influence on the insurance coverage business.

Different Options and Assist

Addressing the distinctive challenges confronted by immigrants in acquiring automobile insurance coverage necessitates a multifaceted strategy encompassing each governmental initiatives and community-based assist programs. Efficient options require a nuanced understanding of the precise authorized and monetary obstacles immigrants encounter, coupled with sensible methods for overcoming these obstacles. These options purpose to foster inclusivity and guarantee equitable entry to important companies like automobile insurance coverage.

Authorities Applications and Initiatives

Governmental assist performs an important position in bridging the entry hole to automobile insurance coverage for immigrants. These initiatives usually concentrate on offering monetary help or subsidies, doubtlessly decreasing the price of insurance coverage premiums. Moreover, streamlined administrative procedures and accessible info channels are very important elements in these packages. Focused packages could supply discounted charges or waivers for particular demographics, notably these with restricted monetary assets.

Examples embrace state-level initiatives that present monetary help to low-income people, together with immigrants, for varied requirements, together with automobile insurance coverage.

Non-profit Organizations Providing Help

Quite a few non-profit organizations actively assist immigrant communities by offering a variety of companies, together with help with insurance coverage purposes. These organizations usually supply culturally delicate steerage, facilitating a smoother utility course of and making certain that immigrants perceive the precise necessities and procedures concerned. Their involvement usually goes past merely aiding with purposes, doubtlessly providing academic workshops on insurance coverage choices, client rights, and monetary literacy.

Many non-profits cater to particular immigrant teams, providing multilingual assist and understanding distinctive cultural contexts.

Assets for Immigrants Looking for Automotive Insurance coverage

Navigating the complexities of automobile insurance coverage as an immigrant requires entry to dependable assets. These assets must be available, simply accessible, and tailor-made to the precise wants and circumstances of immigrant communities. Clear and concise info concerning eligibility standards, utility procedures, and accessible choices is paramount. On-line portals or devoted web sites providing info particularly for immigrants will be extremely helpful, offering translated supplies and multilingual assist.

Authorities businesses, insurance coverage suppliers, and group organizations usually preserve such assets.

Desk of Assist Organizations

| Group | Contact Info | Providers Supplied |

|---|---|---|

| Nationwide Council of La Raza (UnidosUS) | (202) 628-8000 | Advocacy for immigrant rights, together with insurance coverage entry, info and assets for varied immigrant communities. |

| The American Immigration Legal professionals Affiliation (AILA) | (202) 833-8500 | Authorized help and steerage on immigration issues, doubtlessly together with navigating insurance coverage points and eligibility for help packages. |

| Native Immigrant Advocacy Facilities (e.g., in particular states or cities) | (Test native listings for contact info) | Direct help with insurance coverage purposes, entry to monetary help, and details about authorities packages, doubtlessly particular to the native immigrant group. |

| Insurance coverage Info Institutes | (Test web site for contact info) | Instructional assets and knowledge on insurance coverage services and products, together with particulars on automobile insurance coverage. |

Final Phrase

In conclusion, the reply as to whether unlawful immigrants can get automobile insurance coverage is not a easy sure or no. It is a multifaceted challenge deeply intertwined with authorized frameworks, insurance coverage supplier practices, and the distinctive circumstances of every particular person. Whereas challenges stay, the potential for entry and assist exists. This dialogue underscores the necessity for understanding and empathy, recognizing the human ingredient behind these insurance policies and procedures.

The journey in the direction of equitable entry to automobile insurance coverage for all deserves additional exploration.

Often Requested Questions

Can I get automobile insurance coverage if I am within the US with out authorized standing?

Sadly, it is usually difficult. Many insurance coverage firms could not supply protection, and even when they do, the necessities for proof of residency and different paperwork will be tough to satisfy.

What paperwork do I would like to use for automobile insurance coverage as an immigrant?

The precise paperwork required range relying on immigration standing. Widespread paperwork embrace proof of identification, proof of tackle, driver’s license (if relevant), and immigration-related paperwork. It is essential to test with the insurance coverage supplier for the precise record.

Are there any authorities packages or initiatives to assist immigrants in accessing insurance coverage?

Some non-profit organizations or state packages could present help. Exploring assets and choices particular to your immigration standing and site is crucial.

What are the potential biases or discriminatory practices within the insurance coverage business?

Some research recommend that insurance coverage suppliers may exhibit bias or discriminate towards non-citizens. Nonetheless, there are authorized frameworks designed to guard towards such discriminatory practices.