Benefits and downsides of automotive insurance coverage are essential to understanding your monetary and authorized obligations on the street. This complete information explores the advantages and disadvantages, serving to you navigate the complexities of automotive insurance coverage insurance policies and make knowledgeable choices.

From the monetary security web it supplies to the potential prices and limitations, this evaluation supplies a transparent image of what to anticipate when selecting a coverage.

Introduction to Automotive Insurance coverage

Automotive insurance coverage is a contract between a person or entity (the policyholder) and an insurance coverage firm (the insurer). It protects the policyholder financially from potential losses arising from car-related incidents. The aim of this contract is to switch the monetary danger of unexpected occasions, akin to accidents, theft, or harm to the insured automobile, to the insurance coverage firm.

This switch of danger permits people to keep up monetary stability within the face of such occasions.The basic function of automotive insurance coverage is to supply monetary safety in case of unexpected circumstances involving a automobile. This encompasses a broad vary of potential damages, together with collision, complete harm, and legal responsibility points. A well-structured coverage presents complete protection, making certain the policyholder is protected in opposition to a wide selection of perils.

Key Elements of a Typical Automotive Insurance coverage Coverage

A complete automotive insurance coverage coverage sometimes consists of a number of key parts designed to deal with numerous potential dangers. These parts are important to supply ample safety and monetary safety for the policyholder. The most typical coverages are Artikeld under.

Coverage Protection Construction

The next desk Artikels the everyday construction of a automotive insurance coverage coverage, detailing the various kinds of protection and their descriptions. This desk supplies a transparent understanding of the assorted components that contribute to a whole and efficient automotive insurance coverage plan.

| Protection Sort | Description | Instance |

|---|---|---|

| Legal responsibility Protection | Protects the policyholder from monetary accountability for damages triggered to different individuals or their property in an accident. | If the policyholder causes an accident leading to $10,000 in damages to a different individual’s automobile, the legal responsibility protection would pay for these damages as much as the coverage limits. |

| Collision Protection | Covers damages to the insured automobile brought on by a collision with one other automobile or object, no matter who’s at fault. | If the insured automobile is concerned in a collision and sustained $5,000 in damages, the collision protection would pay for the repairs, as much as the coverage limits. |

| Complete Protection | Covers damages to the insured automobile brought on by occasions aside from collisions, akin to theft, vandalism, fireplace, or hail. | If the insured automobile is stolen, the excellent protection would pay for the substitute or restore of the automobile, as much as the coverage limits. |

| Uninsured/Underinsured Motorist Protection | Offers protection if the policyholder is concerned in an accident with a driver who doesn’t have insurance coverage or whose insurance coverage is inadequate to cowl the damages. | If the policyholder is in an accident with an uninsured driver who causes $8,000 in damages, the uninsured/underinsured protection would step in to pay for the damages, as much as the coverage limits. |

| Medical Funds Protection | Covers medical bills for the policyholder and passengers concerned in an accident, no matter fault. | If the policyholder is injured in an accident, medical funds protection would cowl the medical payments incurred because of the accident. |

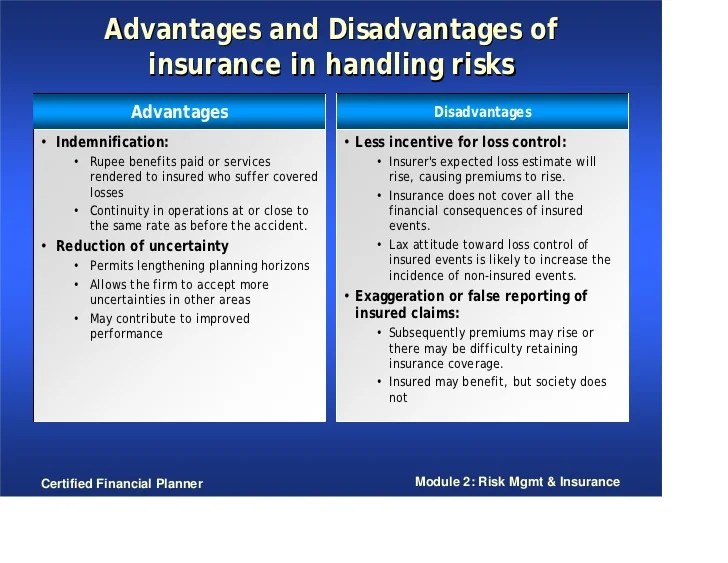

Benefits of Automotive Insurance coverage

Automotive insurance coverage, a important part of accountable automobile possession, presents a large number of advantages extending past mere authorized compliance. These benefits embody monetary safety in unexpected circumstances, authorized safety, and the psychological peace of thoughts that comes with realizing one’s automobile is protected. Understanding these benefits is important for making knowledgeable choices about private and monetary safety.

Monetary Safety in Accidents

Automotive insurance coverage acts as an important monetary security web within the occasion of an accident. It covers damages to the insured automobile, in addition to legal responsibility for damages incurred to different events concerned. This safety mitigates the doubtless devastating monetary penalties of accidents, stopping people from being burdened with substantial out-of-pocket bills. For example, a collision inflicting in depth automobile harm may be financially crippling with out insurance coverage protection, whereas insurance coverage supplies compensation for repairs or replacements, defending the policyholder’s monetary well-being.

Authorized Necessities and Compliance

In numerous areas, automotive insurance coverage is a authorized requirement. Failure to own legitimate insurance coverage can lead to important penalties, together with fines and potential authorized repercussions. These laws guarantee a level of economic accountability for drivers and defend different street customers. Totally different jurisdictions have particular laws concerning minimal protection necessities, which fluctuate primarily based on components akin to the kind of automobile, driver historical past, and native legal guidelines.

Peace of Thoughts and Diminished Stress

Automotive insurance coverage supplies a way of safety and peace of thoughts. Realizing {that a} complete insurance coverage coverage is in place reduces stress related to potential accidents and related liabilities. This assurance permits people to deal with their day by day lives with out fixed nervousness about monetary repercussions from unexpected occasions. The data that monetary burdens are mitigated by insurance coverage promotes a extra relaxed driving expertise and contributes to a safer driving setting.

Varied Forms of Protection

Complete insurance coverage insurance policies embody quite a lot of protection varieties, every providing particular protections. These coverages cater to various wants and circumstances. For instance, legal responsibility protection protects in opposition to claims from third events, whereas collision protection safeguards in opposition to damages to the insured automobile, no matter who’s at fault. Extra protection choices like complete protection handle harm from perils past collisions, akin to vandalism or climate occasions.

Comparability of Totally different Insurance policies

Totally different automotive insurance coverage insurance policies fluctuate considerably of their protection and related premiums. Components akin to the driving force’s age, automobile sort, driving historical past, and placement all affect the premiums. For instance, youthful drivers sometimes face increased premiums as a consequence of a perceived increased danger profile. Equally, drivers with a historical past of accidents or violations usually face elevated premiums. It’s important to check numerous insurance policies from totally different suppliers to seek out probably the most appropriate and cost-effective choice.

Insurance coverage Protection Varieties and Benefits

| Protection Sort | Description | Benefits |

|---|---|---|

| Legal responsibility Protection | Covers damages to different individuals or property in an accident the place the insured is at fault. | Protects in opposition to monetary accountability for damages to others. Meets authorized necessities in lots of jurisdictions. |

| Collision Protection | Covers damages to the insured automobile in an accident, no matter who’s at fault. | Pays for repairs or substitute of the insured automobile, even when the insured is answerable for the accident. Offers monetary safety for automobile restore. |

| Complete Protection | Covers damages to the insured automobile brought on by perils past collisions, akin to vandalism, fireplace, or climate occasions. | Protects in opposition to damages from occasions not associated to accidents, akin to theft or pure disasters. Affords a wider vary of safety past normal collision protection. |

| Uninsured/Underinsured Motorist Protection | Covers damages if the at-fault driver doesn’t have insurance coverage or has inadequate protection. | Offers monetary safety when concerned in an accident with an uninsured or underinsured driver. Mitigates monetary losses when dealing with an at-fault celebration missing ample protection. |

Disadvantages of Automotive Insurance coverage

Automotive insurance coverage, whereas offering essential safety in opposition to monetary loss, presents a number of drawbacks. Understanding these disadvantages is important for shoppers to make knowledgeable choices about their protection and guarantee they aren’t overpaying or underinsured. These disadvantages vary from the monetary burden of premiums to potential issues throughout declare processes.

Value Implications of Automotive Insurance coverage

Automotive insurance coverage premiums characterize a big ongoing monetary dedication. The fee varies significantly primarily based on a number of components, making it a big consideration for potential policyholders. These prices can affect budgets and necessitate cautious planning. Moreover, the fee is usually a barrier to accessing ample protection for some people and households.

Components Influencing Automotive Insurance coverage Prices

Quite a few components contribute to the various prices of automotive insurance coverage. Driver demographics, akin to age, driving historical past, and placement, are essential determinants. A younger driver, as an illustration, usually faces increased premiums as a consequence of statistically increased accident charges. The kind of automobile additionally performs a task, with sports activities automobiles and high-performance autos usually commanding increased premiums as a consequence of their elevated danger of injury or theft.

The situation of the automobile’s major use additionally considerably impacts insurance coverage prices, with increased charges usually noticed in areas with the next incidence of accidents or theft.

Limitations and Exclusions of Automotive Insurance coverage Insurance policies

Every automotive insurance coverage coverage has limitations and exclusions. These are clearly Artikeld within the coverage paperwork, and understanding them is essential. For instance, sure insurance policies might not cowl harm brought on by particular occasions, akin to earthquakes or floods, or harm to the automobile past a sure threshold. Moreover, some insurance policies exclude protection for accidents that happen whereas the automobile is getting used for business functions.

The policyholder should fastidiously evaluate these exclusions to make sure they align with their wants and anticipated circumstances.

Potential for Claims Denial

Claims denial can come up from numerous circumstances. This consists of circumstances the place the policyholder fails to stick to the coverage phrases, akin to offering inaccurate info in the course of the software course of or failing to report an accident promptly. Moreover, claims could also be denied if the occasion falls exterior the scope of protection, akin to harm brought on by intentional acts or put on and tear.

Understanding the coverage’s particular circumstances and prerequisites is important to keep away from such conditions.

Potential Difficulties in Submitting a Declare

Submitting a declare is usually a complicated course of. The mandatory paperwork, together with police experiences and medical information, may be cumbersome to assemble. Additional difficulties might stem from disagreements between the policyholder and the insurance coverage firm concerning the extent of the harm or the validity of the declare. Navigating these challenges requires endurance and a radical understanding of the declare course of.

Potential Bureaucratic Hurdles within the Declare Course of

Bureaucratic hurdles can complicate the declare course of. These obstacles embody prolonged processing occasions, communication breakdowns between the policyholder and the insurance coverage firm, and navigating complicated administrative procedures. Moreover, differing laws and necessities in numerous jurisdictions can introduce additional complexity to the method. Thorough data of the declare course of and associated procedures is paramount to clean decision.

Comparability of Totally different Insurance coverage Insurance policies

| Insurance coverage Coverage Sort | Disadvantages |

|---|---|

| Legal responsibility-Solely Coverage | Offers minimal protection within the occasion of an accident. It solely covers harm to a different individual’s property or damage to a different individual. |

| Complete Coverage | Whereas complete insurance policies supply broader protection, the premiums are sometimes increased. They might nonetheless have exclusions, akin to these associated to put on and tear or particular occasions. |

| Collision Coverage | Collision protection sometimes has the next premium than liability-only insurance policies. It solely covers harm to the insured automobile, regardless of fault. |

| Uninsured/Underinsured Motorist Protection | This protection is important however comes with a value. It protects in opposition to accidents involving drivers with out insurance coverage or with inadequate protection. |

Forms of Automotive Insurance coverage

Understanding the assorted sorts of automotive insurance coverage protection is essential for choosing the suitable safety and avoiding monetary pitfalls. Several types of protection handle distinct dangers related to automobile possession, providing various ranges of economic safety. A complete understanding permits drivers to make knowledgeable choices aligning their insurance coverage wants with their funds and danger tolerance.

Forms of Protection

A wide range of insurance coverage coverages can be found to guard drivers and their autos. These coverages are designed to deal with totally different potential dangers, making certain monetary safety in case of accidents or damages. Every sort of protection presents a selected stage of safety in opposition to numerous circumstances, requiring a cautious evaluation of particular person wants.

- Legal responsibility Protection: This protection protects the policyholder in opposition to monetary accountability for damages triggered to others in an accident. It’s mandated by legislation in most jurisdictions and covers the price of repairing or changing one other individual’s automobile, in addition to paying for medical bills incurred by injured events. Legal responsibility protection sometimes does not cowl damages to the policyholder’s automobile.

- Collision Protection: This protection pays for damages to the insured automobile, no matter who triggered the accident. It protects in opposition to harm from a collision with one other automobile, an object, or an animal. Collision protection is essential for changing or repairing the automobile if it is concerned in an accident the place the policyholder is at fault or if the at-fault celebration is uninsured or has inadequate protection.

- Complete Protection: This protection extends past collisions, masking damages to the insured automobile ensuing from occasions aside from collisions. This consists of occasions akin to vandalism, theft, fireplace, hail, or weather-related harm. Complete protection is important for safeguarding the automobile in opposition to dangers past a easy collision. For instance, a automotive parked in a single day and broken by falling tree branches can be coated below complete insurance coverage, however not below collision protection.

- Uninsured/Underinsured Motorist Protection: This protection protects the policyholder and passengers if concerned in an accident with a driver who lacks or has inadequate insurance coverage. It helps to cowl damages and medical bills in such conditions. It’s a important addition to straightforward legal responsibility protection, particularly in areas with a excessive charge of uninsured drivers. This protection may assist if the at-fault driver has legal responsibility protection however is unable to pay the total quantity of the damages.

- Medical Funds Protection: This protection pays for the medical bills of the policyholder and passengers injured in an accident, no matter fault. It may be essential in offering quick monetary help to these concerned in an accident.

- Private Harm Safety (PIP) Protection: This protection, usually included within the medical funds protection, is primarily centered on masking medical bills for the policyholder and passengers within the automobile, no matter fault. It is designed to help with medical prices, misplaced wages, and different bills related to accidents sustained in an accident.

Evaluating Protection Varieties

The variations between legal responsibility, collision, and complete protection are substantial. Legal responsibility protection focuses on the monetary accountability to others, whereas collision protection protects the insured automobile from harm as a consequence of collisions, no matter fault. Complete protection, in distinction, extends safety to varied incidents past collisions, encompassing occasions akin to vandalism, theft, or weather-related harm. Understanding these distinctions is important for choosing a coverage that adequately addresses particular person danger components.

| Protection Sort | Description | When it Applies |

|---|---|---|

| Legal responsibility | Covers damages to others’ property and accidents to others. | When the insured is at fault in an accident and causes harm or damage to a different celebration. |

| Collision | Covers harm to the insured automobile no matter fault. | When the insured automobile is concerned in a collision, whether or not or not the insured is at fault. |

| Complete | Covers harm to the insured automobile from occasions aside from collisions. | When the insured automobile is broken as a consequence of occasions like vandalism, theft, fireplace, hail, or weather-related harm. |

Significance of Understanding Protection Varieties

A complete understanding of assorted protection varieties is paramount to choosing a coverage that meets particular person wants. Selecting the best protection ensures that drivers are adequately protected in opposition to potential monetary losses. Cautious consideration of the precise dangers related to automobile possession and placement is essential in tailoring an appropriate insurance coverage coverage. Totally different conditions require various kinds of protection, and a lack of knowledge can result in important monetary burdens within the occasion of an accident or harm.

Moreover, the precise necessities of the realm of residence ought to be thought of when selecting applicable coverages.

Components Affecting Automotive Insurance coverage Premiums

Automotive insurance coverage premiums should not a hard and fast quantity; they’re influenced by a large number of things that replicate the perceived danger related to insuring a specific driver and automobile. Understanding these components is essential for shoppers to make knowledgeable choices about their insurance coverage protection and probably cut back prices. These components vary from the driving force’s previous conduct to the traits of the automobile itself.

Driving Historical past, Benefits and downsides of automotive insurance coverage

Driving historical past is a major determinant of insurance coverage premiums. A clear driving file, devoid of accidents or site visitors violations, usually interprets to decrease premiums. Insurance coverage firms assess driving historical past via knowledge collected from motorcar departments, which incorporates accident experiences, site visitors citations, and any prior insurance coverage claims. The severity of previous incidents considerably impacts premium calculations. For example, a driver with a historical past of a number of minor infractions may expertise the next premium than one with a single, extra critical accident.

This method goals to replicate the driving force’s propensity for dangerous conduct and the related chance of future claims.

Location

Geographic location performs a considerable position in automotive insurance coverage prices. Areas with increased charges of accidents, theft, or extreme climate circumstances sometimes have increased insurance coverage premiums. This displays the elevated danger related to these places. For instance, areas susceptible to hurricanes or extreme storms might have increased premiums as a result of elevated danger of injury or complete loss.

Equally, areas with increased crime charges may see elevated premiums for theft protection. The frequency and severity of claims inside a specific space straight have an effect on the premium charges charged in that area.

Automotive Sort and Worth

The kind and worth of the automobile considerably affect premiums. Insurance coverage firms think about components such because the make, mannequin, and 12 months of manufacture of the automobile. Sure fashions are statistically extra susceptible to theft or harm, and that is mirrored within the premium. The worth of the automobile additionally straight impacts the premium. Excessive-value autos usually incur increased premiums, because the potential monetary loss to the insurer within the occasion of an accident or theft is larger.

For instance, a high-performance sports activities automotive may entice the next premium in comparison with a fundamental economic system mannequin as a consequence of its increased restore prices and potential for extra extreme harm in an accident.

Age and Gender

Insurance coverage firms think about age and gender as components influencing premiums. Youthful drivers, usually inexperienced and statistically extra susceptible to accidents, sometimes face increased premiums. Conversely, older drivers, with a confirmed monitor file of accountable driving, might qualify for decrease charges. Equally, gender-based variations in driving habits and accident charges are generally mirrored in premium calculations, although such components are topic to scrutiny and authorized concerns.

Claims Historical past

A driver’s historical past of insurance coverage claims straight impacts their premium. A historical past of frequent claims suggests the next chance of future claims, justifying increased premiums. This displays the monetary danger related to insuring drivers who’ve a monitor file of accidents or harm to their autos. The severity of prior claims additionally performs a big position, with extra extreme claims resulting in steeper premium will increase.

| Issue | Correlation with Premium |

|---|---|

| Driving Historical past (clear file) | Decrease Premium |

| Location (excessive accident areas) | Increased Premium |

| Automotive Sort (high-value/theft-prone) | Increased Premium |

| Age (youthful driver) | Increased Premium |

| Claims Historical past (frequent claims) | Increased Premium |

Declare Course of and Settlement

The declare course of is a important facet of automotive insurance coverage, outlining the procedures for dealing with accidents and damages. A clean and environment friendly declare settlement course of is important for each the insured and the insurance coverage firm, making certain honest compensation and well timed decision. Understanding the steps concerned helps stop potential disputes and ensures a optimistic expertise within the occasion of an accident.

Reporting an Accident

Immediate and correct reporting of an accident is essential. This includes contacting the insurance coverage firm instantly after an accident, no matter perceived severity. Failure to report promptly might affect the declare’s validity. The insurance coverage firm will sometimes require particulars concerning the accident, together with the date, time, location, and an outline of the incident. Amassing info from witnesses, if out there, can also be helpful.

Declare Submitting Procedures

Submitting a automotive insurance coverage declare sometimes includes a number of steps, and a structured method is important for a clean course of. A transparent and arranged file of all documentation is important for profitable declare decision. The precise steps might fluctuate relying on the insurance coverage supplier, however usually embody submitting a declare kind, offering needed documentation, and cooperating with the insurance coverage firm’s investigation.

Declare Settlement Timeframe

The timeframe for declare settlement varies considerably relying on components such because the complexity of the declare, the provision of needed info, and the insurance coverage firm’s inner procedures. For easy claims involving minor damages, settlement may be comparatively fast, usually inside a number of weeks. Extra complicated claims, together with these with important property harm or accidents, might take longer, probably a number of months.

It is essential to grasp that the insurance coverage firm has a proper to analyze the declare and confirm the circumstances earlier than processing fee.

Declare Settlement Outcomes

The end result of a automotive insurance coverage declare can fluctuate, starting from full settlement to denial. A full settlement happens when the insurance coverage firm agrees to cowl your complete quantity of the declare, compensating the insured for all damages. A partial settlement happens when the insurance coverage firm agrees to cowl a portion of the declare, probably as a consequence of components akin to coverage limits or the insured’s contribution to the harm.

A declare denial happens when the insurance coverage firm refuses to settle the declare, sometimes as a consequence of a violation of coverage phrases, inadequate proof, or a willpower that the accident doesn’t fall below the coverage’s protection.

Steps in Submitting a Automotive Insurance coverage Declare

| Step | Description |

|---|---|

| 1 | Report the accident to the insurance coverage firm instantly. |

| 2 | Collect all needed documentation, together with police experiences, medical payments, restore estimates, and witness statements. |

| 3 | Full the declare kind offered by the insurance coverage firm, offering correct and detailed info. |

| 4 | Cooperate with the insurance coverage firm’s investigation, offering any requested info and attending needed conferences. |

| 5 | Overview the settlement supply and, if relevant, negotiate phrases. |

| 6 | If needed, search authorized counsel to guard your pursuits. |

Selecting the Proper Automotive Insurance coverage: Benefits And Disadvantages Of Automotive Insurance coverage

Choosing applicable automotive insurance coverage is essential for safeguarding monetary belongings and making certain authorized compliance. A well-chosen coverage supplies a security web in case of unexpected circumstances, akin to accidents or harm to the automobile. Fastidiously evaluating choices and understanding the nuances of assorted insurance policies is important for making an knowledgeable choice.

Evaluating Insurance coverage Quotes

Evaluating quotes from a number of insurance coverage suppliers is key to securing probably the most advantageous protection. This course of includes acquiring worth estimations from totally different firms, contemplating not solely the premium quantity but in addition the excellent vary of included coverages. Direct comparisons of coverage options and advantages are important for optimum choice.

Evaluating Insurance policies Primarily based on Particular person Wants

Evaluating insurance coverage insurance policies primarily based on particular person wants includes assessing the precise necessities and circumstances of the policyholder. Components just like the automobile’s worth, driving historical past, and geographic location considerably affect the fee and protection. Understanding these components is important for selecting an appropriate coverage. Adjusting protection to match private wants, akin to the extent of legal responsibility safety or complete protection, is vital.

Studying Coverage Wonderful Print

Thorough evaluate of the nice print inside insurance coverage insurance policies is important for avoiding future issues. Understanding the precise phrases and circumstances of every coverage is essential. Coverage exclusions, deductibles, and limitations have to be fastidiously scrutinized to make sure a transparent comprehension of the coverage’s scope and limitations. This course of helps in figuring out potential loopholes or areas that won’t align with the policyholder’s wants.

Components to Contemplate When Selecting Insurance coverage

A number of key components have to be thought of when selecting an insurance coverage coverage. These embody the automobile’s make, mannequin, and 12 months, which straight affect the potential danger and premium. The policyholder’s driving historical past, together with any accidents or site visitors violations, drastically influences the premium calculation. Geographic location performs a task, as some areas have the next danger of accidents or pure disasters.

The specified protection stage, from legal responsibility to complete protection, is a important choice primarily based on private danger tolerance and monetary capabilities. A radical understanding of those components ensures an knowledgeable choice.

Understanding Coverage Phrases and Circumstances

Comprehending the coverage phrases and circumstances is paramount for profitable insurance coverage administration. Understanding the coverage’s limitations, exclusions, and any particular necessities for submitting claims are important points to make clear. Reviewing the small print ensures alignment between the coverage and the policyholder’s wants. Clear understanding of phrases and circumstances prevents potential disputes or misinterpretations throughout declare settlements.

Evaluating Insurance coverage Suppliers

A comparative evaluation of various insurance coverage suppliers can assist within the choice course of. The next desk illustrates a comparability primarily based on numerous standards. This enables for a extra environment friendly and knowledgeable alternative.

| Insurance coverage Supplier | Premium Value (Annual) | Legal responsibility Protection (USD) | Complete Protection (USD) | Buyer Service Score | Declare Settlement Time (Days) |

|---|---|---|---|---|---|

| Firm A | $1,200 | $100,000 | $50,000 | 4.5/5 | 14 |

| Firm B | $1,500 | $250,000 | $100,000 | 4.8/5 | 10 |

| Firm C | $1,000 | $50,000 | $25,000 | 4.2/5 | 18 |

Observe: Premium prices, protection quantities, and customer support rankings are illustrative examples. Precise figures might fluctuate considerably primarily based on particular person circumstances.

Last Wrap-Up

In conclusion, understanding the benefits and downsides of automotive insurance coverage is important for accountable drivers. By weighing the monetary safety, authorized necessities, and potential drawbacks, you can also make a well-informed choice that aligns together with your particular person wants and circumstances. The correct coverage can convey peace of thoughts, whereas the unsuitable one can result in surprising prices and issues.

FAQ Useful resource

What are the everyday prices related to automotive insurance coverage?

Automotive insurance coverage prices fluctuate considerably relying on components like your driving file, location, automobile sort, and age. Premiums may be influenced by claims historical past, and a few firms supply reductions for protected driving habits.

What are the frequent sorts of automotive insurance coverage protection?

Widespread coverages embody legal responsibility, collision, complete, and uninsured/underinsured motorist protection. Legal responsibility protects you from damages you trigger to others, whereas collision and complete cowl your automobile’s harm no matter who’s at fault. Uninsured/underinsured motorist protection protects you in the event you’re concerned in an accident with a driver who does not have insurance coverage.

How do I file a declare if I am concerned in an accident?

The declare course of sometimes includes reporting the accident to your insurance coverage firm, offering needed documentation, and cooperating with investigations. Following the insurance coverage firm’s particular procedures is important for a clean declare course of.

What are the potential limitations or exclusions in automotive insurance coverage insurance policies?

Insurance policies usually exclude protection for sure sorts of harm or incidents, akin to pre-existing circumstances on the automobile, or harm brought on by struggle or intentional acts. Reviewing the nice print and understanding exclusions is essential earlier than signing up.