Municipal credit score union automotive insurance coverage is entering into the highlight, providing a refreshing different to conventional insurance coverage suppliers. These credit score unions, deeply rooted of their communities, are actually providing automotive insurance coverage tailor-made to their members’ wants. It is a distinctive alternative for drivers to probably lower your expenses and assist their native financial system, all whereas getting a personal touch. However how does this native method stack up in opposition to the giants of the business?

This complete look delves into the specifics of municipal credit score union automotive insurance coverage, evaluating its options, companies, and buyer expertise to business suppliers. We’ll uncover the potential advantages, study the coverage construction, and discover the neighborhood impression of this rising sector.

Introduction to Municipal Credit score Unions and Automotive Insurance coverage: Municipal Credit score Union Automotive Insurance coverage

Municipal credit score unions are an important a part of the monetary panorama, serving a selected neighborhood area of interest. They’re cooperative monetary establishments owned and operated by their members, sometimes inside a selected municipality or area. This member-ownership mannequin units them other than conventional banks and different monetary establishments.In contrast to massive business banks, municipal credit score unions prioritize the wants of their members, usually providing extra customized service and aggressive charges on numerous monetary merchandise.

This member-centric method fuels a powerful sense of neighborhood and fosters monetary well-being inside the native space. This deal with neighborhood is a defining attribute.

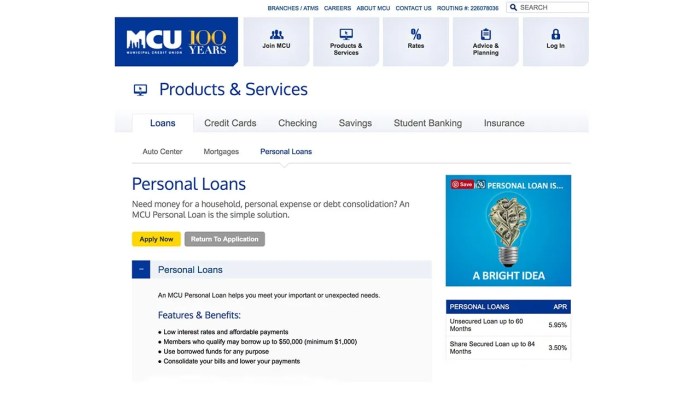

Municipal Credit score Union Automotive Insurance coverage

Municipal credit score unions, dedicated to supporting their members, are more and more providing automotive insurance coverage as a useful extra service. This growth displays a rising need to supply a complete suite of economic merchandise to their members, usually at aggressive charges. The motivation is rooted in fostering monetary safety and comfort for members inside the neighborhood they serve. Members usually discover that their credit score union gives aggressive charges and a greater understanding of their wants in comparison with business insurance coverage suppliers.

Advantages for Automotive Insurance coverage Clients

Municipal credit score unions provide a number of benefits to automotive insurance coverage prospects. A major profit is usually the aggressive pricing. Their member-owned construction and decrease administrative prices can translate to extra reasonably priced premiums. Moreover, prospects would possibly expertise a extra customized method to claims processing, fostering a faster and extra passable decision of any points.

Comparability of Municipal Credit score Union Automotive Insurance coverage and Business Suppliers

| Characteristic | Municipal Credit score Union | Business Supplier | Key Distinction |

|---|---|---|---|

| Pricing | Usually aggressive, probably decrease premiums because of decrease administrative prices. | Pricing can range extensively relying on elements like the corporate and coverage specifics. | Credit score unions might provide extra favorable charges because of their operational construction. |

| Buyer Service | Doubtlessly extra customized service, tailor-made to the wants of the neighborhood. | Service can vary from extremely customized to extra impersonal, relying on the supplier. | Credit score unions intention for a more in-depth relationship with their members. |

| Claims Course of | Potential for sooner declare processing because of smaller operations and member focus. | Claims processing timelines can range considerably relying on the supplier and complexity of the declare. | Sooner decision instances may be achievable because of streamlined processes. |

| Coverage Choices | May provide a restricted vary of insurance policies, specializing in the wants of the neighborhood. | Broader vary of insurance policies, usually catering to numerous wants and conditions. | Credit score unions might specialize within the particular wants of their neighborhood members. |

Merchandise and Companies Provided

Municipal credit score unions usually provide aggressive automotive insurance coverage choices tailor-made to their members. These plans ceaselessly embrace a spread of protection varieties and reductions, making them enticing selections for these in search of reasonably priced and dependable safety.

Varieties of Automotive Insurance coverage Merchandise, Municipal credit score union automotive insurance coverage

Municipal credit score unions sometimes present normal automotive insurance coverage merchandise. These embrace legal responsibility protection, defending you from monetary duty within the occasion of an accident the place you might be at fault. Collision protection compensates for harm to your car ensuing from a collision, no matter fault. Complete protection safeguards your car from harm brought on by occasions apart from collisions, comparable to theft, vandalism, or weather-related incidents.

Protection Choices Inside Every Product

Inside every product sort, numerous protection choices can be found. Legal responsibility protection can embrace bodily harm and property harm. Collision and complete protection might be custom-made with totally different deductibles, impacting the premium. For instance, a better deductible might lead to a decrease premium however requires a bigger out-of-pocket fee in case of a declare. Choices for added protection like uninsured/underinsured motorist safety are additionally ceaselessly obtainable.

Reductions for Members and Demographics

Municipal credit score unions ceaselessly provide unique reductions to their members. These reductions can range however usually embrace reductions for secure driving, bundling insurance coverage with different monetary companies (like loans or mortgages), or for members who’re younger drivers or have a clear driving report. College students and senior residents might also be eligible for particular reductions.

Automotive Insurance coverage Product Packages and Premiums

| Package deal | Protection | Premium | Buyer Profile |

|---|---|---|---|

| Fundamental Legal responsibility | Legal responsibility protection solely | $800-$1200 yearly | Younger driver with a restricted driving historical past |

| Complete Safety | Legal responsibility, collision, and complete | $1500-$2500 yearly | Skilled driver with a clear report and a number of automobiles |

| Household Package deal | Legal responsibility, collision, complete, extra protection for relations | $2000-$3500 yearly | Households with a number of automobiles and drivers |

Notice: Premiums are estimates and might range based mostly on elements like location, car sort, and driving historical past.

Acquiring Quotes and Evaluating Insurance policies

The method for acquiring quotes and evaluating insurance policies is simple. Most municipal credit score unions have on-line quote instruments or devoted customer support representatives. By offering details about your car, driving historical past, and desired protection, you may rapidly obtain a number of quotes. Evaluating totally different coverage choices lets you choose the perfect protection at a aggressive worth.

Buyer Expertise and Advantages

Municipal credit score union automotive insurance coverage gives a singular worth proposition, constructed on belief and neighborhood. This method fosters a powerful buyer relationship, prioritizing member satisfaction over maximizing revenue. This usually interprets to a extra customized and responsive expertise.

Perceived Worth Proposition

Municipal credit score unions usually provide aggressive charges and bundled companies, typically together with roadside help or reductions on different credit score union merchandise. This built-in method offers a complete monetary bundle, making automotive insurance coverage only one piece of a broader relationship. The perceived worth extends past the worth level, encompassing a way of neighborhood and shared duty. Members really feel they’re a part of a supportive community that prioritizes their wants.

Buyer Service and Assist

Municipal credit score unions sometimes present customized service, usually with devoted employees to reply questions and deal with considerations. This customized method is a key differentiator. Robust customer support is usually fostered by a dedication to native communities, mirrored in a higher willingness to hear and reply promptly to member wants. This dedication extends to in-person interactions, telephone calls, and on-line channels, providing numerous contact factors for assist.

Claims Course of and Decision Timeframes

The claims course of at municipal credit score unions usually prioritizes swift decision. Diminished forms and streamlined procedures, usually in comparison with bigger business insurers, contribute to faster turnaround instances. Direct communication and clear updates are ceaselessly emphasised, retaining members knowledgeable all through the claims course of. Anecdotal proof suggests sooner declare settlements are a typical expertise for members.

Group-Centered Initiatives

Many municipal credit score unions incorporate community-focused initiatives into their automotive insurance coverage applications. As an illustration, partnerships with native security organizations might provide reductions to members who take part in driver security programs. These initiatives strengthen the neighborhood bond and promote accountable driving habits, usually offering substantial worth for members.

Buyer Service Channels

| Channel | Availability | Contact Data | Description |

|---|---|---|---|

| Telephone | Sometimes 24/7 | Devoted telephone line or on-line chat | Direct interplay with a consultant for instant help, superb for advanced points or pressing wants. |

| On-line Portal | 24/7 | Safe login to the credit score union web site | Members can entry account info, file claims, and observe progress on-line, providing flexibility and comfort. |

| In-Particular person | Enterprise hours | Credit score union department places | Personalised help and face-to-face interplay, helpful for advanced conditions or these requiring instant clarification. |

| Enterprise hours | Designated e mail deal with | A channel for submitting inquiries and receiving updates, usually helpful for non-urgent requests or follow-up questions. |

Market Evaluation and Developments

Municipal credit score unions are more and more providing automotive insurance coverage, recognizing a rising want for reasonably priced and reliable choices. This shift displays a broader pattern of customers in search of alternate options to conventional business insurers. Understanding the market dynamics and figuring out potential niches is essential for profitable growth on this sector.

Goal Marketplace for Municipal Credit score Union Automotive Insurance coverage

Municipal credit score unions usually serve a selected demographic with a powerful sense of neighborhood. Their goal market is prone to embrace people and households with a historical past of banking with the credit score union, these in search of decrease premiums, and drivers with an excellent driving report. Moreover, a good portion of this goal market might reside within the communities served by the credit score union.

This deal with native communities creates a powerful sense of belonging and loyalty.

Present Market Developments in Automotive Insurance coverage

The automotive insurance coverage market is experiencing substantial shifts. Rising claims prices and inflation are contributing to greater premiums. Technological developments, like telematics and usage-based insurance coverage, are altering how insurance policies are priced. Shoppers are additionally more and more in search of customized and clear insurance coverage choices, which might be supplied by credit score unions. These traits are driving a necessity for insurance coverage suppliers to adapt to evolving buyer expectations.

Pricing Methods of Municipal Credit score Unions vs. Business Suppliers

Municipal credit score unions usually make use of a distinct pricing technique than business insurers. Credit score unions prioritize affordability and neighborhood profit over maximizing revenue. This may translate to decrease premiums for comparable protection, particularly for drivers with favorable profiles. Nonetheless, the provision of particular reductions or options might range relying on the person credit score union. For instance, some credit score unions might provide decrease charges to members who preserve a powerful credit score historical past with the establishment.

Progress and Reputation of Municipal Credit score Union Companies

Municipal credit score unions are experiencing rising recognition in numerous companies. This development stems from a mix of things, together with the growing demand for reasonably priced monetary companies and a stronger sense of neighborhood amongst members. Members usually recognize the clear pricing fashions and the deal with moral enterprise practices which can be inherent in credit score union operations. These elements have fueled development and inspired loyalty.

Market Challenges and Alternatives for Municipal Credit score Union Automotive Insurance coverage

- Competitors from established gamers: The market is crowded with established business insurers, requiring credit score unions to distinguish their choices by aggressive pricing and distinctive customer support. This aggressive panorama necessitates a proactive technique to face out and seize market share. Methods like distinctive reductions, bundled companies, and enhanced digital platforms are key issues.

- Sustaining credibility and belief: Constructing belief and demonstrating monetary stability is important for a credit score union’s success. Speaking a powerful dedication to accountable monetary practices, coupled with clear pricing fashions, is essential for fostering buyer confidence and loyalty. For instance, showcasing a historical past of robust monetary efficiency is usually a useful asset in establishing credibility.

- Attracting a broader buyer base: Increasing the client base to incorporate non-members might require progressive advertising and marketing methods. Highlighting the worth proposition of the credit score union’s automotive insurance coverage choices, comparable to aggressive charges and distinctive customer support, is essential to attracting new prospects. Credit score unions might think about partnerships with native companies or neighborhood organizations to extend their visibility.

Coverage Construction and Procedures

Municipal Credit score Union automotive insurance coverage insurance policies are designed with transparency and member comfort in thoughts. Understanding the coverage phrases and procedures ensures a easy expertise, from buy to claims. This part particulars the construction of those insurance policies, protecting all the things from coverage phrases to claims processing.

Coverage Phrases and Situations

Coverage phrases and circumstances are clearly Artikeld within the coverage doc, accessible to members on-line and at department places. Understanding these phrases is essential for accountable coverage administration. These circumstances cowl numerous features, together with the insured car, coated perils, and exclusions.

- Coverage Interval: The coverage’s efficient dates outline the interval of protection. Policyholders ought to guarantee their coverage covers the dates they want. For instance, a coverage beginning on July 1st and ending on June thirtieth of the next 12 months will present protection for the complete calendar 12 months.

- Protection Limits: The coverage specifies the utmost quantity the credit score union pays for coated losses, essential for understanding monetary implications. As an illustration, the coverage might have a restrict of $100,000 for bodily harm legal responsibility.

- Exclusions: Sure occasions, comparable to pre-existing circumstances or use of the car for business functions, will not be coated. These exclusions are clearly said inside the coverage doc.

Claims Course of

The claims course of is designed for effectivity and member assist. Procedures for various kinds of incidents are detailed under.

- Accidents: Reporting an accident entails offering particulars concerning the incident, together with the placement, time, and concerned events. The credit score union will information members by the required steps to provoke a declare.

- Theft: Reporting theft requires documentation of the theft, comparable to a police report. The credit score union will work with the member to evaluate the protection and provoke the claims course of.

- Harm: Reporting harm, whether or not from an accident or different occasions, entails submitting documentation of the harm, together with photographs and estimates. The credit score union will work with the member to find out the extent of protection and the required restore.

Coverage Renewal and Modification

Coverage renewal and modification procedures are streamlined to make sure a seamless transition. The coverage renewal course of entails reviewing protection wants and updating info as essential.

- Renewal: The credit score union will notify members of their coverage renewal date. Policyholders can renew their insurance policies on-line, by telephone, or in particular person at a department.

- Modification: Adjustments to protection, comparable to including a driver or adjusting protection limits, might be made by the credit score union’s on-line portal, telephone, or department go to. Members ought to assessment the coverage modifications earlier than finalizing them.

Group Engagement and Affect

Municipal credit score unions, deeply rooted of their communities, perceive the significance of supporting native residents. Their automotive insurance coverage initiatives are designed not simply to supply reasonably priced protection but additionally to foster financial development and well-being inside the space. By partnering with native organizations and investing in neighborhood tasks, these credit score unions exhibit a dedication to extra than simply monetary companies.This dedication interprets into tangible advantages for the neighborhood.

From sponsoring native youth applications to contributing to infrastructure enhancements, these initiatives create a ripple impact of optimistic change. The neighborhood advantages from elevated security, entry to assets, and a stronger sense of collective duty.

Group Partnerships Supporting Automotive Insurance coverage

Municipal credit score unions usually collaborate with native organizations to boost their automotive insurance coverage choices. These partnerships are mutually helpful, creating alternatives for shared assets and expanded attain. As an illustration, partnerships with native colleges and security organizations can present academic supplies on secure driving practices to college students, selling safer roads and decrease accident charges.

Social Affect of Automotive Insurance coverage Involvement

The social impression of municipal credit score unions’ automotive insurance coverage extends past monetary assist. By making automotive insurance coverage extra accessible and reasonably priced, they empower people and households, enhancing their mobility and monetary stability. This, in flip, strengthens the native financial system and promotes a more healthy neighborhood setting. Improved entry to transportation can open doorways for employment alternatives, schooling, and participation in neighborhood occasions.

Charitable Donations and Group Investments

Municipal credit score unions ceaselessly make charitable donations and investments associated to their automotive insurance coverage actions. These contributions usually deal with enhancing street security, selling driver schooling, or supporting native organizations that present help to accident victims. For instance, a credit score union would possibly donate funds to an area chapter of the American Purple Cross to help with reduction efforts after a visitors accident.

Examples of Group Engagement Initiatives

These initiatives intention to boost neighborhood security and assist the well-being of residents.

| Initiative | Description | Goal Viewers | Profit |

|---|---|---|---|

| Driver Schooling Applications | Offering workshops and assets on secure driving practices to highschool college students and younger adults. | Highschool college students, younger adults | Diminished accident charges, improved street security. |

| Highway Security Enhancements | Partnering with native municipalities to fund street security enhancements, comparable to crosswalks and visitors indicators. | All neighborhood members | Elevated security for pedestrians and drivers, lowered visitors accidents. |

| Accident Sufferer Help | Donating funds to native organizations that present help to accident victims. | Accident victims and their households | Monetary and emotional assist for these affected by accidents. |

| Group Scholarship Applications | Providing scholarships to college students pursuing careers in transportation and associated fields. | Highschool graduates, school college students | Supporting future generations of transportation professionals and selling neighborhood development. |

Wrap-Up

In conclusion, municipal credit score union automotive insurance coverage presents a compelling different for drivers in search of a extra localized and probably extra reasonably priced possibility. By understanding the nuances of those insurance policies, prospects could make knowledgeable selections that align with their monetary targets and neighborhood values. This localized method could be the contemporary breeze the automotive insurance coverage market wants. Will you be part of the motion?

Query & Reply Hub

What reductions can be found for municipal credit score union automotive insurance coverage members?

Reductions usually range by credit score union however would possibly embrace reductions for members who produce other accounts with the credit score union or for particular demographics like college students or seniors.

How does the claims course of differ between municipal credit score union and business insurance coverage?

Whereas the specifics range, municipal credit score unions usually prioritize pace and customized service in claims decision, probably resulting in faster declare approvals and payouts. Nonetheless, this is dependent upon particular person credit score union practices.

Are there any particular protection choices for particular automobiles or drivers?

Some credit score unions might provide tailor-made protection choices, probably together with specialty insurance coverage for traditional vehicles or automobiles used for business functions.

How does the pricing technique of municipal credit score unions examine to business suppliers?

Pricing can range extensively. Municipal credit score unions usually emphasize community-based charges, whereas business suppliers sometimes make the most of extra advanced actuarial fashions to calculate premiums.