Florida automobile lease insurance coverage necessities loom giant, demanding meticulous consideration from each lessee. Navigating the complexities of protection sorts, minimal quantities, and potential penalties can really feel daunting, however this information illuminates the trail. This enthralling narrative delves into the vital particulars of Florida automobile lease insurance coverage necessities, empowering readers with the information wanted to safe their monetary future.

From understanding the precise necessities for various lease sorts to the intricacies of legal responsibility, collision, and complete insurance coverage, this complete overview leaves no stone unturned. This information is your important companion for making knowledgeable selections, defending your property, and avoiding pricey pitfalls.

Overview of Florida Automotive Lease Insurance coverage Necessities

Florida automobile lease agreements sometimes stipulate particular insurance coverage necessities to guard the lessor’s pursuits and the lessee’s legal responsibility. Understanding these mandates is essential for each events to keep away from potential authorized points and monetary penalties. The precise necessities fluctuate relying on the phrases of the person lease settlement, however typically, complete protection is important.Florida legislation does not dictate exact insurance coverage quantities, however moderately emphasizes the necessity for satisfactory safety towards potential damages or losses.

This consists of complete protection to handle accidents or incidents past the motive force’s management, comparable to vandalism or theft. The extent of insurance coverage required is usually decided by the lease settlement’s particular phrases and situations.

Insurance coverage Protection Varieties Required

Lease agreements in Florida ceaselessly require a minimal degree of insurance coverage protection. This sometimes consists of legal responsibility insurance coverage, which covers the authorized obligations of the lessee if an accident happens. Past legal responsibility, complete and collision protection are ceaselessly mandated, overlaying injury to the leased automobile no matter fault.

Kinds of Insurance coverage Protection and Significance

| Insurance coverage Kind | Description | Significance in a Florida Automotive Lease |

|---|---|---|

| Legal responsibility Insurance coverage | Covers damages to different individuals or their property in an accident the place the lessee is at fault. | This protects the lessee from potential monetary liabilities stemming from accidents the place they’re accountable. |

| Collision Insurance coverage | Covers injury to the leased automobile in an accident, no matter fault. | Essential for guaranteeing the automobile’s restore or substitute in case of an accident, even when the lessee is just not at fault. Protects the lessor’s funding. |

| Complete Insurance coverage | Covers injury to the leased automobile from incidents aside from collisions, comparable to vandalism, theft, fireplace, or hail. | Gives safety towards unexpected occasions that might injury the automobile, additional safeguarding the lessor’s curiosity within the automobile. |

| Uninsured/Underinsured Motorist Protection | Covers damages sustained by the lessee or their passengers if the at-fault driver doesn’t have satisfactory insurance coverage. | Presents safety in circumstances the place the accountable social gathering in an accident lacks adequate insurance coverage to cowl the damages incurred. |

Penalties of Failing to Preserve Required Protection

Failure to take care of the required insurance coverage protection Artikeld within the lease settlement can lead to important penalties. These can embody lease termination, monetary penalties, and even authorized motion. Lenders and leasing firms typically have clauses of their agreements that specify these repercussions. For instance, if a lessee fails to take care of required insurance coverage, the lease settlement would possibly enable the lessor to pursue authorized motion to get better any losses incurred as a result of lack of protection.

Particular Insurance coverage Necessities for Florida Automotive Leases

Florida automobile leasing laws mandate particular insurance coverage protection to guard each the lessee and the lessor. Understanding these necessities is essential for easy lease transactions and avoiding potential monetary burdens. This part delves into the specifics of legal responsibility, uninsured/underinsured motorist, complete, and collision insurance coverage as they pertain to Florida automobile leases.Florida legislation dictates minimal legal responsibility insurance coverage protection for all autos, together with these underneath lease.

Failure to take care of these minimums can result in authorized motion and monetary penalties. Leasing firms sometimes require increased protection limits than the minimums to make sure adequate safety.

Minimal Legal responsibility Insurance coverage Protection

Florida legislation requires a minimal of $10,000 in bodily damage legal responsibility protection per particular person and $20,000 per accident. For property injury legal responsibility, the minimal is $10,000. Lessees ought to perceive that these are minimums, and plenty of lease agreements will specify increased protection limits.

Uninsured/Underinsured Motorist Protection

Uninsured/underinsured motorist (UM/UIM) protection is important for shielding the lessee within the occasion of an accident with an at-fault driver who lacks adequate insurance coverage. Florida legislation requires this protection for leased autos. This protection steps in to pay for damages when the at-fault driver’s insurance coverage is inadequate to cowl the total extent of the losses.

Complete and Collision Insurance coverage

Complete insurance coverage covers injury to a leased automobile from perils not involving a collision, comparable to theft, vandalism, fireplace, hail, or weather-related occasions. Collision insurance coverage, however, covers injury brought on by a collision with one other automobile or object. Each are essential for shielding the automobile’s worth. The variations are vital to understanding the precise safety provided by every sort of protection.

Complete insurance coverage safeguards towards occasions like a tree falling on the automobile, whereas collision insurance coverage protects towards the injury from a automobile accident.

Examples of Insurance policies Assembly Florida Necessities

Quite a few insurance coverage suppliers supply insurance policies that fulfill Florida’s minimal necessities for leased autos. Examples embody insurance policies with increased legal responsibility limits, complete protection for varied perils, and collision protection for varied accident situations. Particular protection quantities and premiums can fluctuate considerably primarily based on the automobile, driver historical past, and coverage options.

Comparability of Insurance coverage Varieties

| Insurance coverage Kind | Description | Relevance in a Florida Automotive Lease |

|---|---|---|

| Legal responsibility | Covers bodily damage and property injury to others in an accident the place the lessee is at fault. | Required by Florida legislation, however typically inadequate for full safety. Leases normally require increased limits. |

| Collision | Covers injury to the leased automobile ensuing from a collision with one other automobile or object, no matter who’s at fault. | Essential for shielding the automobile’s worth if the lessee is concerned in a collision. |

| Complete | Covers injury to the leased automobile from non-collision occasions like theft, vandalism, fireplace, hail, or climate injury. | Important for shielding the automobile towards injury from occasions past a collision, which isn’t coated by collision insurance coverage. |

Insurance coverage Necessities for Completely different Lease Varieties

Florida’s automobile lease insurance coverage necessities aren’t a one-size-fits-all state of affairs. Completely different lease phrases, automobile sorts, and even the dealership’s location can affect the precise insurance coverage insurance policies wanted. Understanding these variations is essential for potential lessees to make sure they’re adequately protected.Lease agreements typically specify the required minimal insurance coverage protection, and it is crucial to overview the high-quality print to grasp the stipulations.

Failure to fulfill these necessities can lead to lease violations and even termination of the settlement.

Variations in Insurance coverage Necessities for Completely different Lease Durations

Lease phrases, from short-term leases to long-term contracts, impression insurance coverage requirements. Brief-term leases, typically for just a few months, would possibly necessitate a decrease protection degree than a long-term lease, which might final for a number of years. This distinction arises from the chance evaluation; a shorter lease interval normally includes a decrease potential for main damages or important monetary losses.

Insurance coverage Protection for Leased Automobiles with Add-ons or Particular Options

Automobiles outfitted with superior options or custom-made elements would possibly necessitate extra insurance coverage protection. As an illustration, specialised efficiency modifications or high-value aftermarket components demand insurance coverage that adequately addresses potential injury or theft. Leasing a luxurious automobile or one with superior expertise would possibly require particular protection to guard these options. Examples embody collision protection, complete protection, and potential extra endorsements.

Insurance coverage Necessities for Lease Agreements with Various Lease Phrases

Lease agreements typically specify minimal protection necessities. These stipulations fluctuate relying on the lease time period. As an illustration, a short-term lease might require a decrease degree of protection than a long-term settlement, which generally requires the next degree of protection. An intensive overview of the lease settlement is important to know the precise protection required.

Distinctive Insurance coverage Necessities for Leasing Automobiles from Out-of-State Dealerships

Florida legislation dictates insurance coverage necessities for autos leased from Florida dealerships. Nevertheless, leasing from out-of-state dealerships would possibly contain particular stipulations. It is essential to confirm the out-of-state dealership’s compliance with Florida’s insurance coverage laws, and perceive if their insurance policies would possibly differ from Florida-based dealerships. For instance, the lessee would possibly have to reveal compliance with Florida’s particular insurance coverage necessities. This would possibly contain acquiring a Florida-based insurance coverage coverage or offering documentation that demonstrates protection equal to Florida’s requirements.

Comparability of Insurance coverage Necessities for Completely different Lease Varieties

| Lease Kind | Typical Protection Necessities | Potential Further Concerns |

|---|---|---|

| Brief-Time period Lease (e.g., 3-6 months) | Decrease protection limits for legal responsibility, collision, and complete insurance coverage could also be adequate. | Potential for increased insurance coverage premiums if the automobile has high-value elements or particular options. |

| Lengthy-Time period Lease (e.g., 3-5 years) | Increased protection limits for legal responsibility, collision, and complete insurance coverage are sometimes required. | Potential for insurance coverage premiums to extend relying on the automobile’s age and worth on the finish of the lease time period. |

| Lease with Particular Options | Further protection for specialised components or high-value elements could also be obligatory. | Seek the advice of with an insurance coverage agent to evaluate the suitable protection wanted for particular options. |

| Out-of-State Lease | Guarantee compliance with Florida’s insurance coverage laws, doubtlessly requiring a Florida-based insurance coverage coverage or equal documentation. | Verification of compliance with Florida’s insurance coverage necessities is essential. |

Understanding Insurance coverage Supplier Choices and Prices: Florida Automotive Lease Insurance coverage Necessities

Securing the fitting auto insurance coverage on your leased automobile in Florida is essential for monetary safety. Understanding the accessible suppliers and understanding the components influencing prices empowers you to make knowledgeable selections. This part particulars the method of acquiring protection, presents potential suppliers, and explains the best way to examine their charges.Navigating the insurance coverage panorama for leased autos may be advanced.

Completely different suppliers supply various insurance policies and premiums. An intensive understanding of those choices and the components impacting value is important to securing probably the most appropriate protection at a aggressive value.

Acquiring Insurance coverage Protection for a Leased Automobile

The method of securing insurance coverage for a leased automobile in Florida typically includes these steps:

- Contacting the leasing firm: The leasing firm would possibly supply insurance coverage or have suggestions for suppliers. They could be a place to begin for exploring choices.

- Acquiring quotes from a number of suppliers: This significant step includes looking for quotes from a number of insurance coverage firms. Evaluating quotes is important for locating one of the best deal.

- Reviewing coverage particulars: Fastidiously study the coverage particulars, together with protection limits, exclusions, and deductibles. Understanding these points is vital for making the fitting alternative.

- Choosing a coverage: After thorough consideration, choose the coverage that greatest meets your wants and price range.

- Submitting required paperwork: Some suppliers would possibly require documentation from the leasing firm or the automobile proprietor to course of the coverage.

Potential Insurance coverage Suppliers in Florida

A number of insurance coverage firms function in Florida, providing protection choices for leased autos. Examples embody Geico, State Farm, Progressive, and Nationwide. These firms have various reputations and monetary strengths, which may impression the standard and reliability of their companies.

- Comparability Methodology: Evaluating insurance coverage charges includes contemplating components like protection ranges, deductibles, and coverage phrases. On-line comparability instruments and direct quotes from suppliers are useful on this course of. Elements comparable to driving historical past and automobile sort may also have an effect on the value.

- On-line Comparability Instruments: A number of on-line platforms enable customers to check quotes from a number of suppliers. These instruments simplify the method and supply an summary of the accessible choices. These platforms typically incorporate varied filters to assist slim down choices primarily based on wants and preferences.

Elements Influencing Automotive Lease Insurance coverage Prices in Florida

Varied components can impression the price of automobile lease insurance coverage in Florida.

- Driver profile: Age, driving historical past, and placement of residence considerably affect charges. A youthful driver or one with a historical past of accidents will doubtless face increased premiums.

- Automobile sort: The make, mannequin, and worth of the automobile can have an effect on insurance coverage prices. Excessive-performance or luxurious autos might include increased insurance coverage premiums.

- Protection choices: The extent of protection chosen, together with legal responsibility, collision, and complete, impacts the price. Increased protection ranges typically result in increased premiums.

- Deductibles: Increased deductibles sometimes lead to decrease premiums. Nevertheless, this additionally means you may have to pay a bigger quantity out of pocket within the occasion of an accident.

- Reductions: Insurance coverage suppliers typically supply reductions for varied components, together with secure driving, anti-theft gadgets, and a number of insurance policies.

Evaluating Insurance coverage Supplier Choices

Evaluating quotes from completely different suppliers is important for locating one of the best worth.

| Insurance coverage Supplier | Strengths | Weaknesses | Typical Prices (Instance) |

|---|---|---|---|

| Geico | Usually aggressive charges, big selection of protection choices. | Customer support experiences fluctuate. | $150-$250/month |

| State Farm | Established fame, intensive community of brokers, typically good customer support. | Doubtlessly increased premiums in comparison with some rivals. | $180-$300/month |

| Progressive | Progressive applied sciences and digital platforms for quoting and claims. | Might have restricted protection choices in particular areas. | $160-$280/month |

| Nationwide | Presents all kinds of reductions and buyer assist. | Buyer critiques on particular service areas may be blended. | $170-$290/month |

Observe: Prices are examples and may fluctuate considerably primarily based on particular person circumstances.

Authorized Implications and Rights for Lessees

Florida legislation mandates particular insurance coverage necessities for leased autos. Lessees have sure rights and obligations relating to these necessities, and failure to stick to them can result in important penalties. Understanding these implications is essential for sustaining a easy lease settlement.Lessees in Florida have the fitting to learn in regards to the particular insurance coverage necessities relevant to their lease settlement.

This consists of the minimal protection limits and varieties of insurance coverage required. Crucially, lessees are entitled to dispute insurance coverage claims associated to their leased automobile, in the event that they consider the declare is just not appropriately dealt with.

Lessee Rights Concerning Insurance coverage

Florida legislation protects lessees by outlining their rights regarding insurance coverage necessities for leased autos. These rights guarantee a good and clear course of. Lessees are entitled to clear communication from the leasing firm about insurance coverage obligations. The leasing firm should present documentation outlining the precise insurance coverage necessities.

Potential Penalties for Non-Compliance

Failure to take care of the required insurance coverage protection can lead to penalties, which may embody however aren’t restricted to:

- Lease termination:

- Monetary penalties from the leasing firm, which might be added to the lease settlement.

- Authorized motion by the leasing firm, doubtlessly resulting in courtroom involvement.

Understanding these potential penalties is important for accountable lease administration.

Sources for Lessees

Lessees going through questions or issues relating to insurance coverage necessities for his or her leased autos have a number of assets accessible:

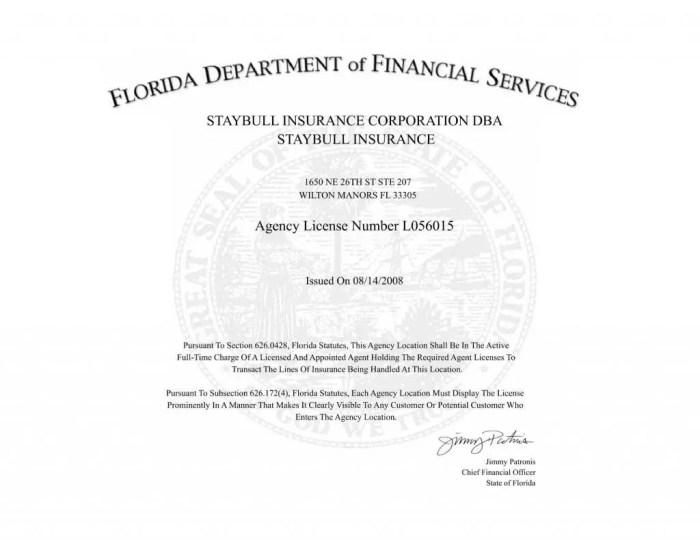

- The Florida Division of Freeway Security and Motor Automobiles (FLHSMV) web site offers info on insurance coverage necessities for varied conditions, together with automobile leasing.

- Native authorized assist organizations can supply help and steering relating to particular authorized points associated to automobile leasing.

- The Florida Bar’s web site can assist find attorneys specializing in leasing and contract legislation.

Using these assets can assist lessees resolve any uncertainties they could encounter.

Disputing an Insurance coverage Declare

Lessees have the fitting to dispute an insurance coverage declare associated to a leased automobile. This course of normally includes the next steps:

- Evaluate the insurance coverage coverage: Fastidiously study the coverage’s phrases and situations, significantly the sections associated to protection and claims.

- Collect supporting documentation: Gather all related paperwork, together with the lease settlement, insurance coverage coverage, and any proof supporting the declare, comparable to accident studies, witness statements, and restore estimates.

- Contact the insurance coverage firm: Provoke communication with the insurance coverage firm to formally dispute the declare, outlining the explanations for the dispute and presenting supporting documentation.

- Negotiate a decision: If the insurance coverage firm is unresponsive or fails to resolve the dispute, discover negotiation methods to succeed in a mutually acceptable answer.

- Search authorized counsel (if obligatory): If negotiations are unsuccessful, think about consulting with an legal professional to pursue additional authorized motion, which can be required to resolve the dispute.

A well-documented and assertive strategy can considerably enhance the possibilities of a positive end result.

Step-by-Step Information to Resolving Disputes

This information offers a structured strategy for resolving disputes relating to insurance coverage protection for a leased automobile in Florida:

- Determine the precise subject: Clearly outline the disagreement in regards to the insurance coverage declare. What points of the declare are disputed?

- Collect proof: Compile all related documentation, together with the lease settlement, insurance coverage coverage, and any proof supporting the declare. Images of injury, for example, are important.

- Formalize the dispute: Draft a proper letter outlining the precise factors of competition and the requested decision. Ship this letter to the insurance coverage firm.

- Talk with the insurance coverage firm: Preserve skilled and constant communication with the insurance coverage firm all through the dispute decision course of. Hold data of all communications.

- Search authorized counsel (if wanted): If the dispute can’t be resolved via direct communication, seek the advice of with an legal professional specializing in leasing and contract legislation to know authorized choices.

Following these steps can streamline the method and doubtlessly result in a passable decision.

Illustrative Examples and Situations

Florida automobile lease insurance coverage necessities may be advanced, however understanding real-world examples simplifies the method. This part offers sensible situations as an example how completely different insurance coverage coverages apply to leased autos and the procedures for dealing with claims. Making use of these examples to particular conditions will assist lessees navigate the complexities of Florida automobile lease insurance coverage.These examples showcase the appliance of Florida automobile lease insurance coverage necessities in numerous conditions, demonstrating how completely different coverages apply and highlighting the procedures for dealing with insurance coverage claims.

Understanding these situations empowers lessees to know their rights and obligations regarding their leased autos.

Lease Violation Situations

Florida lease agreements typically embody particular provisions relating to insurance coverage. Violating these provisions can result in penalties and monetary repercussions.

“A lessee fails to take care of satisfactory insurance coverage protection as stipulated within the lease settlement. This ends in a breach of contract, doubtlessly resulting in lease termination and monetary penalties.”

“A lessee’s insurance coverage coverage lapses in the course of the lease time period. The lessor, missing satisfactory protection, might should pay for repairs or damages, doubtlessly resulting in a requirement for reimbursement from the lessee.”

“A lessee experiences an accident whereas driving the leased automobile, and the insurance coverage protection is inadequate to cowl the damages. The lessee would possibly face duty for exceeding the coverage limits.”

Insurance coverage Protection Software

Understanding how completely different insurance coverage coverages apply to leased autos is essential. Complete insurance coverage, for instance, sometimes covers damages from varied perils.

- Collision Protection: This protection applies when the leased automobile is broken in a collision with one other automobile or object, no matter fault. The lessee is usually accountable for the deductible quantity.

- Complete Protection: This protection addresses damages ensuing from perils aside from collisions, comparable to vandalism, fireplace, or theft. It sometimes covers the total restore or substitute value, minus any relevant deductible.

- Uninsured/Underinsured Motorist Protection: This protection is important if one other driver concerned in an accident is uninsured or underinsured. It protects the lessee towards monetary losses from the negligent actions of an at-fault driver with out adequate protection.

Dealing with Insurance coverage Claims

Following correct procedures throughout an insurance coverage declare is vital.

- Reporting the Accident: Instantly report the accident to the police and your insurance coverage firm, documenting all particulars precisely. This step ensures a easy declare course of.

- Gathering Documentation: Gather all related documentation, together with police studies, restore estimates, and medical payments, as they could be required in the course of the declare course of.

- Speaking with the Insurance coverage Firm: Preserve clear communication with the insurance coverage supplier all through the declare course of. Offering correct info and responding promptly to inquiries will facilitate a sooner decision.

Illustrative Situations

Let’s take a look at just a few examples.

“A lessee with complete protection leases a automobile. The automobile is vandalized, and the injury falls underneath the excellent protection. The insurance coverage firm will cowl the repairs, minus the deductible quantity.”

“A lessee is concerned in an accident with an uninsured driver. The lessee’s uninsured/underinsured motorist protection kicks in, offering monetary safety towards the losses incurred from the accident.”

“A lessee fails to take care of the required insurance coverage protection, leading to a lease violation. The lessor, who has a coverage in place, incurs prices to restore the injury. The lessee might face authorized motion and penalties for breach of contract.”

Sustaining Insurance coverage Protection In the course of the Lease Time period

Sustaining the required auto insurance coverage all through your Florida automobile lease is essential for avoiding penalties and sustaining your good standing with the leasing firm. Failure to take care of protection can result in important monetary repercussions, together with potential lease termination, and even authorized motion. This part particulars the significance of constant insurance coverage, procedures for updates, and suggestions for avoiding pitfalls.Florida legislation mandates particular insurance coverage protection for leased autos.

This ensures the safety of the lender (leasing firm) and different drivers on the highway within the occasion of an accident. Adhering to those necessities is paramount to a easy and compliant lease settlement.

Significance of Constant Protection

Sustaining the required insurance coverage protection all through the lease time period is important to guard each the lessee and the leasing firm. This complete protection safeguards the leased automobile, the lessee’s monetary duty, and the rights of all events concerned in a possible accident. Failure to take care of protection can lead to penalties and lease termination.

Procedures for Updating Insurance coverage Info

Promptly updating insurance coverage info with the leasing firm is important to keep away from any lapse in protection. The leasing firm sometimes offers a delegated methodology for notifying them of modifications. This would possibly contain a particular on-line portal, a delegated type, or a cellphone name. Thorough documentation is important to take care of an correct file. The leasing firm typically requires proof of insurance coverage, comparable to a replica of the insurance coverage coverage or a affirmation from the insurer.

Ideas for Sustaining Insurance coverage Protection and Avoiding Penalties, Florida automobile lease insurance coverage necessities

- Recurrently overview your insurance coverage coverage to make sure it aligns with the lease settlement’s necessities.

- Set up a system for monitoring insurance coverage coverage renewal dates to keep away from lapses in protection.

- Hold copies of all insurance coverage paperwork, together with the coverage declarations web page, and any correspondence with the insurance coverage firm or the leasing firm.

- Contact the leasing firm promptly if any modifications happen in your insurance coverage protection, comparable to a coverage change, a cancellation, or an replace to your protection.

Strategy of Notifying the Leasing Firm About Adjustments

To keep away from penalties, instantly notify the leasing firm of any modifications in your insurance coverage protection. This ought to be finished through the established communication channels, whether or not it’s a web based portal, a delegated type, or a cellphone name. At all times retain copies of all correspondence, together with the notification of the change and any acknowledgment from the leasing firm. This serves as proof of compliance and mitigates potential disputes.

Flowchart for Sustaining Insurance coverage Protection

| Step | Motion |

|---|---|

| 1 | Confirm present insurance coverage coverage particulars and lease settlement necessities. |

| 2 | Guarantee protection meets the desired minimal necessities of the lease settlement. |

| 3 | Determine the method for notifying the leasing firm of any modifications (on-line portal, type, cellphone name). |

| 4 | Replace insurance coverage coverage info with the insurer. |

| 5 | Instantly notify the leasing firm of the up to date coverage info. |

| 6 | Retain copies of all related paperwork (insurance coverage coverage, notification letter, acknowledgment). |

| 7 | Periodically overview protection to make sure continued compliance with the lease settlement. |

Final Phrase

In conclusion, comprehending Florida automobile lease insurance coverage necessities is paramount for a easy and worry-free leasing expertise. This information has meticulously explored the various points of insurance coverage protection, from the authorized mandates to the sensible issues of value and supplier choices. Armed with this information, lessees can confidently navigate the complexities of insurance coverage necessities, guaranteeing they meet all obligations and safeguard their monetary well-being all through their lease time period.

This complete evaluation offers a framework for knowledgeable decision-making, guaranteeing a safe and affluent leasing journey.

FAQ Overview

What are the minimal legal responsibility insurance coverage protection quantities mandated by Florida legislation for leased autos?

Florida legislation mandates a minimal of $10,000 for bodily damage per particular person and $20,000 for bodily damage per accident, plus $10,000 for property injury.

What’s the distinction between complete and collision insurance coverage?

Collision insurance coverage covers injury to your automobile brought on by a collision with one other automobile or object. Complete insurance coverage, nonetheless, covers a broader vary of incidents, together with injury from fireplace, theft, vandalism, hail, and extra.

How do I examine insurance coverage charges for my leased automobile?

Evaluating charges includes gathering quotes from varied suppliers. Elements comparable to your driving file, automobile sort, and placement affect charges. Use on-line comparability instruments and straight contact a number of suppliers to get correct quotes.

What are my rights as a lessee relating to insurance coverage necessities in Florida?

Lessees have the fitting to know the precise insurance coverage necessities Artikeld of their lease settlement. They need to be told of the implications of failing to take care of satisfactory protection. Lessees ought to pay attention to accessible assets to handle any questions or issues.