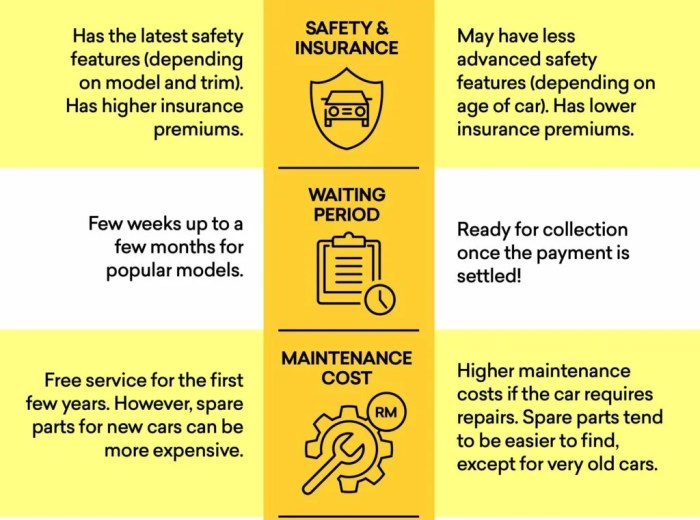

Used automotive insurance coverage vs new automotive insurance coverage – Used automotive insurance coverage vs. new automotive insurance coverage presents a vital consideration for car house owners. Understanding the nuances of protection, premiums, and components influencing every kind of coverage is crucial for making knowledgeable choices. This evaluation explores the distinct traits of insuring used and new autos, offering a complete comparability to assist within the choice course of.

The price of insurance coverage is usually influenced by components such because the car’s make, mannequin, yr, and security options. Mileage, situation, and the motive force’s historical past additionally play a big position in used automotive insurance coverage premiums. Conversely, new automotive insurance coverage premiums typically replicate the car’s worth, superior security methods, and potential depreciation. This evaluation dives into these key components, illustrating the variations and similarities in protection choices accessible for each varieties of autos.

Insurance coverage Premiums for Used Vehicles vs. New Vehicles

Unlocking the secrets and techniques of insurance coverage prices is vital to clever monetary choices. Understanding the components that affect premiums for used and new autos empowers you to make knowledgeable selections. This evaluation will delve into the intricacies of insurance coverage prices, offering readability on how various factors contribute to the worth you pay.Comprehending the distinction in insurance coverage premiums between used and new vehicles is essential for accountable budgeting.

This includes understanding the interaction of car age, situation, security options, and market worth. A deep dive into these facets lets you make a well-informed alternative concerning your automotive insurance coverage wants.

Common Insurance coverage Premiums Comparability

Insurance coverage premiums for used vehicles are typically decrease than these for brand new vehicles. This distinction stems from numerous components influencing the danger evaluation. Used vehicles, on account of their age and depreciation, usually pose a decrease threat of great monetary loss within the occasion of an accident or theft. The market worth of a used car is considerably lower than that of a brand new one, which is an important think about insurance coverage calculation.

Insurers assess the potential for loss based mostly on the car’s value, resulting in decrease premiums for used autos.

Components Influencing Insurance coverage Prices

A number of key components decide the insurance coverage premium for each new and used vehicles. Automobile age, situation, and market worth immediately have an effect on the premium. Moreover, the motive force’s historical past and placement additionally play a vital position in the fee calculation. A driver with a historical past of accidents or violations could face greater premiums whatever the car kind.

Automobile Make, Mannequin, and Yr Influence

The make, mannequin, and yr of a car considerably affect insurance coverage prices. Sure fashions are inherently extra liable to accidents or theft than others, resulting in greater insurance coverage premiums. Luxurious autos and sports activities vehicles, for instance, often have greater insurance coverage premiums on account of their greater worth and potential for loss. The yr of manufacture additionally performs a job, with older fashions typically having fewer security options, probably leading to greater insurance coverage prices.

Security Options Influence

Automobiles outfitted with superior security options, similar to airbags, anti-lock brakes, and digital stability management, usually have decrease insurance coverage premiums. These options demonstrably cut back the danger of accidents and accidents, an element insurers think about when calculating premiums. New autos typically come customary with extra complete security options, resulting in a decrease insurance coverage price in comparison with their used counterparts.

Insurance coverage Prices for Totally different Used Automotive Sorts

Insurance coverage premiums for used vehicles differ based mostly on the car kind. Luxurious used vehicles, on account of their greater worth and sometimes greater restore prices, often have greater insurance coverage premiums than compact or financial system fashions. Sports activities vehicles, identified for his or her efficiency and better accident potential, typically have elevated premiums. A radical understanding of those variations is crucial for knowledgeable budgeting.

Desk Evaluating Common Insurance coverage Premiums

| Automobile Kind | New Automotive | Used Automotive |

|---|---|---|

| Sedan | $1,500-$2,500 yearly | $1,000-$2,000 yearly |

| SUV | $1,800-$3,000 yearly | $1,200-$2,500 yearly |

| Luxurious Automotive | $2,500-$4,000 yearly | $1,800-$3,500 yearly |

| Sports activities Automotive | $2,000-$4,500 yearly | $1,500-$4,000 yearly |

Notice: These are estimated figures and precise premiums could differ based mostly on particular person circumstances, location, and insurance coverage supplier.

Components Affecting Used Automotive Insurance coverage

Understanding the components influencing used automotive insurance coverage premiums is essential for accountable automotive possession. Figuring out these components empowers you to make knowledgeable choices about your car’s safety and budgeting. A well-informed driver can proactively handle their insurance coverage prices, guaranteeing enough protection with out pointless expense.Used automotive insurance coverage premiums aren’t static; they’re dynamic and rely upon a number of key variables.

These components, starting from the car’s historical past to the motive force’s report, all play an important position in shaping the ultimate price of your insurance coverage. A deeper dive into these elements is vital to maximizing your safety and minimizing your bills.

Automobile Mileage

Mileage considerably impacts insurance coverage premiums. Increased mileage typically correlates with elevated put on and tear, probably resulting in extra frequent repairs and upkeep. This elevated threat interprets into greater insurance coverage premiums. Low mileage autos, conversely, current a decrease threat of expensive repairs, resulting in decrease premiums. The historic relationship between mileage and restore prices is well-documented and a serious consideration for insurance coverage suppliers.

Automobile Situation

The general situation of a used automotive is a vital determinant of its insurance coverage price. Vehicles with intensive injury, vital mechanical points, or obvious neglect necessitate greater premiums. Conversely, well-maintained vehicles with minor beauty points or no seen injury are sometimes assigned decrease insurance coverage premiums. Insurance coverage firms assess the situation based mostly on components like physique injury, inside put on, and the presence of any vital mechanical issues.

Driver Historical past

A driver’s previous report considerably impacts used automotive insurance coverage premiums. Drivers with a historical past of accidents or claims will usually face greater premiums in comparison with drivers with clear information. Insurance coverage firms think about the severity and frequency of previous incidents when calculating premiums, reflecting the danger related to a selected driver. This can be a vital side to contemplate for accountable driving habits.

Upkeep and Service Historical past

A complete upkeep and repair historical past is usually a worthwhile asset when securing used automotive insurance coverage. Automobiles with common servicing and documented repairs are perceived as decrease threat, resulting in decrease insurance coverage premiums. Insurance coverage firms desire vehicles which have undergone routine upkeep, which displays proactive preventative measures in opposition to potential points. This demonstrates the motive force’s dedication to sustaining the car’s reliability and security.

Influence of Components on Used Automotive Insurance coverage Prices

| Issue | Description | Influence on Value |

|---|---|---|

| Mileage | The variety of miles a car has traveled. | Increased mileage usually leads to greater premiums on account of elevated put on and tear and potential restore wants. |

| Situation | The general bodily state of the car, together with physique injury, mechanical points, and inside put on. | Automobiles in poor situation typically incur greater premiums, as they current the next threat of expensive repairs. |

| Driver Historical past | The driving force’s previous report of accidents, claims, and violations. | Drivers with a historical past of accidents or claims face greater premiums, reflecting the next threat to the insurance coverage firm. |

| Upkeep and Service Historical past | Documentation of normal upkeep and repairs carried out on the car. | Automobiles with a well-documented upkeep historical past usually have decrease premiums, as they show decrease threat and higher reliability. |

Components Affecting New Automotive Insurance coverage: Used Automotive Insurance coverage Vs New Automotive Insurance coverage

New automotive insurance coverage premiums are influenced by a large number of things, typically past the straightforward buy worth. Understanding these components empowers you to make knowledgeable choices about protection and probably cut back your prices. This information is essential for guaranteeing enough safety whereas minimizing pointless bills.

Components Influencing New Automotive Insurance coverage Premiums

New automotive insurance coverage premiums will not be static. They’re dynamic and attentive to a number of key components, starting from the car’s inherent security options to its total market worth. This dynamic pricing mechanism ensures insurers can precisely assess threat and modify premiums accordingly.

Influence of Security Options on Insurance coverage Charges

Superior security options in new vehicles are immediately correlated with decrease insurance coverage premiums. Fashionable autos often embrace options like airbags, anti-lock brakes (ABS), digital stability management (ESC), and lane departure warning methods. These security applied sciences cut back the probability of accidents and the severity of accidents within the occasion of a collision. Consequently, insurers view autos outfitted with these superior security methods as posing a decrease threat.

Insurance coverage firms often provide reductions to drivers who go for autos with these useful options.

Automobile Worth and Insurance coverage Premiums

The worth of a brand new automotive immediately impacts its insurance coverage premium. Increased-value autos are usually costlier to insure. It’s because the next worth implies a higher monetary loss within the occasion of theft or injury. Insurance coverage firms assess the potential for substantial monetary loss and modify the premiums accordingly. For instance, a high-end luxurious car with a considerably greater price ticket is usually related to the next insurance coverage premium in comparison with a equally outfitted, however inexpensive mannequin.

Out there Insurance coverage Coverages for New Vehicles, Used automotive insurance coverage vs new automotive insurance coverage

Quite a few insurance coverage coverages can be found for brand new vehicles. Complete protection protects in opposition to numerous dangers, similar to injury from accidents, theft, vandalism, or pure disasters. Collision protection supplies safety in case of accidents. Legal responsibility protection is remitted in most jurisdictions, safeguarding in opposition to hurt brought on to others in an accident. These coverages present various ranges of safety, permitting drivers to pick the choices that greatest go well with their wants and price range.

Comparability of Insurance coverage Prices for Comparable Fashions with Totally different Trim Ranges

Even inside the similar automotive mannequin, completely different trim ranges can result in variations in insurance coverage premiums. Increased trim ranges typically embrace extra luxurious options and superior security methods, which can affect insurance coverage prices. A top-of-the-line mannequin with superior security options and the next price ticket is more likely to have the next premium in comparison with a base mannequin. For example, a top-trim mannequin of a sports activities automotive, with its refined security methods and performance-oriented elements, will probably have the next insurance coverage premium than the equal mannequin with primary gear.

Influence of New Automotive Options on Insurance coverage Prices

| Function | Description | Influence on Value |

|---|---|---|

| Security Options (e.g., airbags, ABS, ESC) | Superior security methods, lowering accident threat and severity of accidents. | Decrease insurance coverage premiums on account of decreased threat. |

| Worth | The market worth of the car. | Increased worth autos usually have greater insurance coverage premiums on account of elevated potential monetary loss. |

| Horsepower/Efficiency | The car’s engine energy. | Increased horsepower autos, notably sports activities vehicles, may result in greater premiums on account of potential for elevated threat in accidents. |

| Luxurious Options | Added luxurious elements, like superior infotainment methods. | Potential influence on price depends on the particular function and its affect on total threat. |

Insurance coverage Protection Choices for Used Vehicles

Unlocking the proper insurance coverage protection to your used automotive is essential for monetary peace of thoughts. Understanding the completely different choices accessible, and the way they influence your premium, empowers you to make knowledgeable choices. This empowers you to decide on the perfect match to your wants and price range.Insurance coverage protection for used autos affords a spectrum of safety, from primary legal responsibility to complete protection.

Choosing the suitable protection ranges is significant to safeguard your monetary well-being in case of an accident or unexpected injury. This rigorously thought of choice displays your private threat tolerance and monetary objectives.

Legal responsibility Protection

Legal responsibility protection is the basic safety for used automotive house owners. It safeguards your monetary pursuits if you happen to’re liable for inflicting injury to a different particular person’s property or accidents to a different particular person. This protection is a authorized necessity in most jurisdictions, and it protects you from substantial monetary liabilities. It’s the minimal protection required by regulation in lots of areas.

Collision Protection

Collision protection protects your used automotive from injury brought on by an accident, no matter who’s at fault. This protection comes into play when your car is concerned in a collision. This safety is especially worthwhile once you’re uncertain in regards to the different driver’s accountability. Having collision protection minimizes monetary worries in case of a collision.

Complete Protection

Complete protection extends past collisions, safeguarding your used automotive in opposition to numerous perils, similar to vandalism, hearth, theft, or hail injury. It supplies an important layer of safety in opposition to occasions past a easy accident. This ensures your automotive is protected even once you’re not concerned in a collision.

Examples of Used Automotive Insurance coverage Insurance policies

A primary coverage for a used automotive may embrace solely legal responsibility protection, minimizing premium prices. A extra complete coverage may embrace legal responsibility, collision, and complete protection, offering broader safety however at the next premium.

Influence of Protection on Prices

The price of insurance coverage for used vehicles immediately correlates with the chosen protection choices. Legal responsibility-only insurance policies usually have the bottom premiums. Including collision and complete protection will increase the premium. Components just like the automotive’s age, mannequin, and worth affect the ultimate premium.

Insurance coverage Coverage Comparability Desk

| Protection Kind | Description | Value Instance |

|---|---|---|

| Legal responsibility | Covers damages to different folks’s property or accidents brought on by the motive force. | $100-$500 per thirty days |

| Collision | Covers injury to your car in an accident, no matter who’s at fault. | $150-$700 per thirty days |

| Complete | Covers injury to your car from occasions apart from collisions, similar to theft, vandalism, or pure disasters. | $50-$300 per thirty days |

| Uninsured/Underinsured Motorist | Covers damages if you happen to’re concerned in an accident with an uninsured or underinsured driver. | $25-$150 per thirty days |

Increased protection choices typically result in greater premiums. A calculated method to protection is crucial for managing your price range.

Insurance coverage Protection Choices for New Vehicles

Securing the proper insurance coverage protection to your prized new automotive is essential. Understanding the varied choices accessible empowers you to make knowledgeable choices, safeguarding your funding and peace of thoughts. A well-chosen coverage can provide substantial safety in opposition to unexpected occasions.Complete insurance coverage insurance policies for brand new vehicles typically present a broader vary of safety than these for used vehicles, reflecting the upper worth and newer know-how within the car.

The premium you pay shall be immediately correlated with the extent of protection you choose.

Sorts of Protection Out there for New Vehicles

Insurance coverage insurance policies for brand new vehicles usually embrace a number of key coverages. Understanding these choices is significant for selecting the perfect match to your wants and price range.

- Legal responsibility Protection: This elementary protection protects you in opposition to monetary accountability if you happen to trigger injury to a different particular person’s property or harm to a different particular person. It’s typically a compulsory requirement in most jurisdictions.

- Collision Protection: This protection pays for injury to your new automotive no matter who’s at fault in an accident. It supplies complete safety to your car.

- Complete Protection: This broad protection goes past accidents, defending your car from occasions similar to vandalism, theft, hearth, hail injury, or different non-collision incidents. That is typically a vital addition for sustaining the worth of your new automotive.

- Uninsured/Underinsured Motorist Protection: This safeguards you if you happen to’re concerned in an accident with a driver who would not have enough insurance coverage. It covers medical bills and car injury in such conditions.

- Hole Insurance coverage: A selected protection choice, hole insurance coverage covers the distinction between the precise money worth of your new automotive and the excellent mortgage quantity. That is notably related for brand new vehicles financed via a mortgage, offering extra monetary safety in case of a complete loss.

Influence of Protection Choices on Insurance coverage Value

The alternatives you make concerning protection choices immediately influence your insurance coverage premiums. The extra intensive the protection, the upper the fee shall be. Nonetheless, this improve in premium typically corresponds to a higher diploma of safety and monetary safety.

- Increased protection limits: Growing the bounds for legal responsibility protection, collision, and complete protection usually leads to greater premiums. The upper the quantity coated, the extra the insurer is defending your property within the occasion of a big declare.

- Including extras: Optionally available add-ons, similar to hole insurance coverage, additional affect the premium. The presence of those extra coverages will contribute to the next insurance coverage price.

Examples of Totally different Insurance coverage Insurance policies Tailor-made for New Vehicles

Insurance coverage insurance policies for brand new vehicles could be custom-made to suit particular person wants and budgets. A complete coverage may embrace legal responsibility, collision, complete, uninsured/underinsured motorist, and probably hole insurance coverage.

Comparability of Protection Choices for New and Used Vehicles

The desk under illustrates the potential variations in protection choices for brand new and used vehicles. Notice that specifics can differ considerably by insurer and particular person circumstances.

| Protection Kind | New Automotive | Used Automotive |

|---|---|---|

| Legal responsibility | Covers damages brought on to others | Covers damages brought on to others |

| Complete | Protects in opposition to theft, vandalism, hearth, and many others. | Protects in opposition to theft, vandalism, hearth, and many others. Potential limitations relying on car age and situation |

Suggestions for Saving Cash on Used Automotive Insurance coverage

Unlocking monetary freedom begins with sensible selections, and securing inexpensive used automotive insurance coverage is a key aspect. By understanding the methods for price discount, you possibly can successfully handle your bills and allocate funds in the direction of different priorities. This part Artikels actionable steps to barter higher charges, keep a constructive driving report, and leverage insurance coverage bundling for vital financial savings.Efficient methods for controlling used automotive insurance coverage prices contain proactive measures and knowledgeable decision-making.

Understanding the nuances of insurance coverage pricing and actively pursuing financial savings alternatives empowers you to optimize your insurance coverage price range and liberate sources for different monetary objectives.

Negotiating Higher Charges

Insurance coverage suppliers typically provide versatile pricing buildings, and proactive negotiation can result in vital financial savings. Researching aggressive quotes from a number of insurers is essential. Evaluating insurance policies based mostly on options, protection ranges, and deductibles may also help you determine alternatives for price discount. Presenting your favorable driving report, a key think about figuring out insurance coverage premiums, can typically affect your charges.

Sustaining a Good Driving Document

A pristine driving report serves as a strong instrument for securing decrease insurance coverage premiums. Avoiding visitors violations, similar to dashing tickets or accidents, immediately impacts your insurance coverage charges. By adhering to visitors legal guidelines and demonstrating accountable driving habits, you construct a historical past that qualifies you for favorable premiums. This proactive method can translate to substantial financial savings over time.

Bundling Insurance coverage with Different Providers

Bundling your used automotive insurance coverage with different providers, similar to dwelling or renters insurance coverage, typically leads to discounted charges. This strategic method leverages the worth of your total insurance coverage wants and affords a possible discount in your total insurance coverage expenditure. This synergistic method is a worthwhile instrument in maximizing your financial savings.

Examples of Reductions Out there

Quite a few reductions can be found to those that meet particular standards. Examples embrace reductions for secure driving, multi-vehicle insurance coverage, and anti-theft units. These incentives can result in appreciable financial savings, demonstrating the worth of accountable driving and proactive measures to safe your car. Insurance coverage firms typically promote these packages to draw and retain prospects, offering alternatives for substantial financial savings.

Significance of Sustaining a Good Driving Document

A spotless driving report is a worthwhile asset in securing aggressive insurance coverage charges. Insurance coverage firms usually provide discounted charges for drivers with no accidents or violations. Sustaining a constructive driving report not solely safeguards your monetary well-being but additionally promotes accountable highway habits.

Methods for Lowering the Value of Used Automotive Insurance coverage

Implementing methods for price discount is achievable via proactive measures. Procuring round for quotes from a number of insurers is an important step. Analyzing protection choices and deductibles may also help determine areas for potential financial savings. By understanding the components influencing insurance coverage premiums, you possibly can leverage methods to scale back your prices.

Suggestions for Saving Cash on New Automotive Insurance coverage

Unlocking vital financial savings on new automotive insurance coverage is achievable with strategic planning and proactive measures. This includes understanding the components influencing premiums and actively searching for alternatives to scale back your total prices. Adopting these sensible methods won’t solely prevent cash but additionally show accountable monetary administration.New automotive insurance coverage premiums are sometimes greater in comparison with used automotive insurance policies.

That is primarily because of the perceived greater threat related to newer autos, typically resulting in greater claims and restore prices. Nonetheless, quite a few avenues exist to mitigate these prices and safe extra favorable charges. The secret is to leverage accessible reductions and negotiate successfully with insurance coverage suppliers.

Methods for Lowering New Automotive Insurance coverage Prices

Proactive measures are important in securing decrease insurance coverage premiums for brand new autos. These methods are tailor-made to determine and remove pointless bills.

- Keep a flawless driving report: A clear driving report is paramount in attaining decrease insurance coverage premiums. Accidents and violations immediately influence your threat profile, thus influencing your premiums. By sustaining a secure driving report, you show accountable habits, resulting in decrease insurance coverage prices.

- Bundle insurance coverage insurance policies: Combining your auto insurance coverage with different insurance policies, similar to dwelling or life insurance coverage, can yield substantial reductions. Insurance coverage suppliers typically provide bundled reductions to incentivize prospects to consolidate their insurance coverage wants below a single supplier.

- Negotiate with insurance coverage suppliers: Do not hesitate to barter together with your insurance coverage supplier for higher charges. Researching rivals’ pricing and presenting your case for decrease premiums can typically result in favorable outcomes. Being proactive and knowledgeable is vital to attaining higher charges.

- Make the most of accessible reductions: Many insurance coverage firms provide reductions for particular traits, similar to anti-theft units, defensive driving programs, or good scholar standing. Profiting from these reductions can considerably cut back your premium prices.

Examples of Reductions for New Automotive Insurance coverage

Reductions are a key aspect in lowering insurance coverage premiums. Insurance coverage suppliers provide quite a few reductions to incentivize accountable habits and reward policyholders.

- Defensive driving programs: Finishing a defensive driving course demonstrates dedication to secure driving practices. This typically leads to substantial reductions in your insurance coverage premiums.

- Anti-theft units: Putting in anti-theft units in your car, similar to alarm methods or monitoring units, demonstrates your dedication to defending your funding. Insurance coverage firms typically present reductions for autos with enhanced safety features.

- Good scholar reductions: In case you are a scholar, insurance coverage firms could provide reductions for sustaining an excellent tutorial report. This acknowledges accountable habits and a dedication to non-public improvement.

Negotiating Higher Charges with Insurance coverage Suppliers

Negotiation is a strong instrument for acquiring higher charges. Understanding your choices and being ready to current a compelling case can yield substantial financial savings.

- Evaluate charges from a number of suppliers: Earlier than committing to a coverage, evaluate charges from numerous insurance coverage suppliers. This supplies a complete understanding of the market and permits you to decide on probably the most cost-effective choice.

- Spotlight any security options: Mentioning the security options of your new car, similar to superior airbags or digital stability management, can affect your insurance coverage fee. Insurance coverage firms typically acknowledge and reward autos with enhanced security options.

- Emphasize a clear driving report: A spotless driving report is a big think about acquiring favorable charges. Highlighting this side demonstrates accountable driving habits and reduces the perceived threat.

Final Recap

In conclusion, selecting between used automotive insurance coverage and new automotive insurance coverage necessitates a cautious analysis of particular person wants and circumstances. Whereas new vehicles typically command greater premiums on account of their worth and superior options, used vehicles could also be cheaper relying on the car’s situation and the motive force’s historical past. This comparability underscores the significance of understanding the particular components that have an effect on premiums for every kind of car and deciding on applicable protection choices to safeguard monetary pursuits.

Generally Requested Questions

What components affect the price of used automotive insurance coverage apart from the car’s situation and mileage?

The driving force’s historical past, together with claims and accidents, considerably impacts used automotive insurance coverage premiums. Moreover, the kind of protection chosen (legal responsibility, complete, collision) and the car’s upkeep and repair historical past additionally have an effect on the fee.

How do security options have an effect on new automotive insurance coverage premiums?

New vehicles outfitted with superior security methods, similar to airbags and anti-lock brakes, typically qualify for decreased insurance coverage premiums. The presence of those options demonstrates a decrease threat of accidents, influencing the insurance coverage supplier’s evaluation.

Are there reductions accessible for bundling insurance coverage with different providers for used vehicles?

Sure, many insurance coverage suppliers provide reductions for bundling used automotive insurance coverage with different providers, similar to dwelling or renters insurance coverage. This could result in substantial financial savings and ought to be explored as a possible cost-saving measure.

What’s the typical protection for brand new vehicles in comparison with used vehicles?

Whereas primary protection choices like legal responsibility and collision are customary for each new and used vehicles, new vehicles typically have entry to prolonged guarantee choices and complete protection tailor-made to newer fashions. This can be mirrored within the premium.