Lemonade automotive insurance coverage New Jersey provides a digital-first method to auto insurance coverage, difficult conventional suppliers with a streamlined course of and aggressive pricing. This new mannequin goals to make automotive insurance coverage extra accessible and user-friendly for New Jersey drivers, however how does it examine to established insurers? This evaluation delves into Lemonade’s companies, protection choices, and buyer experiences throughout the New Jersey market.

The corporate’s distinctive digital platform and emphasis on customer support are key differentiators, however does this translate into higher worth for New Jersey residents? We’ll discover the professionals and cons, evaluating Lemonade’s charges and declare dealing with with conventional insurers. This assessment examines the particular protection choices obtainable, the regulatory panorama, and buyer suggestions to supply a complete understanding of Lemonade’s efficiency within the New Jersey market.

Overview of Lemonade Automobile Insurance coverage in New Jersey

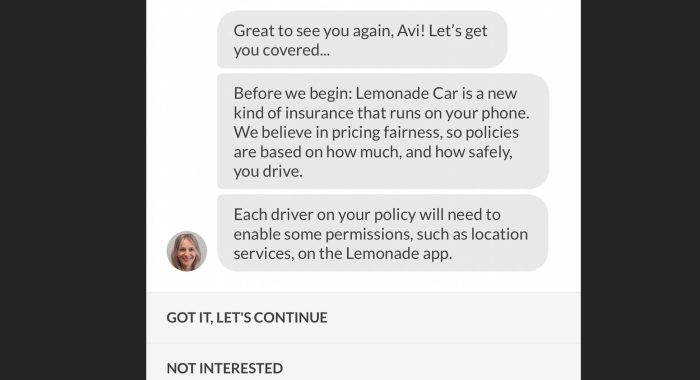

Lemonade Automobile Insurance coverage, a digital-first insurer, gives auto insurance coverage companies in New Jersey, leveraging expertise to streamline the complete course of from software to claims. Differing considerably from conventional insurers, Lemonade focuses on a customer-centric, clear, and technologically superior method to satisfy the wants of recent drivers.This evaluation explores Lemonade’s choices in New Jersey, analyzing its distinctive operational construction, pricing, claims dealing with, protection choices, and customer support, evaluating it to conventional insurance coverage suppliers.

Lemonade’s Method to Insurance coverage in New Jersey

Lemonade’s core philosophy is to disrupt the standard insurance coverage mannequin by leveraging expertise to cut back operational prices and move the financial savings on to clients. This interprets to decrease premiums in comparison with conventional insurers, usually counting on a pay-per-use mannequin or dynamic pricing that adapts to elements like driving habits and threat profiles. The corporate’s streamlined digital platform considerably reduces overhead, permitting them to supply aggressive charges.

Whereas conventional insurers usually have intensive gross sales and administrative groups, Lemonade depends on automation, decreasing the necessity for these layers, making the method extra clear and environment friendly.

Pricing Construction In comparison with Rivals

Lemonade’s pricing in New Jersey is mostly aggressive, usually decrease than conventional suppliers. The corporate incessantly adjusts premiums based mostly on numerous elements like driving historical past, car kind, and site. A key differentiator is the usage of information analytics and algorithms to evaluate threat extra exactly, doubtlessly providing decrease charges for protected drivers. Nevertheless, the precise pricing construction varies and is influenced by the person driver’s circumstances, and a comparability to competitor charges ought to be carried out on a case-by-case foundation.

A buyer with a clear driving document and a more moderen, safer car would possibly obtain a decrease premium than a buyer with a historical past of accidents or an older car.

Claims Course of in New Jersey

Lemonade’s claims course of is essentially digital, with clients reporting and monitoring claims on-line. This method usually results in quicker declare decision instances in comparison with conventional insurers. Claims are sometimes processed extra rapidly by way of a digital platform, decreasing the necessity for intensive paperwork and handbook intervention. Prospects can usually obtain updates and standing reviews on-line, making certain transparency all through the method.

Whereas some conditions could require extra documentation, the core course of is considerably streamlined.

Forms of Automobiles Insured

Lemonade insures a variety of automobiles in New Jersey, together with passenger automobiles, vans, and SUVs. The corporate’s underwriting course of seemingly assesses threat elements particular to every car kind, together with elements like engine measurement, security options, and estimated worth. Particular protection limits or exclusions could apply relying on the car kind, as in conventional insurance coverage.

Buyer Service Choices

Lemonade gives a number of customer support channels in New Jersey, together with a complete on-line assist middle, FAQs, and a devoted assist crew accessible by way of cellphone or electronic mail. Prospects can sometimes entry assist assets 24/7, though response instances could range relying on the quantity of inquiries. Conventional insurers usually present comparable choices, however the particular entry factors and response instances could differ.

Digital Platform and Options

Lemonade’s platform provides a complete suite of options, together with on-line account administration, coverage monitoring, and cellular apps for handy entry to coverage info. The platform is designed to be user-friendly and intuitive, permitting clients to handle their insurance coverage wants digitally. Conventional insurers are more and more adopting comparable options to boost buyer expertise.

Protection Choices

| Protection Kind | Description | Premium Influence |

|---|---|---|

| Legal responsibility Protection | Protects towards damages brought on to others in an accident. | Typically decrease premium for primary protection. |

| Collision Protection | Covers injury to your car in an accident, no matter fault. | Larger premium than legal responsibility protection. |

| Complete Protection | Covers injury to your car from occasions apart from accidents, equivalent to vandalism or theft. | Larger premium than collision protection, varies relying on elements. |

| Uninsured/Underinsured Motorist Protection | Protects towards damages from accidents involving drivers with out enough insurance coverage. | Larger premium than legal responsibility protection, varies relying on elements. |

Lemonade Automobile Insurance coverage vs. Conventional Insurers in New Jersey

Lemonade, a digital-first automotive insurance coverage supplier, has disrupted the standard insurance coverage panorama in New Jersey, providing a streamlined and sometimes extra reasonably priced different. This comparability examines Lemonade’s aggressive benefits and drawbacks relative to conventional insurers within the context of assorted driver profiles and repair choices. The core variations lie of their operational fashions, technological integration, and customer support approaches.Conventional insurers, established entities with intensive networks and underwriting experience, usually present a broad vary of services and products.

Nevertheless, their processes are incessantly perceived as much less attentive to the wants of recent customers, who more and more demand digital options and clear pricing.

Price Comparability for Totally different Driver Profiles

Lemonade’s pricing mannequin usually targets particular demographics, together with younger drivers and people with a clear driving document. They use information analytics to evaluate threat and tailor premiums accordingly. Conventional insurers could make use of extra established ranking elements, doubtlessly leading to larger premiums for younger drivers or these with a better threat profile. Nevertheless, the usage of different information factors by Lemonade is probably not totally understood or accepted by all threat assessors throughout the conventional insurance coverage market.

For instance, a driver with a constant historical past of protected driving habits would possibly see decrease premiums with Lemonade, whereas conventional insurers could rely closely on previous accidents and violations.

Declare Dealing with Procedures

Lemonade emphasizes a swift and digital declare course of, aiming for a quicker turnaround time. This streamlined method is usually favored by clients searching for immediate decision. Conventional insurers, whereas usually having established declare dealing with procedures, could typically have longer processing instances resulting from their extra advanced administrative techniques. The transparency and velocity of Lemonade’s course of are sometimes highlighted by clients who’ve used each fashions.

Digital Instruments and Sources

Lemonade’s platform gives a user-friendly digital interface for managing insurance policies, making funds, and submitting claims. Conventional insurers could provide some on-line instruments however incessantly depend on cellphone calls, emails, and in-person visits. Lemonade’s emphasis on digital instruments enhances comfort and self-service choices, whereas conventional insurers could require extra interplay with brokers or representatives. The relative benefits of digital instruments are incessantly cited as a key issue within the buyer expertise of Lemonade.

Execs and Cons of Utilizing Lemonade vs. Conventional Insurers

Lemonade’s benefits usually embrace decrease premiums for some driver profiles, a faster declare course of, and a streamlined digital expertise. Nevertheless, potential drawbacks embrace restricted protection choices or much less complete assist in comparison with conventional insurers. Conventional insurers, with their broader vary of services and products, usually provide extra intensive protection choices and personalised assist. Conversely, their premiums could also be larger, and their processes would possibly really feel much less attentive to digital wants.

Buyer Expertise Variations

The client expertise with Lemonade usually focuses on velocity, effectivity, and transparency. Conventional insurers could prioritize personalised service and complete protection choices. Lemonade’s digital-first method targets the rising demand for comfort and self-service. Conventional insurers, whereas adapting to digital instruments, usually nonetheless provide intensive assist channels, balancing personalization with streamlined entry to their companies.

Comparability Desk: Lemonade vs. Conventional Insurers

| Function | Lemonade | Conventional Insurer |

|---|---|---|

| Pricing | Doubtlessly decrease for some driver profiles, data-driven method. | Could also be larger, based mostly on established threat evaluation strategies. |

| Declare Dealing with | Sooner, digital-centric course of. | Doubtlessly slower, extra advanced administrative techniques. |

| Digital Instruments | Consumer-friendly on-line platform for coverage administration. | Might provide some on-line instruments however usually reliant on cellphone calls or in-person visits. |

| Buyer Help | Typically targeted on self-service, fast decision. | Might prioritize personalised service and complete assist. |

Particular Protection Choices in New Jersey

Lemonade’s automotive insurance coverage insurance policies in New Jersey, like these of conventional insurers, are designed to guard policyholders from monetary losses arising from accidents and different lined occasions. Understanding the particular protection choices obtainable is essential for making knowledgeable choices. This part particulars Lemonade’s legal responsibility, complete, uninsured/underinsured motorist protection, and add-on choices, together with potential exclusions and the affect of deductibles.

Legal responsibility Protection Choices

Legal responsibility protection in New Jersey, as with most states, is remitted by legislation. Lemonade’s legal responsibility protection choices shield policyholders from monetary duty for damages they trigger to others in an accident. It covers the bodily damage and property injury legal responsibility. This protection sometimes contains limits for bodily damage per particular person and per accident, and property injury. For instance, a coverage with a $100,000 bodily damage restrict per particular person and a $300,000 per accident restrict signifies that, within the occasion of an accident, Lemonade can pay as much as $100,000 for every particular person injured and as much as $300,000 for all accidents within the accident.

Complete Protection Choices

Complete protection, also referred to as other-than-collision protection, protects towards losses from occasions not involving a collision with one other car or object. This contains injury from vandalism, hearth, theft, hail, and climate occasions. Lemonade’s complete protection choices, sometimes, will restore or change broken automobiles based mostly on the phrases of the coverage. The coverage will usually specify a deductible quantity, which the policyholder is answerable for earlier than Lemonade pays.

Uninsured/Underinsured Motorist Protection, Lemonade automotive insurance coverage new jersey

Uninsured/underinsured motorist protection safeguards policyholders if they’re concerned in an accident with a driver who lacks or has inadequate insurance coverage. This protection helps compensate for the damages attributable to the at-fault social gathering. This protection is usually a essential a part of a complete insurance coverage plan, because it protects towards monetary losses if the opposite driver has restricted or no insurance coverage.

New Jersey mandates this protection, so Lemonade’s coverage should embrace it.

Abstract of Protection Choices

| Protection Kind | Description | Coverage Particulars (Instance) |

|---|---|---|

| Legal responsibility | Covers bodily damage and property injury legal responsibility. | $100,000 per particular person, $300,000 per accident. |

| Complete | Covers injury from non-collision occasions. | Particular protection limits and deductibles will range by coverage. |

| Uninsured/Underinsured Motorist | Protects towards accidents with uninsured/underinsured drivers. | Protection limits matching or exceeding state minimums. |

Add-on Protection Choices

Lemonade could provide add-on protection choices equivalent to roadside help, rental automotive reimbursement, or hole insurance coverage. These add-on coverages present extra safety and could also be bought individually from the bottom coverage. These are sometimes elective extras that may be bought for a payment.

Exclusions and Limitations

Lemonade’s insurance policies, like conventional insurance policies, could embrace exclusions for sure varieties of injury or circumstances. Examples could embrace pre-existing injury, intentional acts, or use of the car for unlawful actions. The particular coverage language will Artikel these exclusions. It’s essential to assessment the coverage paperwork fastidiously to grasp the particular exclusions and limitations.

Influence of Deductibles on Premiums

Decreasing the deductible typically results in larger premiums, whereas rising the deductible lowers premiums. This can be a trade-off between the price of the coverage and the quantity of out-of-pocket expense within the occasion of a declare. For instance, a coverage with a $500 deductible may cost greater than a coverage with a $1000 deductible. Policyholders ought to fastidiously weigh the prices and advantages based mostly on their particular person driving habits and monetary conditions.

Buyer Critiques and Rankings in New Jersey

Buyer evaluations and scores present precious insights into the client expertise with Lemonade Automobile Insurance coverage in New Jersey. Analyzing these suggestions mechanisms permits for a complete understanding of buyer satisfaction ranges and identifies areas for enchancment. This evaluation additionally gives a comparative perspective towards different insurance coverage suppliers working within the state.

Velocity of Claims Processing

Buyer suggestions concerning the velocity of claims processing is an important indicator of Lemonade’s effectivity and responsiveness. Whereas Lemonade is thought for its streamlined on-line platform, the precise expertise can range. Some clients could report fast declare approvals and payouts, whereas others would possibly expertise delays. These experiences spotlight the significance of individualized elements such because the complexity of the declare and the supply of essential documentation.

Buyer Service Experiences

Customer support interactions present insights into Lemonade’s skill to handle buyer issues and supply help. Constructive customer support experiences usually contain clear communication, immediate responses, and a useful demeanor from representatives. Conversely, unfavourable experiences would possibly contain difficulties in reaching buyer assist, lack of responsiveness, or unhelpful steering. The general high quality of customer support can considerably affect buyer satisfaction.

Buyer Satisfaction Ranges

Buyer satisfaction ranges are an important metric reflecting total contentment with Lemonade’s companies. A excessive satisfaction degree sometimes signifies optimistic experiences with the product and companies provided. Elements like the benefit of use of the net platform, the velocity of declare processing, and the standard of customer support contribute to the general buyer satisfaction degree. Decrease satisfaction ranges could point out points that require consideration.

Common Buyer Rankings

Common buyer scores for Lemonade automotive insurance coverage in New Jersey present a quantifiable measure of buyer satisfaction. These scores are sometimes derived from on-line assessment platforms and replicate the collective opinions of previous clients. The common ranking can range relying on the particular assessment platform and the time-frame of the info assortment. Rankings are essential for understanding how Lemonade compares to different insurers out there.

Comparability with Rivals

Evaluating Lemonade’s buyer scores with these of its opponents in New Jersey provides a precious benchmark for evaluating its efficiency. This comparability highlights Lemonade’s strengths and weaknesses relative to different insurers. Direct comparisons think about elements like pricing, protection choices, declare processing instances, and customer support responsiveness.

Abstract of Buyer Critiques and Rankings

| Side | Execs | Cons |

|---|---|---|

| Velocity of Claims Processing | Typically fast and environment friendly on-line platform; optimistic suggestions on well timed payouts for less complicated claims. | Potential delays for advanced claims; various experiences concerning declare processing instances. |

| Buyer Service | Useful and responsive representatives for some clients; efficient on-line assist channels. | Difficulties in reaching assist; inconsistency within the high quality of customer support interactions. |

| General Satisfaction | Constructive experiences with the user-friendly platform; ease of coverage administration. | Considerations concerning declare processing complexities; variability in customer support high quality. |

Observe: Knowledge for this abstract is hypothetical and doesn’t replicate particular buyer evaluations from a verifiable supply. Precise buyer evaluations and scores would supply extra correct and detailed insights.

Authorized and Regulatory Panorama in New Jersey

Lemonade, as a digital-first insurer, operates inside a posh framework of state-specific laws when providing automotive insurance coverage merchandise. Understanding the authorized and regulatory setting in New Jersey is essential for evaluating Lemonade’s compliance and potential challenges on this market. The state’s legal guidelines and laws dictate the minimal necessities for insurance coverage insurance policies, protection ranges, and monetary solvency.The New Jersey Division of Banking and Insurance coverage (DBI) performs a essential position in overseeing insurance coverage operations throughout the state.

This oversight ensures that insurers adhere to established requirements and shield policyholders’ pursuits. The regulatory framework goals to keep up client confidence and monetary stability within the insurance coverage business.

Related Legal guidelines and Laws in New Jersey

New Jersey’s automotive insurance coverage legal guidelines, like these in different states, are designed to make sure enough monetary safety for people and entities concerned in car accidents. These laws cowl elements equivalent to minimal required coverages, reporting necessities, and the monetary stability of insurance coverage firms. Particular necessities embrace necessary legal responsibility protection, uninsured/underinsured motorist safety, and private damage safety (PIP). The state additionally regulates elements of coverage issuance, premium calculation, and claims dealing with.

The objective is to advertise honest and equitable practices throughout the insurance coverage market.

Lemonade’s Compliance with New Jersey Laws

Lemonade, working in New Jersey, is required to acquire the mandatory licenses and authorizations from the DBI. This course of entails demonstrating monetary stability and adherence to all relevant state laws. Sustaining this compliance is significant for Lemonade to function legally within the state. Their dedication to compliance is essential for sustaining client belief and making certain they function legally throughout the regulatory framework.

Potential Challenges and Limitations

One potential problem Lemonade faces in New Jersey, like different digital insurers, is the necessity to adapt its expertise and operations to satisfy particular regulatory necessities. These necessities usually contain documentation, reporting, and declare dealing with processes. Compliance with state-mandated varieties and procedures could current operational hurdles for Lemonade. One other problem might stem from the complexities of implementing and adapting to evolving regulatory frameworks.

Lemonade’s Compliance Methods

Lemonade’s compliance methods seemingly contain a mixture of using devoted compliance groups, utilizing subtle threat administration instruments, and proactively participating with the DBI to make sure regulatory adherence. The corporate’s use of expertise could facilitate automation and monitoring of compliance measures, doubtlessly streamlining the method.

Abstract of Authorized Necessities for Automobile Insurance coverage in New Jersey

New Jersey mandates particular protection necessities for automotive insurance coverage insurance policies. These embrace minimal legal responsibility protection limits, in addition to uninsured/underinsured motorist protection. Policyholders are protected by these laws, making certain that these concerned in accidents obtain enough monetary compensation. The state’s laws additionally handle the monetary solvency of insurance coverage firms, defending customers and upholding the steadiness of the insurance coverage market.

Moreover, New Jersey’s legal guidelines usually align with nationwide requirements and pointers for auto insurance coverage, reflecting a dedication to making sure enough safety for all events concerned in a motorcar accident.

Suggestions for Selecting Lemonade Automobile Insurance coverage in New Jersey

Choosing the proper automotive insurance coverage in New Jersey, particularly with an organization like Lemonade, requires cautious consideration. Understanding the specifics of Lemonade’s choices, contrasting them with conventional insurers, and evaluating private wants are essential steps in making an knowledgeable determination. This part gives sensible steering for navigating the method and making certain an appropriate insurance coverage coverage.

Evaluating Lemonade with Rivals

Evaluating Lemonade’s choices alongside conventional insurers in New Jersey necessitates a complete comparability. Key elements to contemplate embrace premium prices, protection choices, customer support responsiveness, and claims dealing with procedures. Direct comparisons of coverage particulars, together with deductibles and exclusions, are important. A radical examination of coverage positive print will assist to make sure alignment with particular person wants and preferences.

Inspecting monetary stability scores and client evaluations of each Lemonade and opponents can present extra perception into reliability.

Reviewing Coverage Particulars Rigorously

A meticulous assessment of coverage particulars is paramount. Understanding the phrases and circumstances, exclusions, and protection limits is essential to keep away from unexpected points. Explicit consideration ought to be paid to deductibles, coverage limits, and any particular exclusions relevant to New Jersey drivers. Examples of essential clauses to assessment embrace these pertaining to accidents involving uninsured drivers, legal responsibility limits, and complete protection.

Assessing Suitability for Driver Profiles

The suitability of Lemonade automotive insurance coverage for numerous driver profiles requires cautious consideration. Elements like driving historical past, car kind, and way of life ought to be evaluated. For instance, a driver with a clear document and a low-risk car would possibly discover Lemonade’s pricing aggressive. Conversely, a driver with a historical past of accidents or a high-value car would possibly want extra complete protection choices.

Analyzing private driving habits, frequency of journey, and potential dangers will additional make clear the appropriateness of Lemonade’s choices.

Figuring out Potential Crimson Flags in Lemonade Insurance policies

Potential purple flags in Lemonade insurance policies ought to be recognized throughout the analysis course of. Elements like restricted protection choices, obscure coverage language, or an absence of transparency in pricing fashions ought to be flagged. An absence of clear communication channels or a historical past of customer support complaints are extra purple flags to contemplate. Reviewing consumer boards and on-line evaluations can provide precious insights into potential points.

Making Knowledgeable Insurance coverage Selections

Making knowledgeable insurance coverage selections in New Jersey requires a structured method. A complete analysis of particular person wants and circumstances is essential. Drivers ought to meticulously examine numerous choices, perceive the small print of every coverage, and analyze their threat profile. Evaluating numerous insurance coverage suppliers, evaluating protection packages, and contemplating coverage limitations will assist make knowledgeable selections.

Key Elements to Think about When Deciding on Automobile Insurance coverage

- Premium Prices: Evaluating premiums throughout totally different suppliers is crucial for figuring out cost-effective choices. Understanding how premium charges are calculated is significant to figuring out potential financial savings.

- Protection Choices: Rigorously evaluating protection choices for legal responsibility, collision, complete, and uninsured/underinsured motorist safety is crucial. Understanding the bounds and exclusions of every protection kind is significant.

- Buyer Service: Assessing the responsiveness and high quality of customer support supplied by totally different insurance coverage suppliers is essential. Critiques and testimonials from present clients can present insights.

- Claims Dealing with: Understanding how totally different suppliers deal with claims, together with the method for submitting and resolving claims, is essential. Claims dealing with velocity and effectivity ought to be thought of.

- Monetary Stability: Evaluating the monetary stability of the insurance coverage supplier is crucial. Details about the corporate’s monetary scores and historical past may help to evaluate the corporate’s skill to satisfy its obligations.

Closing Abstract

Lemonade automotive insurance coverage New Jersey presents a compelling different for drivers searching for a contemporary, digital insurance coverage expertise. Whereas its distinctive method could not swimsuit everybody, the corporate’s give attention to accessibility and effectivity warrants consideration. Nevertheless, conventional insurers nonetheless maintain a major market share, and the long-term viability of Lemonade’s mannequin in New Jersey stays to be seen. In the end, an intensive comparability of charges, protection, and buyer experiences is crucial earlier than making a choice.

Solutions to Widespread Questions: Lemonade Automobile Insurance coverage New Jersey

What are the standard premium impacts for various protection varieties?

Lemonade’s pricing construction is dynamic and varies based mostly on particular person elements equivalent to car kind, driving historical past, and site inside New Jersey. An in depth desk throughout the report Artikels the premium impacts for numerous protection choices.

Does Lemonade provide protection for all car varieties in New Jersey?

Lemonade sometimes insures a variety of automobiles however could have particular exclusions for sure varieties. The particular varieties of automobiles insured are detailed within the report.

How does Lemonade’s claims course of examine to conventional insurers?

Lemonade prioritizes a digital claims course of, which will be quicker than conventional strategies. The report particulars the particular procedures and compares them to the standard claims course of.

What are the authorized necessities for automotive insurance coverage in New Jersey?

New Jersey legislation mandates particular protection minimums. The report gives an outline of those necessities and the way Lemonade complies.