Automobile insurance coverage quotes North Dakota: Navigating the panorama of inexpensive protection within the plains state. North Dakota’s distinctive driving circumstances and insurance coverage rules demand a tailor-made strategy to discovering the most effective coverage. This information dives deep into the intricacies of automotive insurance coverage in North Dakota, providing insights into numerous coverage varieties, components impacting premiums, and methods for saving cash.

From understanding obligatory coverages to evaluating insurance coverage suppliers, this complete useful resource equips you with the information to safe the proper automotive insurance coverage coverage in your wants. Uncover easy methods to get hold of quotes successfully and examine the most effective offers accessible in North Dakota.

Introduction to Automobile Insurance coverage in North Dakota

Yo, future drivers in North Dakota! Getting automotive insurance coverage is like having a security internet in your trip. It is a must-have to guard your self and others on the street. This information breaks down the necessities, from obligatory coverages to completely different coverage varieties. Let’s dive in!Understanding automotive insurance coverage in North Dakota is essential for staying secure and financially sound.

It is greater than only a authorized requirement; it is a good transfer to defend you from potential monetary disasters, like accidents or theft. Figuring out the specifics of various insurance policies helps you make knowledgeable choices.

Obligatory Coverages in North Dakota

North Dakota, like many states, has obligatory minimal insurance coverage necessities. This implies you are legally obligated to hold particular coverages to guard your self and others concerned in an accident. These obligatory coverages act as a security internet, making certain that anybody harmed in an accident receives compensation.

Sorts of Automobile Insurance coverage Insurance policies

North Dakota presents numerous insurance coverage coverage varieties, every designed to cowl completely different dangers. Legal responsibility protection, as an illustration, protects you from monetary duty if you happen to trigger an accident. Collision protection steps in when your automobile is broken in an accident, no matter who’s at fault. Complete protection, alternatively, shields your automobile from non-accident harm, like hail, fireplace, or vandalism.

Understanding these variations helps you tailor your coverage to your wants.

Causes for Automobile Insurance coverage in North Dakota

Individuals want automotive insurance coverage in North Dakota for a large number of causes, all centered round defending their property and well-being. Accidents are sadly frequent, and correct insurance coverage can cowl medical bills, automobile repairs, and misplaced wages. Theft is one other danger, and complete protection can change a stolen automobile. Harm from pure disasters or different unexpected occasions can also be coated.

Mainly, insurance coverage is a security internet that helps you navigate the unpredictable world of driving.

Comparability of Minimal Required Coverages

| State | Bodily Harm Legal responsibility | Property Harm Legal responsibility |

|---|---|---|

| North Dakota | $25,000 per individual, $50,000 per accident | $25,000 |

| Instance State 1 | $30,000 per individual, $60,000 per accident | $25,000 |

| Instance State 2 | $50,000 per individual, $100,000 per accident | $10,000 |

This desk showcases a comparability of minimal required coverages in North Dakota and a few instance states. Observe that these minimums may not totally cowl all bills in a severe accident. You would possibly contemplate growing your protection for complete and collision when you have a more moderen or costlier automobile. It is important to judge your particular person wants and circumstances when deciding in your insurance coverage protection.

Components Influencing Automobile Insurance coverage Quotes

Yo, future drivers! Determining automotive insurance coverage in North Dakota can really feel like decoding a secret code, however it’s completely manageable as soon as you realize the important thing components. Understanding these components is essential for getting the most effective deal and avoiding sticker shock. So, let’s dive in and break down the nitty-gritty!

Driving Report

Your driving historical past considerably impacts your insurance coverage charges. A clear slate means decrease premiums, whereas rushing tickets, accidents, or perhaps a DUI will hike up the fee. Consider it like this: a spotless document is sort of a gold star, getting you higher charges. A less-than-stellar document is sort of a black mark, making your insurance coverage costlier.

It is because insurance coverage corporations assess danger, and a historical past of violations alerts the next probability of future claims.

Car Kind

The form of automotive you drive performs an enormous function in your insurance coverage premiums. Excessive-performance sports activities automobiles, for instance, are typically costlier to insure than fundamental sedans. It is because they usually contain extra danger. A sports activities automotive, with its potential for higher-speed accidents, has the next declare frequency, which implies increased premiums. Conversely, a fundamental sedan with a confirmed security document will seemingly get you a decrease charge.

A premium automobile additionally comes with increased restore prices in case of an accident.

Car Worth

The worth of your automotive is a significant component. A costlier automotive means a bigger payout for insurance coverage corporations in case of a complete loss or theft. This results in increased premiums. An affordable automotive would possibly get you a decrease premium, however it additionally means a smaller payout in case of a complete loss or theft.

Location

Your North Dakota location issues. Some areas have increased accident charges than others, which influences premiums. Areas with increased crime charges or extra accidents might need increased premiums to mirror this.

Credit score Historical past

Your credit score rating can have an effect on your automotive insurance coverage charges. Insurance coverage corporations generally use credit score scores as a technique to gauge danger. A great credit score rating suggests you are a accountable particular person, resulting in decrease premiums.

Age and Gender

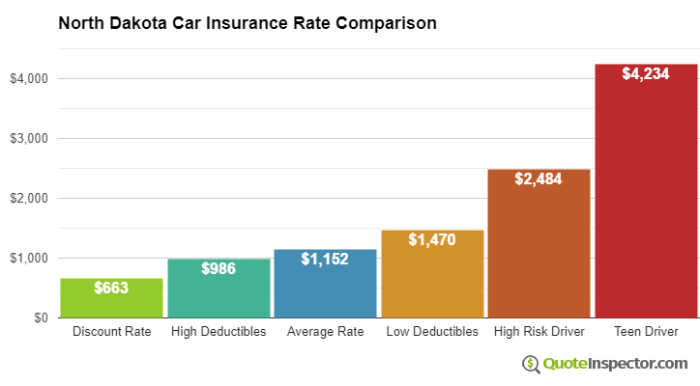

Age and gender are additionally components. Youthful drivers, statistically, have increased accident charges than older drivers, which regularly interprets to increased premiums. Ladies, usually, have decrease accident charges than males. There is a correlation between these components and danger evaluation by the insurance coverage firm. So, youthful drivers and males are likely to pay increased premiums.

Insurance coverage Charges by Car Kind

| Car Kind | Estimated Premium (Illustrative – Precise varies) |

|---|---|

| Economic system Sedan | $800 – $1200 per yr |

| Sports activities Automobile | $1200 – $2000 per yr |

| Luxurious SUV | $1500 – $2500 per yr |

| Pickup Truck | $1000 – $1800 per yr |

Observe: These are illustrative examples, and precise charges depend upon numerous different components.

Evaluating Insurance coverage Suppliers in North Dakota: Automobile Insurance coverage Quotes North Dakota

Yo, future drivers! Determining automotive insurance coverage in North Dakota could be a whole headache, however figuring out which firm is best for you is essential. This breakdown will provide help to examine completely different suppliers and discover the most effective match in your wants and funds.

Main Automobile Insurance coverage Suppliers in North Dakota

North Dakota’s obtained a bunch of insurance coverage giants vying for your small business. A few of the most distinguished gamers you may see out there embody State Farm, Geico, Progressive, Farmers Insurance coverage, and Allstate. These corporations have been round for some time and have a strong popularity within the space. Figuring out who’s who within the recreation offers you a great place to begin to check.

Repute and Monetary Stability, Automobile insurance coverage quotes north dakota

Insurance coverage corporations have to be financially steady to pay out claims when accidents occur. An organization’s popularity and monetary energy are essential. You need to select a supplier with a historical past of dealing with claims easily and effectively. Web sites like AM Greatest, Moody’s, and Customary & Poor’s give scores for insurance coverage corporations, so checking these out can provide you a good suggestion of how dependable an organization is.

Buyer Service Scores and Opinions

Customer support is significant when it is advisable file a declare or have questions. Web sites like Yelp, Google Opinions, and the Higher Enterprise Bureau are nice assets to see what different drivers must say in regards to the service from completely different corporations. Studying actual buyer experiences can provide you a really feel for a way easy the method is, which may be tremendous useful in your choice.

Declare Settlement Procedures

The method of settling claims varies between suppliers. Some corporations have on-line portals or cell apps that make submitting claims simpler. Figuring out how every firm handles claims is an efficient technique to examine and distinction. You need to examine their web sites for particulars about their claims course of. It is a good suggestion to determine how lengthy the claims course of normally takes, too.

Comparability Desk of Prime Insurance coverage Suppliers

| Insurance coverage Supplier | Options and Advantages | Buyer Service Scores (Estimated) | Monetary Stability Score (Estimated) |

|---|---|---|---|

| State Farm | Wide selection of protection choices, established popularity, robust native presence. | 4.5 out of 5 stars | Wonderful |

| Geico | Aggressive charges, user-friendly on-line instruments, good customer support | 4.2 out of 5 stars | Good |

| Progressive | Reductions for good driving data, modern on-line instruments. | 4 out of 5 stars | Very Good |

| Farmers Insurance coverage | Sturdy native presence, customized service, intensive protection choices. | 4.3 out of 5 stars | Wonderful |

| Allstate | In depth protection choices, a number of reductions, good customer support | 4.1 out of 5 stars | Good |

Observe

Scores are estimated and will range based mostly on particular buyer experiences. All the time examine official sources for exact particulars.*

Acquiring Automobile Insurance coverage Quotes in North Dakota

Getting the appropriate automotive insurance coverage in North Dakota is essential, like discovering the proper match in your trip. Figuring out easy methods to get quotes effectively and examine completely different choices is essential to saving moolah. This part will stroll you thru the method, from looking on-line to selecting the most effective deal.

Discovering On-line Automobile Insurance coverage Quotes in North Dakota

Discovering on-line automotive insurance coverage quotes in North Dakota is a breeze! Quite a few web sites concentrate on evaluating quotes from numerous insurance coverage suppliers. These platforms simplify the method, letting you enter your particulars and immediately obtain quotes from completely different corporations.

Step-by-Step Course of for Acquiring A number of Quotes

Getting a number of quotes is crucial for securing the absolute best deal. This is a easy course of to observe:

- Go to a good on-line comparability web site. These platforms collect quotes from completely different suppliers, saving you the trouble of checking every firm individually. Examples embody Insurify, Policygenius, and others.

- Present your private data and automobile particulars precisely. This consists of your driving historical past, automobile particulars (make, mannequin, yr, and so forth.), and site. The extra correct your enter, the extra exact the quotes can be.

- Evaluate the quotes rigorously. Evaluate premiums, protection choices, and any extra charges. Look out for hidden prices! Take into account components like deductibles and coverage limitations.

- Contact the suppliers straight. Usually, the web quotes supply a great place to begin, however reaching out straight might help make clear any doubts or particular circumstances.

- Select the coverage that most closely fits your wants and funds. Take into account your danger tolerance and desired protection ranges when making your choice. Keep in mind, it is about discovering a stability.

Dependable Sources for Free Automobile Insurance coverage Quotes

Whereas some web sites supply free quotes, it is essential to bear in mind that these providers should still have hidden charges or limitations. Many respected comparability web sites will let you examine quotes from completely different corporations with out upfront prices. All the time learn the wonderful print!

Data Wanted to Acquire a Quote

The data required to get a automotive insurance coverage quote usually consists of:

- Your identify, deal with, and date of delivery.

- Your driver’s license quantity and state.

- Car particulars like make, mannequin, yr, and VIN.

- Driving historical past, together with any accidents or violations.

- Desired protection ranges and any particular necessities.

Evaluating and Choosing the Greatest Quote

After you have a number of quotes, rigorously examine the premiums, protection choices, and deductibles. Look past the bottom value and assess the full value of the coverage. Components like reductions and add-ons must also be thought-about. Do not simply give attention to the bottom premium; make sure the protection aligns along with your wants.

On-line Comparability Web sites for Quotes in North Dakota

| Web site | Options | Execs | Cons |

|---|---|---|---|

| Insurify | Wide selection of suppliers, user-friendly interface | Simple navigation, fast quotes | Could not supply the deepest reductions |

| Policygenius | Complete comparability instruments, academic assets | Wonderful for understanding protection choices | Potential for barely increased premiums |

| QuoteWizard | Number of insurance coverage varieties, specialised choices | Good for particular wants (e.g., bikes, basic automobiles) | Could not have as many suppliers |

| NextInsurance | Quick and easy quote course of, clear pricing | Simple to check completely different insurance policies | May need fewer customized suggestions |

Understanding Automobile Insurance coverage Insurance policies

Yo, future drivers! Navigating automotive insurance coverage insurance policies can really feel like decoding historical hieroglyphics, however it’s completely doable. Figuring out what’s coated and what’s not is essential to getting the most effective deal and avoiding surprises down the street. Let’s break it down!

Frequent Coverages in North Dakota Insurance policies

Automobile insurance coverage insurance policies in North Dakota normally embody a couple of important coverages. Understanding these will provide help to make the appropriate decisions. Legal responsibility protection is essential; it protects you if you happen to trigger an accident and hurt another person. Collision protection kicks in in case your automotive will get wrecked, no matter who’s at fault. Complete protection steps in for incidents like vandalism, theft, or climate harm.

These are the usual recreation within the insurance coverage world.

Deductibles and Coverage Limits

Deductibles are the quantity you pay out-of-pocket earlier than your insurance coverage firm steps in. Consider it as your upfront fee. Decrease deductibles imply decrease month-to-month premiums, however you may pay extra when you have an accident. Coverage limits are the utmost quantity your insurance coverage can pay out for a coated declare. Selecting increased limits may cost a little extra, however it offers you larger monetary safety in case of a severe accident.

For instance, a $100,000 legal responsibility restrict means your insurer can pay as much as $100,000 if you happen to trigger a serious accident.

Exclusions and Limitations in Insurance policies

Each coverage has exclusions—issues not coated. As an illustration, some insurance policies would possibly exclude harm brought on by particular varieties of occasions, like warfare or sure varieties of racing. Additionally, there are limitations, like the quantity coated for particular varieties of damages or the length of protection. Reviewing the wonderful print is completely important!

Significance of Studying the High-quality Print

Do not simply skim the coverage; learn it completely! Hidden clauses or exclusions can drastically change your protection. Understanding these clauses is like having a secret weapon in opposition to sudden points. Studying the wonderful print will provide help to perceive what’s coated, and importantly, what’s NOT coated.

Completely different Sorts of Coverages

| Protection Kind | Description |

|---|---|

| Legal responsibility | Protects you if you happen to trigger an accident and hurt another person. It covers issues like medical payments and property harm. |

| Collision | Covers harm to your automotive in an accident, no matter who’s at fault. |

| Complete | Covers harm to your automotive from issues apart from accidents, like vandalism, theft, or climate occasions. |

| Uninsured/Underinsured Motorist | Protects you if you happen to’re hit by somebody who would not have insurance coverage or would not have sufficient insurance coverage to cowl the damages. |

Suggestions for Saving on Automobile Insurance coverage

Hey, future drivers! Saving on automotive insurance coverage in North Dakota is completely achievable. It is like discovering a secret code to unlock cheaper premiums. We’ll break down the important thing methods to get you that candy, candy low cost.Figuring out easy methods to navigate the automotive insurance coverage recreation in North Dakota could be a whole lifesaver. It is all about good decisions and savvy strikes to get the most effective charges potential.

Let’s dive in!

Secure Driving Habits

Secure driving is not nearly avoiding accidents; it is a direct path to decrease premiums. Constant accountable driving habits considerably affect your insurance coverage charges. Consider it as investing in your individual monetary future. By minimizing danger, you are primarily rewarding your self with decrease premiums.

- Keep a clear driving document: Avoiding site visitors violations, rushing tickets, and accidents is essential. Each ticket or accident can enhance your premium considerably. Staying on the appropriate aspect of the legislation is a complete win-win.

- Drive defensively: Being conscious of your environment and anticipating potential hazards helps you keep away from accidents. Consider it as being a proactive driver, not a reactive one.

- Comply with site visitors legal guidelines: It is a no-brainer, however it’s important. Staying throughout the velocity restrict, utilizing flip alerts, and respecting site visitors indicators are basic for a secure and inexpensive insurance coverage charge.

Bundling Insurance coverage Insurance policies

Bundling your automotive insurance coverage with different insurance policies, like house or renters insurance coverage, can usually lead to vital reductions. Insurance coverage corporations usually supply bundled reductions as a technique to incentivize clients to make use of their providers for all their insurance coverage wants. Consider it as a loyalty reward for selecting one supplier for all of your wants.

- Combining automotive, house, and renters insurance coverage can yield substantial financial savings. That is like getting a bonus low cost for being a loyal buyer.

- Many insurance coverage corporations supply reductions for combining various kinds of insurance coverage. This could be a vital cost-saving technique for accountable shoppers.

Sustaining a Good Driving Report

A clear driving document is a significant component in figuring out your insurance coverage premium. It demonstrates your duty and reliability as a driver. It is like a report card in your driving, exhibiting the way you deal with the street.

- Keep away from any site visitors violations: This consists of rushing tickets, reckless driving, and another violation that may hurt your driving document.

- Report any accidents promptly and precisely: Honesty and transparency along with your insurance coverage firm will provide help to preserve a great document and keep away from any potential points afterward.

- Take defensive driving programs: Taking these programs can improve your driving expertise and enhance your security document. It is a proactive step in direction of avoiding accidents.

Selecting the Proper Protection Quantity

Understanding your wants and selecting the suitable protection quantity is crucial for saving cash. Overpaying for pointless protection is a waste of cash.

- Assess your monetary scenario and liabilities: Calculate how a lot protection you realistically want. That is key to avoiding overpaying for pointless protection.

- Consider the potential dangers: Take into account the worth of your automobile and your potential liabilities in case of an accident. This helps decide the appropriate protection quantity.

- Evaluate completely different protection choices: Do not hesitate to check completely different coverage choices from numerous suppliers to search out the most effective protection in your wants and funds. That is like purchasing round for the most effective deal.

Methods to Decrease Insurance coverage Premiums in North Dakota

Listed below are some key methods to get these insurance coverage charges decrease in North Dakota:

- Secure Driving Practices: Keep a clear driving document, drive defensively, and observe site visitors legal guidelines. This is sort of a preventative measure in opposition to pricey accidents.

- Bundling Insurance policies: Mix your automotive insurance coverage with different insurance policies like house or renters insurance coverage. This is sort of a multi-purpose insurance coverage bundle that saves you cash.

- Evaluate Insurance coverage Suppliers: Do not accept the primary quote you get. Store round and examine quotes from numerous suppliers to search out the most effective charge. That is like discovering the most effective deal out there.

- Keep a Good Driving Report: Keep away from any site visitors violations and accidents. This reveals insurance coverage corporations that you are a accountable driver.

- Select the Proper Protection Quantity: Assess your wants and select protection that fits your funds and circumstances. That is about getting the appropriate protection with out overspending.

Final Level

In conclusion, securing the appropriate automotive insurance coverage in North Dakota includes understanding your wants, researching suppliers, and evaluating quotes. By contemplating components like driving historical past, automobile kind, and protection choices, you will discover an inexpensive coverage that aligns along with your monetary scenario. Armed with this data, you are well-positioned to make knowledgeable choices and shield your self and your property on the roads of North Dakota.

Fast FAQs

What are the minimal insurance coverage necessities in North Dakota?

North Dakota mandates legal responsibility insurance coverage, with particular minimal protection quantities. Test the North Dakota Division of Insurance coverage web site for probably the most up-to-date data.

How does my credit score rating have an effect on my insurance coverage charges?

Credit score historical past, whereas not at all times a direct issue, can generally be thought-about by insurance coverage corporations when assessing danger. A powerful credit score rating would possibly doubtlessly result in decrease premiums.

Can I get a free automotive insurance coverage quote on-line?

Sure, a number of on-line comparability web sites present free quotes. Use these assets to check insurance policies and determine potential financial savings.

What’s one of the simplest ways to check insurance coverage quotes?

Use comparability web sites to collect quotes from a number of suppliers. Learn the wonderful print rigorously and examine protection choices and premiums.