Safeco auto insurance coverage rental automobile protection is essential for drivers who lease autos. Understanding your coverage’s scope is essential to peace of thoughts when behind the wheel of a borrowed automobile. This complete information dives deep into Safeco’s rental automobile protection, explaining particulars, limitations, and easy methods to navigate the method successfully.

Navigating the complexities of rental automobile insurance coverage may be difficult. This information offers a transparent and concise overview, simplifying the method and empowering you to make knowledgeable selections. From protection specifics to assert procedures, we have got you lined.

Protection Particulars

Safeco Auto Insurance coverage provides rental automobile protection as a part of many insurance policies. This protection helps defend you if that you must lease a automobile as a consequence of an accident or different lined occasion. Understanding the specifics of this protection, together with its limitations and exclusions, is essential for maximizing its advantages.Rental automobile protection is designed to assist pay for rental bills when your car is out of service as a consequence of a lined occasion.

This protection may be very helpful, however realizing what it does and would not cowl is essential. Totally different insurance policies might have barely various phrases, so reviewing your particular coverage is at all times really helpful.

Protection Clarification

Safeco’s rental automobile protection usually contains the price of a rental car whereas your insured automobile is being repaired or is in any other case unavailable as a consequence of a lined occasion. This usually contains incidents like accidents, theft, or harm to your car. The protection often covers the rental’s each day charge, insurance coverage premiums related to the rental, and every other cheap costs.

Coverage language will specify these phrases.

Limitations and Exclusions, Safeco auto insurance coverage rental automobile protection

Rental automobile protection, like different insurance coverage provisions, has limitations and exclusions. These limitations assist outline what’s lined and what is not. For instance, the protection might not apply to leases for leisure or private use. It usually applies solely when your car is out of service as a consequence of a lined occasion. Some insurance policies might exclude sure kinds of leases (e.g., luxurious autos).

Moreover, each day and whole journey limits are sometimes in place to regulate prices. Insurance policies will clearly Artikel these limits.

Coverage Language Examples

Typical coverage language will use phrases like “lined rental automobile bills,” “cheap rental costs,” and “each day rental limits.” It is essential to learn the precise wording of your Safeco coverage for exact particulars.

“Rental automobile protection is on the market for lined autos, as much as a most each day charge of $50.”

This instance illustrates a typical limitation present in coverage language.

Sorts of Rental Automobile Protection Choices

Safeco might supply varied choices for rental automobile protection, probably together with totally different ranges of each day limits, whole journey limits, or add-ons. These choices can range relying on the precise coverage.

Comparability with Different Main Insurance coverage Suppliers

Evaluating Safeco’s rental automobile protection with different main suppliers entails inspecting the each day and whole journey limits, deductibles, and the kinds of occasions lined. Elements just like the kinds of rental autos lined and the precise coverage language additionally should be thought of. Whereas direct comparisons may be troublesome with out particular coverage particulars, typically, protection particulars and limitations range amongst insurers.

Protection Limits Desk

This desk illustrates typical protection limits. Notice that these are examples and will differ from Safeco’s particular insurance policies.

| State of affairs | Every day Restrict | Complete Journey Restrict |

|---|---|---|

| Accident Injury | $50 | $1,000 |

| Theft | $40 | $800 |

| Coated Car Restore | $60 | $1,500 |

Protection Applicability: Safeco Auto Insurance coverage Rental Automobile Protection

Your Safeco auto insurance coverage rental automobile protection offers safety while you’re behind the wheel of a rental car. This protection steps in to assist pay for damages to the rental automobile, however it’s essential to grasp when it applies and what conditions it will not cowl.This part particulars the precise conditions the place Safeco’s rental automobile protection kicks in, highlighting exclusions and essential components to contemplate.

Understanding these nuances helps you maximize the advantages of this protection.

Circumstances of Protection Software

Rental automobile protection usually applies while you’re legally working a rental car that you’ve got contracted with a rental company, throughout the phrases of your Safeco coverage. This protection often applies for autos you lease for private use, like for holidays or errands.

Examples of Protection Activation

Protection will seemingly be activated when you’re concerned in an accident whereas driving a rental automobile, and the accident will not be your fault. This might embody collisions, property harm, or accidents to different folks. One other instance is that if the rental automobile is broken by a lined peril, like a theft or vandalism, when you’re accountable for it.

Conditions The place Protection Would possibly Not Apply

Protection might not apply in sure circumstances. For instance, if the rental automobile has pre-existing harm, Safeco’s rental automobile protection will seemingly not compensate you for that harm. Moreover, some rental agreements have particular clauses that may have an effect on the protection’s utility. It is vital to evaluation the rental settlement rigorously to grasp any limitations or exclusions. As an illustration, some rental insurance policies have particular necessities for reporting incidents or have restrictions on the kinds of actions permitted whereas working the car.

Figuring out Protection Applicability for a Particular Rental Automobile

To find out if a selected rental automobile falls underneath the protection, it’s best to rigorously evaluation your Safeco coverage’s phrases and situations relating to rental automobile protection. Additionally, completely evaluation the rental settlement you might have with the rental company. The coverage and the settlement ought to specify which kinds of rental autos are lined and any limitations.

Elements Affecting Rental Automobile Protection Eligibility

| Issue | Description |

|---|---|

| Coverage Phrases | Your Safeco auto insurance coverage coverage’s particular language relating to rental automobile protection will Artikel the small print. |

| Rental Settlement | The rental settlement with the automobile rental firm will comprise phrases and situations, presumably impacting the protection. |

| Pre-existing Injury | Protection seemingly will not apply to pre-existing harm to the rental automobile. |

| Rental Automobile Sort | Some kinds of rental autos won’t be lined or may need limitations on the protection. |

| Utilization of the Rental Automobile | Actions permitted by the rental firm and your Safeco coverage are key concerns. |

Claims and Procedures

Submitting a declare on your rental automobile protection with Safeco is a simple course of, designed to get you again on the highway rapidly and effectively. This part particulars the steps concerned, required documentation, and potential points to anticipate. Understanding these procedures will enable you navigate the method easily.

Declare Submitting Course of

The method for submitting a rental automobile declare with Safeco mirrors that of different claims. Start by contacting Safeco’s customer support division. They’re going to information you thru the preliminary steps and assist collect the mandatory info. This proactive method helps guarantee a well timed and correct declare decision.

Required Documentation

To expedite the declare course of, collect the next paperwork:

- An in depth description of the accident or incident, together with the date, time, location, and circumstances.

- Copies of your rental settlement and any related insurance coverage info for the rental automobile.

- Police report, if relevant.

- Images or movies of the harm to the rental automobile.

- Proof of the quantity of the rental automobile harm, akin to restore estimates or invoices.

- Your Safeco insurance coverage coverage info, together with your coverage quantity.

- Your contact info, together with your title, deal with, cellphone quantity, and electronic mail deal with.

Offering these paperwork precisely and fully will guarantee a smoother declare course of.

Declare Submitting Steps Abstract

This desk summarizes the steps concerned in submitting a rental automobile insurance coverage declare with Safeco:

| Step | Motion |

|---|---|

| 1 | Contact Safeco customer support to provoke the declare. |

| 2 | Collect all vital paperwork, together with the rental settlement, police report (if relevant), and harm estimates. |

| 3 | Present the required documentation to Safeco’s customer support consultant. |

| 4 | Comply with up with Safeco to inquire concerning the declare’s standing and anticipated decision time. |

| 5 | If vital, take part in any requested inspections or evaluations. |

Contact Data

For customer support help relating to rental automobile protection, please contact Safeco at:

- Cellphone quantity: (Insert Safeco Cellphone Quantity Right here)

- Web site: (Insert Safeco Web site Right here)

- E mail Deal with: (Insert Safeco E mail Deal with Right here)

These contact particulars present avenues to deal with any queries or considerations associated to your declare.

Declare Processing Timeframe

The standard timeframe for processing a rental automobile insurance coverage declare with Safeco will depend on a number of components, such because the complexity of the declare, the supply of vital paperwork, and the severity of the harm. Claims involving minor harm, full documentation, and clear circumstances are sometimes resolved inside a number of weeks. Extra complicated claims, requiring intensive investigation or repairs, might take longer.

Widespread Declare Points

Some widespread points encountered in the course of the rental automobile declare course of embody:

- Incomplete or inaccurate documentation. This will delay the declare processing considerably. Guarantee all vital info is available and proper.

- Problem in acquiring a police report, significantly if the accident occurred in a international jurisdiction. Pre-planning for these conditions is essential. Contact Safeco for help if required.

- Discrepancies between the reported harm and the ultimate restore estimates. Clear communication and detailed documentation are crucial to keep away from misunderstandings.

- Disputes relating to the accountability for the accident or harm. If disagreements come up, Safeco will help in resolving the problem pretty and effectively.

Addressing these potential points proactively can reduce problems and velocity up the declare decision.

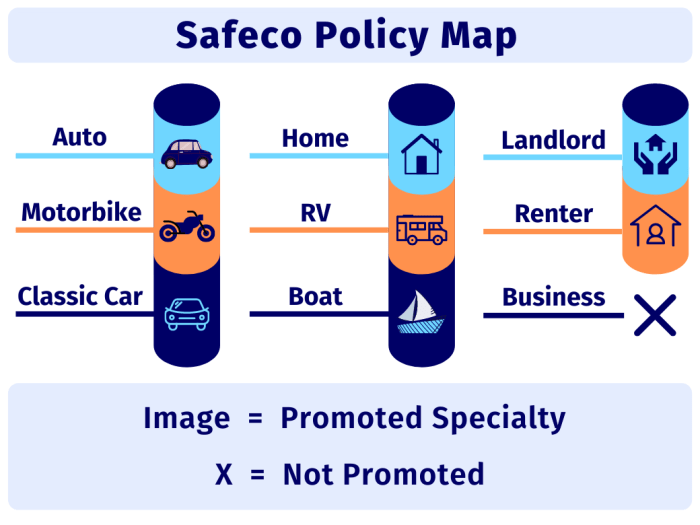

Rental Automobile Protection Choices

Safeco provides varied ranges of rental automobile protection to guard you in case your car is broken or stolen. Understanding these choices can assist you select the perfect safety on your wants and finances. These choices lengthen past your major car insurance coverage and supply particular protection for rental automobiles.Rental automobile protection usually comes into play while you want a short lived car as a consequence of a lined declare or an unexpected circumstance.

This protection will not be automated and must be added to your coverage. It offers an additional layer of safety, safeguarding you from surprising bills when you require a rental.

Rental Automobile Protection Ranges

Totally different Safeco rental automobile protection choices supply various levels of safety. The extent of protection you select will depend on your driving habits, typical rental durations, and threat tolerance. Think about your wants and the potential prices of a rental car alternative in case of an incident.

- Fundamental Protection: This selection offers probably the most fundamental degree of safety. It often covers harm to the rental automobile as much as a sure restrict, and typically covers theft, however might have deductibles. That is the least costly possibility, however provides the bottom degree of safety. The advantages are the bottom value, however the drawbacks are restricted protection and potential excessive out-of-pocket prices.

- Enhanced Protection: This selection often extends the protection limits for harm and theft, probably eradicating or decreasing deductibles. It is typically costlier than fundamental protection, however offers extra complete safety towards monetary loss within the occasion of an accident or theft. The advantages are elevated protection and decrease out-of-pocket prices. The drawbacks are the upper value in comparison with fundamental protection.

- Premium Protection: That is probably the most complete possibility, usually masking nearly all harm or theft with no or very low deductibles. It’s usually the most costly however offers the best peace of thoughts. The advantages are most safety and minimal monetary threat. The drawbacks are the considerably greater value in comparison with different choices.

Protection Comparability Desk

| Protection Stage | Description | Estimated Value (Annual) | Deductible (Instance) |

|---|---|---|---|

| Fundamental | Covers harm as much as a restrict, might embody theft. | $50 – $150 | $500 |

| Enhanced | Elevated protection limits and probably decrease deductibles. | $150 – $300 | $250 |

| Premium | Complete protection with minimal or no deductibles. | $300+ | $0 – $100 |

Comparability with Opponents

| Characteristic | Safeco | Competitor A | Competitor B |

|---|---|---|---|

| Fundamental Protection Restrict | $5000 | $3000 | $10,000 |

| Enhanced Protection Deductible | $250 | $500 | $250 |

| Premium Protection Deductible | $0 | $100 | $0 |

Notice: Competitor knowledge is hypothetical and for illustrative functions solely. Precise competitor particulars might range.

Choosing the Greatest Protection

Think about these components when selecting the perfect rental automobile protection:

- Your Driving Habits: In case you’re a frequent renter or drive in high-risk areas, enhanced or premium protection may be worthwhile.

- Typical Rental Durations: Longer leases usually necessitate extra intensive protection.

- Funds: Rental automobile protection prices range considerably between choices.

- Potential Rental Bills: Consider the potential bills if in case you have an accident or the automobile is stolen.

Extra Add-ons and Enhancements

Safeco may supply further add-ons for enhanced safety, akin to:

- Collision Injury Waiver (CDW): Covers harm to the rental automobile no matter fault.

- Loss Injury Waiver (LDW): Covers harm or theft of the rental automobile.

- Supplemental Legal responsibility Protection: Protects you from legal responsibility for harm to the rental automobile past your coverage limits.

Coverage Specifics and Examples

Rental automobile protection underneath your Safeco auto insurance coverage coverage offers safety while you’re driving a rental car. Understanding the specifics and the way they apply to totally different conditions is essential for using the protection successfully. This part particulars typical eventualities, coverage functions, and steps in case of an accident.This part will present concrete examples for example how your Safeco rental automobile protection works in varied conditions.

It would enable you perceive what’s lined, what’s not lined, and your obligations when an incident happens.

Typical Rental Automobile Protection Eventualities

Your rental automobile protection extends to varied conditions. As an illustration, when you’re concerned in an accident whereas driving a rental automobile, this protection might apply. Equally, if the rental automobile sustains harm, akin to vandalism or a collision with one other car, this coverage may supply help.

Coverage Language Software

Safeco’s coverage language for rental automobile protection clarifies the scope of safety. It Artikels the kinds of damages lined, the circumstances underneath which protection applies, and the steps concerned in submitting a declare. This part illustrates the sensible utility of the coverage’s wording in widespread eventualities.

Actions in Case of an Accident

Within the occasion of an accident whereas driving a rental automobile, it is essential to behave promptly and appropriately. First, guarantee the protection of everybody concerned. Subsequent, get hold of the mandatory info from different drivers, witnesses, and the rental firm. Doc the scene completely with pictures. Lastly, contact your Safeco consultant or the designated declare contact, following the procedures Artikeld in your coverage paperwork.

Coated Damages

The next desk Artikels widespread damages usually lined underneath Safeco’s rental automobile protection:

| Sort of Injury | Description |

|---|---|

| Collision | Injury ensuing from a direct impression with one other car or object. |

| Complete | Injury brought on by occasions apart from collision, akin to vandalism, theft, or weather-related occasions. |

| Unintentional Injury | Unintentional harm to the rental car. |

| Property Injury | Injury to a different particular person’s property throughout a rental automobile accident. |

Safeco Coverage Wording Relating to Rental Automobile Protection

Safeco’s coverage wording relating to rental automobile protection clearly defines the boundaries of legal responsibility. It particulars what is taken into account a lined loss, the deductible quantities, and the exclusions. As an illustration, the coverage might exclude harm ensuing from pre-existing situations or put on and tear. Particular wording relating to rental automobile protection may be present in your coverage doc. It’s extremely really helpful to evaluation your coverage doc for probably the most up-to-date particulars.

“Protection for rental automobiles is contingent upon the precise phrases and situations Artikeld in your Safeco auto insurance coverage coverage.”

Continuously Requested Questions About Rental Automobile Protection

These are some widespread questions on rental automobile protection:

- Does my coverage cowl harm to a rental automobile if I am at fault? Protection might apply relying on the precise phrases of your coverage and the circumstances of the accident. Discuss with your coverage doc for detailed info.

- What are the restrictions on protection for rental automobiles? The bounds of legal responsibility and protection particulars are Artikeld in your Safeco auto insurance coverage coverage. Overview the doc for a whole understanding of any restrictions.

- How do I file a declare for harm to a rental automobile? Comply with the declare procedures Artikeld in your Safeco coverage paperwork. These steps usually embody reporting the incident to Safeco and offering vital documentation.

Visible Illustration of Protection

Safeco’s rental automobile protection offers peace of thoughts while you’re on the highway. Understanding the method and protection choices is essential to maximizing your safety. This part visually particulars how the protection works, serving to you anticipate and navigate potential eventualities.

Rental Automobile Protection Course of Flowchart

The next flowchart illustrates the steps concerned in claiming rental automobile protection. This visible illustration clarifies the method from initiating the declare to receiving compensation.  Description: A flowchart begins with a consumer initiating a declare, adopted by verification of protection and coverage particulars. The flowchart then branches to cowl potential conditions like accidents, harm, or theft, requiring additional documentation and evaluation.

Description: A flowchart begins with a consumer initiating a declare, adopted by verification of protection and coverage particulars. The flowchart then branches to cowl potential conditions like accidents, harm, or theft, requiring additional documentation and evaluation.

Finally, it results in declare approval and reimbursement.

Protection Choices Visualization

This graphic organizer visually represents the varied protection choices out there underneath Safeco’s rental automobile protection. Understanding these choices helps you select the perfect safety on your wants.

| Protection Possibility | Description | Instance |

|---|---|---|

| Legal responsibility Protection | Protects you from monetary accountability when you trigger an accident whereas renting a car. | You rear-end one other automobile whereas renting. |

| Collision Protection | Covers damages to the rental car no matter who’s at fault. | The rental automobile is broken in a collision, even when you’re not accountable. |

| Complete Protection | Covers damages to the rental car from perils apart from collision, like vandalism or theft. | The rental automobile is broken by vandalism or stolen. |

Protection Eventualities and Illustrations

Visible aids are essential in understanding complicated ideas. The next eventualities assist illustrate how the protection operates in varied conditions.  Description: A visible of a automobile accident involving a rental car. This demonstrates the legal responsibility protection situation, highlighting the necessity to doc the occasion. Extra photos may be included for theft or vandalism.

Description: A visible of a automobile accident involving a rental car. This demonstrates the legal responsibility protection situation, highlighting the necessity to doc the occasion. Extra photos may be included for theft or vandalism.

Step-by-Step Protection Course of Diagram

This step-by-step diagram visualizes the declare course of. This illustration aids in understanding every stage and the required actions.  Description: A numbered diagram exhibiting the declare course of steps: 1. Report the incident, 2. Collect documentation, 3.

Description: A numbered diagram exhibiting the declare course of steps: 1. Report the incident, 2. Collect documentation, 3.

File a declare, 4. Assess the declare, 5. Obtain reimbursement.

Protection Limitations and Exclusions Graphic Organizer

Understanding the restrictions and exclusions of your protection is important. This graphic organizer shows the protection limitations and exclusions.  Description: A graphic organizer outlining the restrictions and exclusions of Safeco’s rental automobile protection. For instance, the graphic might embody “pre-existing harm” or “leases exceeding a sure interval.”

Description: A graphic organizer outlining the restrictions and exclusions of Safeco’s rental automobile protection. For instance, the graphic might embody “pre-existing harm” or “leases exceeding a sure interval.”

Final Phrase

In conclusion, understanding Safeco auto insurance coverage rental automobile protection empowers you to be a accountable driver, no matter whether or not you are behind the wheel of your individual car or a rental. By comprehending the coverage’s particulars, limitations, and declare procedures, you’ll be able to confidently lease a car, realizing you are protected. This information serves as your compass within the realm of rental automobile insurance coverage.

Basic Inquiries

What are the standard each day and journey limits for rental automobile protection?

Every day and journey limits range relying in your particular coverage. Discuss with your coverage paperwork for exact figures.

What if I encounter pre-existing harm on a rental automobile?

Safeco’s protection usually would not apply to pre-existing harm. Examine the rental car completely earlier than driving and report any points to the rental company.

How lengthy does it often take to course of a rental automobile insurance coverage declare?

Declare processing occasions range. Elements just like the severity of the harm and the completeness of your declare documentation have an effect on the timeline.

What documentation is required to file a rental automobile declare?

You may seemingly want the rental settlement, police report (if relevant), restore estimates, and any supporting documentation.